Q1 2025 – Melbourne Apartment Market

April 26th 2025 | , Urban Property Australia

- While values of Inner-City apartments increased over the March 2025 quarter, rising by 1.5%, median prices remain lower than they were 12 months earlier;

- Inner Melbourne apartment rents are once again nearing all-time high levels having increased by 4.5% over the year, led by rental growth recorded in 1-bedroom apartments;

- Transactional activity for apartments in the Inner-City region has begun strongly with 1,200 sales recorded over the first quarter of 2025, surpassing levels achieved last year.

Inner-City Melbourne Apartment Summary

Most of the pipeline of new apartments for the Inner-City currently under construction are within the build-to-rent sector in contrast to the built-to-sell sector. Currently there are 5,900 apartments under construction within the Inner-City Melbourne region. However, with 400 new apartments completed in 2025 to date, this year is on track to record the lowest year of new supply since 2008. Over the past 20 years, on average, there have been 3,600 new apartments delivered to the Inner-City market.

Prices

While values of Inner-City apartments increased over the March 2025 quarter, rising by 1.5% to $597,000 according to the REIV, values remain lower than they were 12 months earlier. Over the 12 months to March 2025, values of 1-bedroom, 2-bedroom and 3-bedroom Inner-City apartments all declined. Values of 2-bedroom Inner-City apartments declined by 0.2% to $630,000 with median prices of 1-bedroom apartments falling by 1.3%. Prices of 3-bedroom apartments declined by 3.4% over the year to March 2025 according to the REIV having outperformed other apartments in recent years. With solid rental growth coupled with a constrained pipeline, Urban Property forecasts that the strong values of Melbourne Inner-City apartments have reached their nadir and will be supported in the short term.

Supply

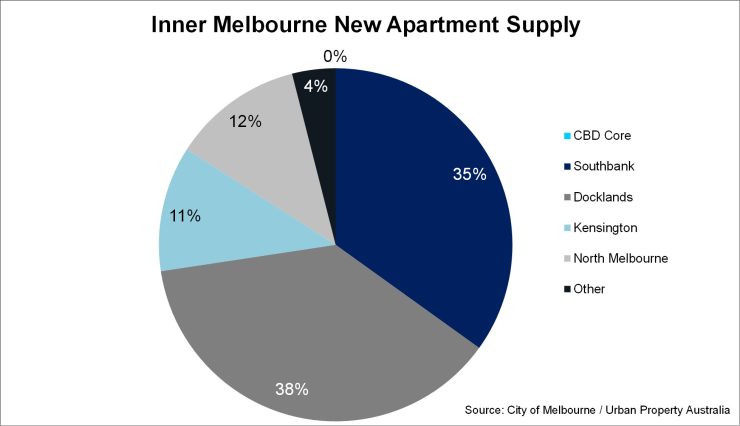

Currently there are 5,900 apartments under construction within the Inner-City Melbourne region. Urban Property Australia research recorded 400 new apartments completed in the Inner-City Melbourne market over the first quarter of 2025, with the outlook for annual completions of new Inner-City apartments this year on track to the lowest year of supply since 2008. Over the past 20 years, on average, there have been 3,600 new apartments delivered to the Inner-City Melbourne market each year. Most of the pipeline of new apartments for the Inner-City currently under construction are within the build-to-rent sector in contrast to the built-to-sell sector. Of the 39 new developments currently under construction, 37% of the apartments are in the Docklands, followed by 35% in Southbank and 12% in North Melbourne. Looking ahead, while there are a further 22,000 apartments with plans approved in the Inner-City Melbourne region, Urban Property Australia’s research forecasts that new apartment supply in the Inner-City Melbourne precinct is projected to remain below the average annual levels for the next five years despite the near record population growth and state government incentives.

Demand

Transactional activity for apartments in the Inner-City region has begun strongly with 1,200 sales recorded over the first quarter of 2025, surpassing levels achieved last year. Most transactions were focused on Southbank and CBD-Core located apartments which collectively accounted for 52% of all sales followed by those based in the Docklands and Carlton which both accounted for 11% of total Inner-City apartments sold in 2025 to date. Looking ahead, Urban Property Australia’s research forecasts that the transactional activity of the Inner-City apartment market will continue to strengthen as investor demand gathers momentum buoyed by the all-time high rental levels but may be moderated by the limited pipeline of new apartments.

Vacancy

While the Inner-City’s residential population has begun to recover the losses it suffered in recent years, its population remains below the all-time high recorded in 2020. According to the REIV, as at March 2025, the residential vacancy rate for the Inner-City precinct (0-4km radius of the GPO) was 3.0%, its highest level since November 2023 having increased through 2024 despite the limited supply pipeline. Looking ahead, Urban Property forecasts that the vacancy rates for the Inner Melbourne precinct will continue to remain below its long-term average of 3.3% as employment in the CBD picks up, international students return coupled with a relatively constrained pipeline of new apartments.

Rents

With the vacancy rate remaining low coupled with the limited development pipeline, Inner Melbourne apartment rents are once again nearing all-time high levels. As at March 2025, median Inner Melbourne apartment rents were $600 per week, having increased by 4.5% over the year, according to the REIV. Over the year to March 2025, average rents for all sized-bedroom apartments in the Inner-City precinct rose by at least 2.5%, somewhat surprisingly led by 1-bedroom apartments which increased by 4.2% over the year. Urban Property Australia forecasts that although Inner Melbourne rents have close to all-time highs, further rental growth is likely with growing employment in the CBD and the rising international student numbers.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.