Q1 2023 – Melbourne Office Market

April 26th 2023 | , Urban Property Australia

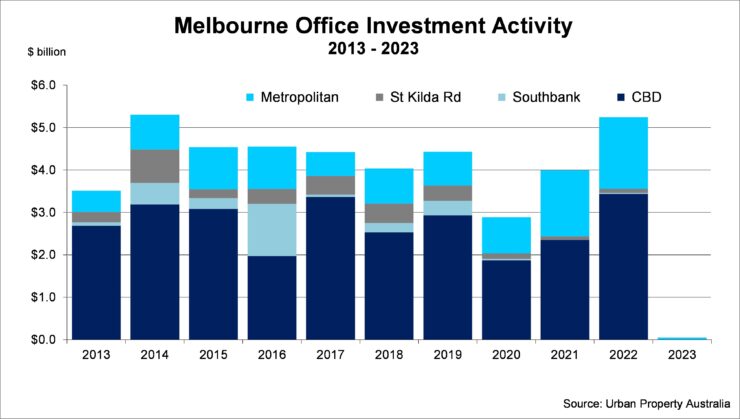

- Sales activity across Melbourne’s office markets have been subdued in 2023 to date with only $50 million transacted in the metropolitan market and no sales recorded in the CBD, St Kilda Road and Southbank markets;

- Victoria’s total employment has increased by increased by 140,000 over the past 12 months which has resulted in the state’s unemployment rate falling to 3.6% as at March 2023;

- The total Melbourne CBD office vacancy has continued to rise, increasing to 13.8%, its highest level since January 1999.

Office Market Summary

Similar to Australia’s other commercial markets, sales activity has been modest in 2023 to date. Across Melbourne’s metropolitan office market there have only been two major sales in the Melbourne metropolitan office market totalling $50 million in 2023 so far. In comparison to last year, the volume of sales across the Melbourne metropolitan office market totalled $250 million in the first quarter. Mirroring the employment growth, tenant enquiries and leasing activity continues to improve with office occupancy rates also recovering.

Sales Volume / Yields

Similar to Australia’s other commercial markets, sales activity has been modest in 2023 to date. Across Melbourne’s metropolitan office market there have only been two major sales in the Melbourne metropolitan office market totalling $50 million in 2023 so far. In comparison to last year, the volume of sales across the Melbourne metropolitan office market totalled $250 million in the first quarter. While sales activity for the past five consecutive years has been above average, investment activity in coming years may be more constrained, adversely impacted by increased funding costs and investor uncertainty regarding the ongoing changes of working styles. Given the increased uncertainty, prime metropolitan office yields have continued to ease and now average 7.0% with secondary yields averaging 8.0%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

Urban Property is projecting 150,000sqm of new office projects to be completed in the metropolitan office market in 2023. Of all the total stock currently under construction in the metropolitan office market, 57% is already committed. With tenant demand strengthening and the level of new supply peaking in the Melbourne metropolitan office market in the short term, Urban Property projects that the vacancy rate has peaked and will trend down as tenants capitalise on the attractive leasing terms on offer to upgrade their office accommodation. Although the vacancy rate is anticipated to have peaked, with vacancy levels still elevated; looking ahead, the development pipeline is forecast to ease as funding requirements for new projects will constrain new supply for the medium term.

Tenant Demand

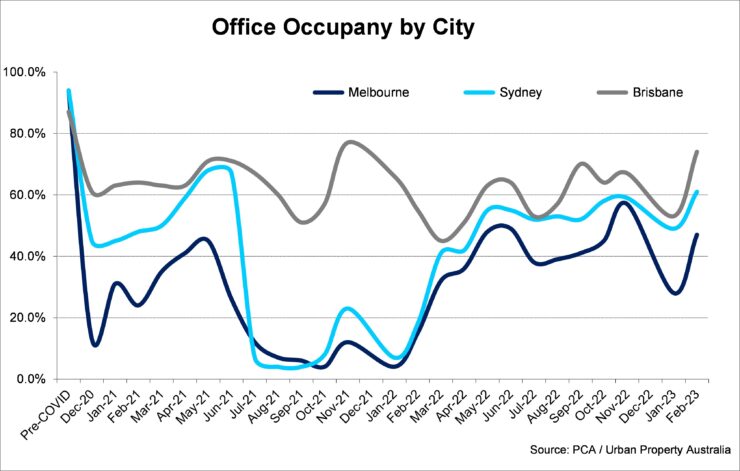

Over the past year, Victoria’s total employment has increased by 140,000 which has resulted in the state’s unemployment rate falling to 3.6% as at March 2023, down from 4.0% as at March 2021. Highlighting the growing business investment environment, as at February 2023, there were 71,200 jobs being advertised compared with only 50,800 in February 2021. Mirroring the employment growth, tenant enquiries and leasing activity continues to improve. While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels, albeit pleasingly levels have also recovered in the past six months. Latest office occupancy levels in Melbourne have risen to 47% compared with 15% a year earlier.

Vacancy / Rents

With an improving level of tenant demand, meeting the wave of new completions the vacancy rate of the Melbourne metropolitan office market remained steady at 12% as at March 2023, albeit still almost double the long-term average. Urban Property forecast that the vacancy rate of the metropolitan office market has peaked for the short term as the pipeline of new supply reduces in coming years. Reflecting the stabilising vacancy levels and improving leasing activity across the Melbourne metropolitan office market, prime rents continue to rise with both growth in net face rental levels and decreases in incentive levels. Looking ahead, Urban Property Australia forecasts that prime rents will continue to rise as tenant demand gathers momentum. In contrast, secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is highlighted from the recent trend of tenant moves.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to rise, increasing to 13.8% as at January 2023, its highest level since January 1999. Interestingly, having reached a 28-year high, sub-lease vacancy levels appear to have peaked in the short term, falling from 2.6% in July 2022 to 1.9% as at January 2023. Although tenant demand in the CBD office market over the six months to January 2023 was negative, the result was driven by tenants vacating secondary stock at the expense of prime grade office space. While rental incentives appear to have stabilised, prime office space recorded some marginal growth of face rents, resulting in a slight increase in net effective rents over the year. After recording all-time high transactional activity in the Melbourne CBD office market last year, no major sales were transacted in the first quarter of 2023.Urban Property Australia forecasts that prime CBD office net effective rents will gather momentum in 2023 as occupancy levels continue to rise.

Outside of the CBD, the vacancy rate of the Southbank office market fell to 14.6% as at January 2023, above its 10-year average. While the vacancy rate of the St Kilda Road office market rose to 21.6% as at January 2023, an all-time high. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Similar to Melbourne’s other office markets, transactional activity remains subdued in both Southbank and St Kilda Road office markets with no assets transacted in 2023 to date.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.