Q2 2021 – Australian Economic Overview

August 2nd 2021 | , Urban Property Australia

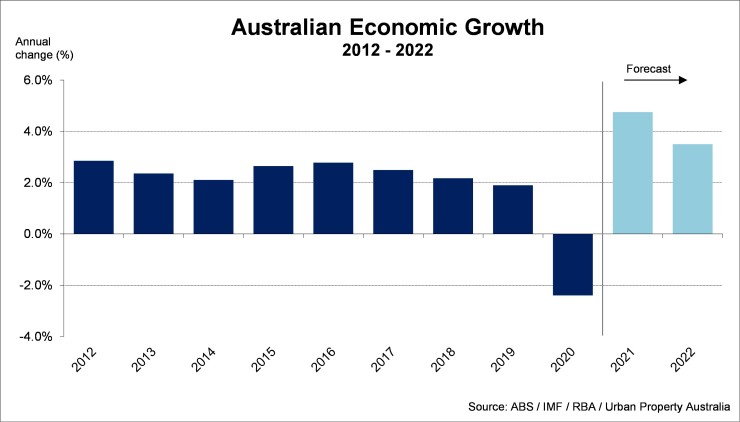

The Australian economy is transitioning from recovery to expansion phase earlier and with more momentum than anticipated. The unique features of the pandemic and policy response have seen the economy rebound much faster than in previous downturns. Along with favourable health outcomes and the removal of restrictions on activity, this snap-back in activity has been supported by extraordinary fiscal and monetary support.

In response to the stronger economic activity and the labour market exceeding expectations, Australia’s GDP growth projections have been upgraded. Australia’s economy is forecast to grow by 4.75% over 2021 and 3.5% over 2022. The level of GDP is still expected to remain a little below that forecast before the pandemic, mostly due to lower population growth.

Conditions in the labour market have continued to improve more quickly than anticipated; with both total employment and total hours worked now higher than before the pandemic, and the decline in the unemployment rate to 4.9% in June – falling to its lowest rate in 10 years. From late 2021, employment growth is expected to moderate in line with activity and impact of the lockdown environment across Sydney.

The unemployment rate is expected to remain relatively stable for the remainder of 2021 with the unemployment rate expected to sit at 4.5% in mid-2023. The lower forecast unemployment rate is also likely to result in wages growth and underlying inflation picking up a bit faster than previously anticipated. Inflation is expected to be close to 2% by mid-2023.

Strong household spending is expected to underpin GDP growth through 2023, supported by the further lifting of activity restrictions, a stronger outlook for household disposable income, wealth effects from higher housing prices, and reduced uncertainty. As economic outcomes continue to improve and more consumption possibilities become available, households are likely to rebalance more of their spending back towards services.

Thankfully, containment measures did not have a material impact on residential construction activity over 2020; instead, government grants, lower interest rates and JobKeeper payments supported both activity and profitability in the sector.

Dwelling investment returned to its pre-pandemic level in the December 2020 quarter, around two quarters earlier than previously expected, proving to be one of the more resilient parts of the economy through the pandemic. Residential construction activity is expected to grow steadily over 2021, as the large volume of development applications approved under the Australian Government’s HomeBuilder scheme and similar state-based grants are worked through. The recent announcement of the extended deadline for the commencement of HomeBuilder projects means that some of this activity will be spread out over a longer period than previously assumed.

While a large share of construction related to the HomeBuilder scheme is expected to represent a pull-forward in activity, low interest rates and the strong rebound in housing prices are expected to sustain growth in dwelling investment over the next three years. Investment in higher-density residential construction is expected to remain subdued over the next year or so; this is due to low levels of building approvals over most of the past three years and lower investor appetite for these types of properties than seen over recent housing cycles. A gradual recovery in population growth should support a decline in rental vacancy rates in larger capital cities and a pick-up in higher-density investment towards the end 2023.

Spurred on by the HomeBuilder program which has proved more popular than anticipated, demand for building materials has increased since the pandemic, with high levels of housing starts and renovation activity. The HIA’s current forecasts suggest 130,000 new homes will be built across the country in 2021, up from the previous peak of 120,000 in 2017. In addition to the domestic stimulus programs, global competition for timber is driving up the cost with many other countries having used construction as stimulus, increasing competition for materials globally. The shortage of building materials including timber, bricks and windows has led to costly delays for renovations and new homes with dwellings which previously were completed in four months now requiring between six and 12 months to complete. With the increased cost of building largely being absorbed by builders, there may will a risk of a rise in builder insolvencies.

Non-mining business investment is expected to increase steadily over the next three years. Following a 10% decline after the onset of the pandemic, it is expected to return to its pre-pandemic level by early 2022 and expand thereafter. Investment began recovering in the December 2020 quarter, which was sooner than expected, and stronger reported business confidence and investment intentions support the more favourable outlook being sustained.

The forecast profile for mining investment has been revised up a little. Profitability in the sector is picking up strongly in response to the recovery in commodity prices, and higher oil prices have improved the viability of some LNG projects. But despite buoyant commodity prices there have been few indications to date that major miners plan to expand iron ore-related investment in response to higher prices.

Government spending is expected to contribute to GDP growth across the next three years. The large public investment programs announced over 2020 are expected to remain an important contributor to growth. The profile for public consumption has been upgraded to incorporate some expected additional spending related to the vaccination program. Other pandemic-related spending is expected to decline across through to 2023 but is offset by expected public consumption commitments stemming from longer-term factors such as the ageing population.

Fiscal policy has played an important role during the pandemic, although the size and composition of this support has varied across economies. In Australia, fiscal policy has supported incomes and encouraged specific categories of spending. Given the faster than expected recovery of Australia’s economy, some economists are now predicting that interest rates will rise in late 2022 (well ahead of the RBA’s 2024 timeline) before peaking at 1.25% in late 2023. The RBA continues to maintain its stance that it will not increase the cash rate until actual inflation is sustainably within the 2% to 3% target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.