Q2 2023 – Melbourne Residential Market

July 23rd 2023 | , Urban Property Australia

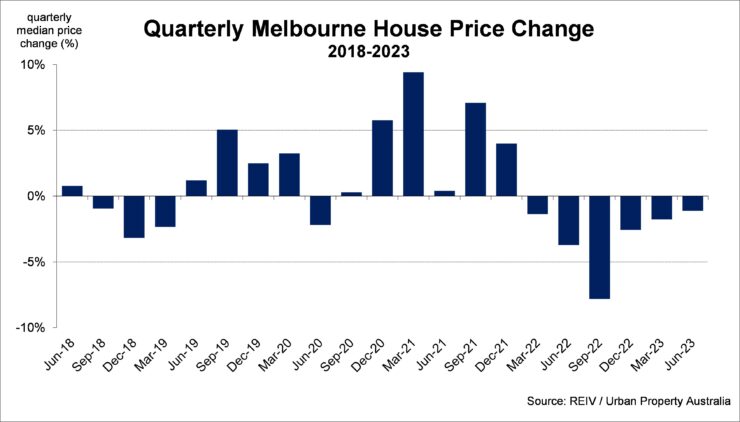

- Although the Melbourne median house price has declined through the year to June 2023, the rate of quarterly decreases has eased indicating that prices appear close to stabilising;

- Reflecting the growing housing shortage in Melbourne, median house rents increased by 6% over the year with unit rents rising by 16% over the year;

- Demand for housing in Melbourne continues to strengthen with vacancy rates falling to four-year lows with the Outer region the tightest sub-market.

Residential Market Summary

Although the Melbourne median house price has declined through the year to June 2023, the rate of quarterly decreases has eased indicating that prices appear close to stabilising. Interestingly, Melbourne median unit prices increased over the June 2023 quarter, the first rise in values since December 2021. While the downside risks to housing values are clear, there are some mitigating factors, including record levels of net overseas migration, a burgeoning housing undersupply, and an expectation that labour markets will hold reasonably tight.

Prices

While Melbourne’s median house price continues to decrease, they remain above pre-pandemic levels as recent results indicate that prices may be stabilising. As at June 2023, Melbourne’s median house price was $937,500 according to the REIV, having declined by 1.1% over the quarter and down 3% in 2023 to date. Although the Melbourne median house price has declined through the year to June 2023, the rate of quarterly decreases has eased indicating that prices appear close to stabilising. Interestingly, Melbourne median unit prices increased over the June 2023 quarter, the first rise in values since December 2021. According to the REIV, as at June 2023, Melbourne’s median unit price increased to $630,500 and is in fact 1% through 2023 to date. Looking ahead, while the downside risks to housing values are clear, there are some mitigating factors, including record levels of net overseas migration, a burgeoning housing undersupply, and an expectation that labour markets will hold reasonably tight.

Supply

According to the ABS, there are currently 71,700 dwellings under construction across Victoria, close to all-time high levels. While the number of dwellings currently under construction is 14% above the 10-year average, total levels are 3% lower than those recorded a year earlier. While the number of both houses and units under construction across Victoria are above their respective 10-year averages, with construction prices having risen by 25% over the past three years and higher financing costs, the level of new supply is likely to continue to decrease in coming years with commencements falling to nine-year lows. Further ahead, over the year to May 2023, a total of 55,100 dwellings were approved in Victoria, below the 10-year average and the lowest level in 10 years. The share of unit developments declined through 2023 with its proportion is now below the long-term average, rising as a result of more challenging financing for unit development and now account for 37% of all dwelling approvals.

Demand

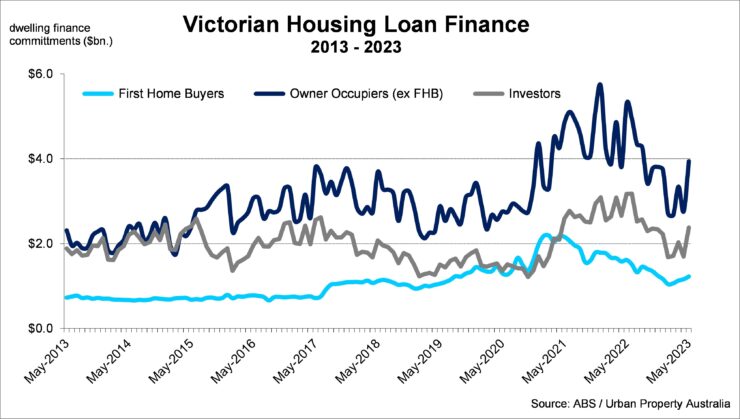

With Australia’s borders reopen to overseas migrants, Victoria’s population is once again growing, increasing by over 130,900 over the past year, its highest level in six years. Victoria’s population growth was driven by overseas migrants with the state still losing people moving to other states. While total annual Victorian housing finance commitments sit 18% above the 10-year average in May 2023 with $85.7 billion financed, levels have fallen by 22% over the past year. Monthly finance commitments have decreased across all categories compared to levels 12 months ago with both owner occupier and investor finance levels down 25%. Unsurprisingly, first home buyers’ levels have also decreased, having declined by 24% over the year. While investor financing volumes have fallen over the year, investors now account for 32% of total housing finance commitments in Victoria, compared to their share 27% two years ago. Looking ahead, with strong rental growth and a shortage of housing, Urban Property Australia expects that investors will continue to grow their share of housing loans.

Vacancy

According to the REIV, as at June 2023, the vacancy rate for Melbourne residential property fell to 2.1%, down from its peak of 6.5% of March 2021, and now sits below the 10-year average of 3.1%. All precincts’ current vacancy rates now sit below their respective 10-year averages with vacancy rates decreasing across all of Melbourne’s precincts over the year to June 2023. The vacancy rate of the Outer region recorded the tightest rate at 1.6%, albeit higher than its trough of 1.3% in March 2023. The Middle Melbourne region holds the highest vacancy rate at 2.9% while the vacancy rate of the Inner region sits at 2.0%. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain low with falling supply levels coupled with population growth of Melbourne gathering momentum.

Rents

Mirroring the improving vacancy trends, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over the year to June 2023, the weekly median rent for houses in metropolitan Melbourne increased to $530 per week, up from $500 per week a year earlier. Across Melbourne, rents for houses located in the Outer region increased by 11.1%, with rents in the Middle region increasing by 10.4% and the rents in the Inner precinct rising by 5.1%. Interestingly, rents for Melbourne units increased by 16.3% (more than double the rise observed in Melbourne houses) over the year with unit rents rising across all precincts. Looking forward, Urban Property expects that residential rents will steadily increase as prospective buyers will have a lower borrowing capacity impacted by higher interest rates.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.