Q3 2023 – Melbourne Office Market

November 13th 2023 | , Urban Property Australia

- Sales activity in the Melbourne metropolitan office market has been relatively resilient with almost $650 million transacted in the market in 2023 to date, been boosted by a number of major transactions recently;

- The Melbourne CBD office vacancy has continued to rise, increasing its highest level since 1997 with the vacancy rate of the St Kilda Road office market rising to an all-time high;

- While leasing activity has improved through 2023, it remains relatively modest compared to historical levels with occupiers focused on A-grade space.

Office Market Summary

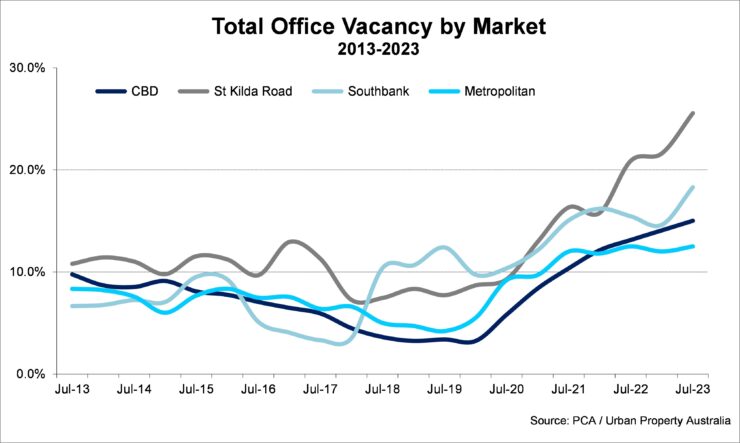

Sales activity in the Melbourne metropolitan office market has been relatively resilient with almost $650 million transacted in the market in 2023 to date, accounting for more than 40% of all of Melbourne’s office sales (inclusive of the CBD), its highest proportion in 15 years. The Melbourne CBD office vacancy has continued to rise, increasing to 15.0%, its highest level since July 1997. Outside of the CBD, the vacancy rate of the St Kilda Road office market rose to 25.5%, an all-time high. While tenant demand has been positive over the past 12 months, take up of stock remains subdued with occupiers focused on A-grade space.

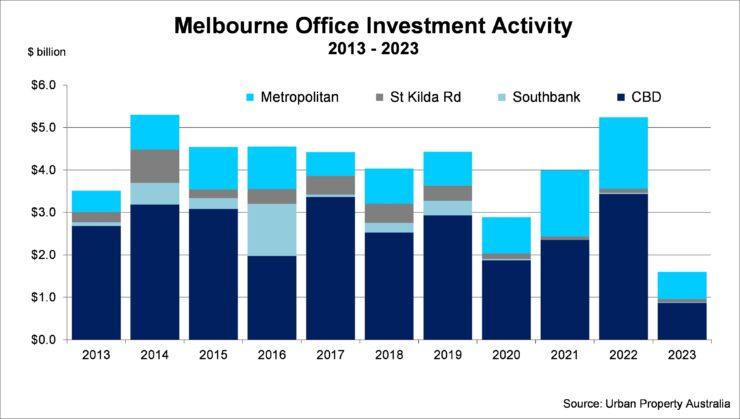

Sales Volume / Yields

While investors remain wary about the office sector, investment activity within the Melbourne’s metropolitan office market has been relatively resilient with almost $650 million transacted in the market in 2023 to date, nearing its annual average of $700 million. The level of investor interest in the Melbourne’s metropolitan office is further highlighted with the fact that the sector has accounted for more than 40% of all of Melbourne’s office sales (inclusive of the CBD), its highest proportion in 15 years. Investment volume in Melbourne’s metropolitan office in 2023 has been boosted by a number of major transactions with four office sales exceeding $50 million. While sales activity across the Melbourne’s metropolitan office market is likely to surpass its 10-year average, 2023 is projected to the lowest level in 10 years impacted by increased funding costs. Given the increased uncertainty, prime metropolitan office yields have continued to ease and now average 7.25% with secondary yields averaging 8.5%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

Urban Property is projecting 250,000sqm of new office projects to be completed in the metropolitan office market in 2023 and 2024. Of all the total stock currently under construction in the metropolitan office market, 52% is already committed. Much of the focus of the new development remains focused on the City Fringe with the precinct accounting for 60% of all new metropolitan office stock projected to be completed in 2023 and 2024. With tenant demand strengthening and the level of new supply peaking in the Melbourne metropolitan office market in the short term, Urban Property projects that the vacancy rate has peaked and will trend down as tenants capitalise on the attractive leasing terms on offer to upgrade their office accommodation. Although the vacancy rate is anticipated to have peaked, with vacancy levels still elevated; looking ahead, the development pipeline is forecast to slow as funding requirements for new projects will constrain new supply for the medium term.

Tenant Demand

Over the past year, Victoria’s total employment has increased by 133,000 which has resulted in the state’s unemployment rate falling to 3.5% as at September 2023, down from 4.7% as at September 2021. Highlighting the solid business investment environment, as at September 2023, there were 69,900 jobs being advertised compared with the 10-year average of 47,000. Mirroring the employment growth, tenant enquiries and leasing activity continues to improve. While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels, albeit pleasingly levels have also recovered in the past six months. Latest office occupancy levels in Melbourne have risen to 47% compared with 15% a year earlier. While tenant demand has been positive over the past 12 months, take up of stock remains subdued with occupiers focused on A-grade space.

Vacancy / Rents

While the level of tenant demand improved, it was surpassed by the level of new completions and as such the vacancy rate of the Melbourne metropolitan office market rose slightly, increasing to 12.5% as at June 2023, still almost double the long-term average. Urban Property forecast that the vacancy rate of the metropolitan office market has peaked for the short term as the pipeline of new supply reduces in coming years. Reflecting the stabilising vacancy levels and improving leasing activity across the Melbourne metropolitan office market, prime rents continue to rise with both growth in net face rental levels while incentive levels stabilise. Looking ahead, Urban Property Australia forecasts that prime rents will modestly rise as tenant demand gathers momentum. In contrast, secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is highlighted from the recent trend of tenant moves.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to rise, increasing to 15.0% as at July 2023, its highest level since July 1997. As occupiers continue to re-assess their CBD office requirements, sub-lease vacancy levels rose through 2023 with now more than 100,000 square metres across the CBD offered for sub-lease with Urban Property Australia projecting further rises in 2024. Tenant demand in the CBD office market over the first half of 2023 was negative, with most occupation levels of most grades contracting, surprisingly led by A-grade office stock. As a result of the tenant vacations, the A-grade office vacancy rate in the CBD has increased to 15.2% – its highest level since 1995. Net effective rents for Melbourne CBD office stock have declined as incentives has risen in response to increasing vacancy rates and subdued tenant demand. While there is increasing sales activity in the CBD, the market looks set to record its lowest level of sales volume since 2012 with $860 million transacted in 2023 to date.

Outside of the CBD, the vacancy rate of the Southbank office market rose to 18.3% as at July 2023, its highest rate since January 1995. Elsewhere the vacancy rate of the St Kilda Road office market rose to 25.5% as at July 2023, an all-time high. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Similar to Melbourne’s other office markets, transactional activity remains subdued in both Southbank and St Kilda Road office markets with less than $100 million transacted across the two office markets in 2023 to date compared with the long-term average of $500 million.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.