Q3 2019 – Melbourne Industrial Market

October 22nd 2019 | , Urban Property Australia

- Underpinned by strong pre-commitments, new supply for the Melbourne industrial market is forecast to reach its highest level in 10 years in 2020,

- Vacancy levels now down to five-year lows, driven by strong leasing activity in prime assets,

- Spurred by increased infrastructure investment and dwindling land availability, industrial land values have reached all-time highs across Melbourne’s sub-regions;

- Investment activity declined in 2019 with owners increasingly holding assets with rents growing at above-average levels.

Industrial Market Summary

Conditions in the Melbourne industrial property market remain strong. The industrial sector is in the midst of a significant transformation which is changing the shape of occupier demand and attracting significant investment. Industrial property continues to outperform other Australian property sectors boosted by strong rental growth and continued yield compression.

New Supply

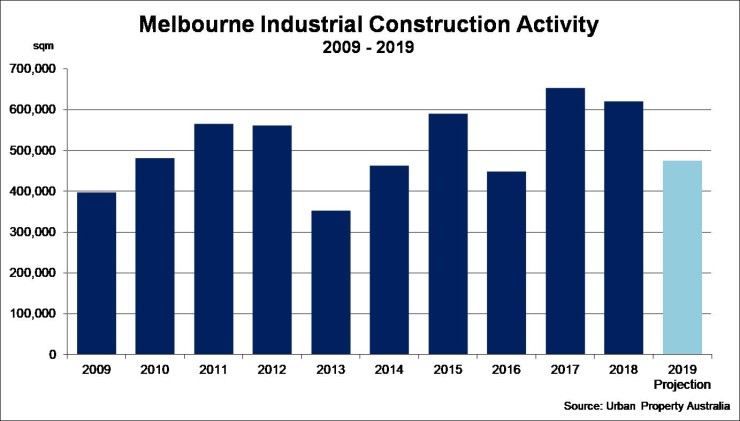

Although tenant demand remains robust, constrained by limited serviced land, Urban Property Australia projects that approximately 475,000sqm will be delivered across the Melbourne industrial market in 2019, the lowest level of new supply completed since 2013. Capitalising on strong tenant demand, the majority of new stock added to the market has been speculatively developed. Urban Property Australia has recorded a significant increase in speculative development over 2019 with 275,000sqm projected to be completed compared with 125,000sqm speculatively developed in 2018. The successful absorption of the speculative developed projects has buoyed developers to undertake further speculative development with 2020 forecast to be another above average year for speculatively developed industrial completions. New supply over 2019 has been focused in the Western sub-region with the precinct accounting for 56% of new supply delivered to Melbourne which has been boosted by this speculative development.

Looking ahead, Urban Property Australia forecasts that new supply for the Melbourne industrial market will reach decade highs. At present 600,000sqm of new industrial stock is under construction and scheduled for completion in 2020 of which the majority is located in the North. In contrast to 2019, most of the new supply projected to be completed next year is also pre-committed highlighted by Kaufland’s new distribution centre in Mickleham.

Tenant Demand & Rents

Leasing activity in the Melbourne industrial market has been healthy in 2019 with tenant demand levels above average. Having peaked in 2016, the level of vacant industrial property has trended down, falling to five-year lows as at September 2019. Much of the leasing activity in the industrial market has been within prime assets which has resulted in the level of prime industrial stock lower than within secondary space for the first time since 2016. Supported by the strong population growth and evolving e-commerce sector, logistics and retail trade occupiers continue to underpin leasing activity of industrial space in Melbourne in 2019. Urban Property Australia research revealed that logistic & transport companies, retailers and wholesale traders accounted for 63% of all take up recorded this year to date. Melbourne’s strong population growth and affordable rental levels compared to other Australian industrial markets is expected to maintain above-average tenant demand in 2020 with robust levels of enquiry levels.

The declining vacancy levels coupled with sustained tenant demand has placed upward pressure on rental levels. Over the year to September 2019, Melbourne prime industrial rents grew by 6%. Despite speculative development activity above average, Urban Property Australia projects that rents will continue to grow across the Melbourne industrial market in 2020 aided by the low vacancy levels.

Land Values

According to the Department of Environment, Land, Water and Planning there are 26,100 hectares of industrially zoned land across metropolitan Melbourne with 6,291 hectares of that vacant. Over the 17-year period between 2000/01 and 2017/18, there was a net increase of 4,251 hectares of land zoned for industrial use across metropolitan Melbourne.

Prior to the GFC, industrial land consumption across metropolitan Melbourne averaged 300 hectares per year. Following the GFC, consumption declined significantly, but began to increase from 2011/12. Over the last three years however, consumption of industrial land has increased to levels approaching those prior to the GFC. In 2018, 248 hectares of Melbourne industrial land was consumed, the fourth highest level in 11 years, reflecting the strong leasing activity.

The scale of infrastructure projects currently under construction across the state, along with the difficulty of securing investment grade assets and depletion of industrial zoned land across the Melbourne metropolitan area resulted in industrial land values increasing in all sub-regions over the 12 months to September 2019. Urban Property Australia recorded land value annual growth of 44% in the Western region, with the values increasing by 15% in the North and 10% in the South East over the year.

Sales Activity & Yields

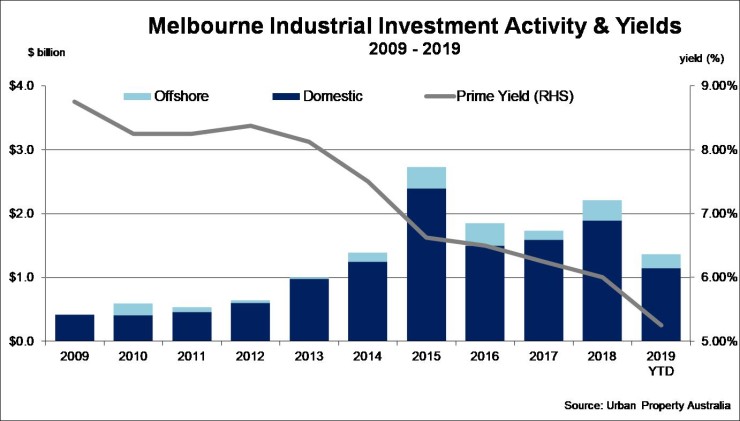

Despite strong investor interest for Melbourne industrial property, sales activity in 2019 to date totals $1.4 billion, which is expected to be lower than the previous four calendar years. The lower investment volume however should not be interpreted as a reflection of waning demand for industrial assets; rather a shortage of available investment grade properties on market. The majority of sales were recorded in the West and South East with domestic purchasers dominating acquisitions. While domestic institutions (AREITs, superannuation funds and unlisted funds) accounted for 40% of industrial sales volume, private investors still acquire the majority of assets available for purchase. Urban Property Australia research revealed that 80% of industrial properties sold in 2019 transacted below $25 million.

The tight supply of investment grade assets coupled with strong investor demand resulted in Melbourne industrial yields continue to compress through the year to September 2019. Prime Melbourne industrial yields remain below the previous historical low with prime yields ranging between 5.25% and 6.50%. Given the record low yields at present, further capital growth will be driven in the short term by income growth rather than significant further yield compression.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.