Q3 2020 – Australian Economic Overview

October 15th 2020 | , Urban Property Australia

In line with international experience, the Australian economy is currently in recession as a result of the COVID-19 pandemic; its first in almost 30 years. Real GDP contracted by 7.0% in the June quarter 2020, the largest quarterly fall on record, after a modest fall of 0.3% in the March quarter 2020.

There have been record falls in a range of key economic indicators over the first half of 2020. Earlier this year, business conditions and confidence fell to record lows and there were significant downgrades to firms’ capital expenditure plans. In the household sector, there were record falls in consumer confidence, with consumption of services such as accommodation, food, recreation and transport particularly hard hit. There have been severe job losses, with the unemployment rate rising at its fastest pace on record in April, alongside a record fall in participation.

The unwinding of containment measures in the latter part of the June quarter 2020 led to a noticeable recovery in economic activity and an improvement in the labour market. Of the 1.3 million people who lost their job or were stood down on zero hours in April, almost 60% or 760,000 have returned work as at October. The pace of output growth is forecast to pick up in late 2020 and into the first half of 2021, as restrictions continue to ease and business and consumer confidence improves. Additional policy support will also continue to boost economic activity. Following a fall of 3.75% in 2020, real GDP is expected to grow by 4.25% in 2021.

The first tranches of the Government’s economic support were effective in mitigating the most severe economic effects of the pandemic. While the unemployment rate is estimated to rise further, peaking at 8% in the December quarter 2020, the labour market overall is expected to continue to recover, with the unemployment rate forecast to reach 6.5% by the June quarter 2022.

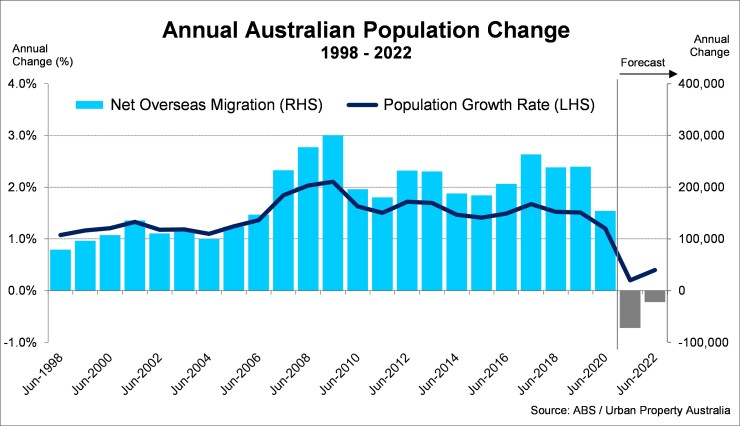

Alongside the confidence and income effects, substantially slower population growth will also weigh on the recovery. Australia’s population growth is expected to fall to 0.2% in 2020/21 and 0.4% in 2021/22, the slowest growth in over a century, due to net overseas migration which is expected to be negative over this period for the first time since 1946.

It is assumed that state border restrictions currently in place are lifted by the end of 2020, except for Western Australia which is assumed to open from April 2021. A gradual return of international students and permanent migrants is assumed through the latter part of 2021. Inbound and outbound international travel is expected to remain low through the latter part of 2021, after which a gradual recovery in international tourism is also assumed to occur.

Net overseas migration is significantly affected by international travel restrictions and weaker labour markets domestically and globally. It is assumed to fall from around 154,000 persons in 2019/20 to be around 72,000 persons by the end of 2020/21, before gradually increasing to around 201,000 persons in 2023/24.

Having cut official interest rates to a record low 0.25% in March 2020 as the Reserve Bank of Australia (RBA) sought to protect the domestic economy from the fallout of the COVID-19 pandemic, it is expected that the cash rate and other elements of the RBA’s monetary stimulus package will remain around current settings until 2023.

Dwelling investment is expected to remain weak in the near term, with a forecast fall of 11% in 2020/21. The sharp contraction in the June quarter 2020 largely reflected a pre-existing slowing in activity. Further declines are expected in the September quarter 2020 as commencements continue to slow and Stage 4 restrictions in Melbourne reduce the level of activity, particularly for apartment development sites.

However, early indicators of demand for new housing construction and liaison with industry suggest the HomeBuilder scheme in conjunction with other housing policies and low interest rates is pulling forward demand and will provide notable support to activity in late 2020 and into 2021. Dwelling investment is forecast to rise by 7% in 2021/22.

New business investment is forecast to fall by 9.5% in 2020/21, driven by a significant deterioration in the outlook for non-mining investment, before growing by 6% in 2021/22. The highly uncertain environment created by the COVID-19 pandemic is expected to see a sharp decline in machinery and equipment investment in the near term and a gradual run off in non-dwelling construction as demand for new projects declines and work in the pipeline is completed.

The Australian Government is investing $110 billion over 10 years from 2020/21 in transport infrastructure across Australia. Since the start of the COVID-19 pandemic the Government committed to invest an additional $14 billion in new and accelerated infrastructure projects over the next four years. Moreover, as part of the 2020/21 Federal Budget, an additional $7.5 billion investment was announced as part of the Federal Government’s COVID-19 economic recovery plan.

Copyright © 2020 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.