Q1 2025 – Australian Economic Overview

April 26th 2025 | , Urban Property Australia

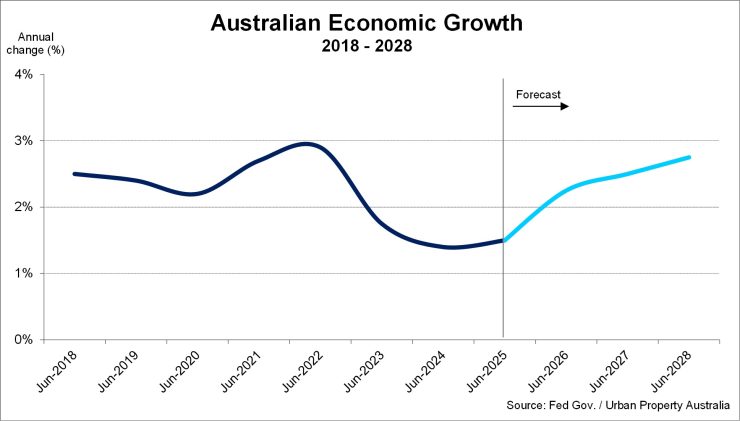

According to the IMF, Australia’s annual output will be $13 billion lower in 2025 than forecast in January 2025, with Australia’s economy predicted to grow by 1.6%, down from 2.1% as previously projected, impacted by the US tariffs. Like many countries that trade with the US, Australia is currently subject to a 10% “baseline” tariff.

Despite heightened global uncertainty, growth has picked up and a soft landing is looking increasingly likely for Australia. Beyond this year, the economy is expected to gain further momentum with growth of 2.25% projected in the 12 months to June 2026 and 2.5% the following financial year.

Household consumption growth remained subdued over the past year with many households continuing to face cost-of-living pressures, including high mortgage costs. However, growth in real household disposable income is forecast to continue to pick up, which is expected to drive a gradual rise in consumption over the next three years.

In terms of housing investment, there are signs that capacity constraints in the construction sector are gradually easing. Inflation in the price of construction materials has fallen and the availability of suitable labour is beginning to improve. Alongside the easing in capacity constraints, financing costs are also expected to moderate. This will enable construction activity to gradually respond to robust housing demand, with dwelling investment expected to gather momentum from mid-2025.

Government investment has underpinned the Australian economy over the past two years, however, looking ahead government investment is expected to moderate as private sector demand becomes a more prominent driver of growth in the economy.

Business investment has grown solidly for two years and, is expected to remain at recent decade highs with non-mining investment expected to be the main contributor to growth over coming years, supported by investment in renewable energy infrastructure, warehouses and data centres.

Employment growth has been strong, and the unemployment rate has remained low. The strength of the labour market has contributed to a smaller-than-expected rise in the unemployment rate. The unemployment rate is forecast to peak at 4.25% and wage growth is expected to remain above pre-pandemic rates.

Inflation has moderated substantially, and recent progress has been better than expected. The moderation in inflation has been assisted by cost-of-living relief and the decline in petrol prices. Inflation is now forecast to be 2.5% as at June 2025, lower than expected in previous projections. Excluding energy rebates and fuel, inflation is expected to return sustainably to the target band around the middle of this year.

With expectations that headline inflation to fall to near the bottom of the Reserve Bank of Australia’s target range at 2.3% along with the general global economic slowdown and negative sentiment that the tariffs may bring it is forecast that the RBA will also cut interest rates in 2025. On current market predictions, interest rates are projected to fall below 3% by the end of the year.

Australian population growth continues to ease with net overseas migration declining from its peak in mid-2023 reflecting lower migrant arrivals. Net overseas migration levels are projected to ease over the next year before stabilising from mid-2026.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.