Global and Australian Economic Outlook Mid 2017

July 5th 2017 | , Urban Property Australia

While the global economy appears to be gaining momentum, the Australian economy has been lacklustre. Although Australia recorded 26 years of growth in Australia without a technical recession as at April 2017, the pace of Australia’s economy grew at its slowest rate since 2009.

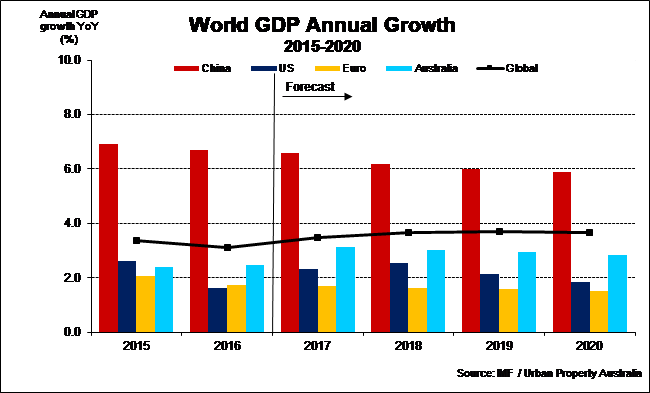

In 2016, the global economy recorded its lowest growth since the GFC, but there are encouraging signs that growth is strengthening in 2017. After prolonged weakness, global trade volumes have picked up in recent months and there are signs of an improving outlook for business investment and industrial production in a number of major economies.

According to the International Monetary Fund (IMF), world economic growth is expected to rise from 3.1% in 2016 to 3.5% in 2017 and 3.6% in 2018, slightly above the October 2016 World Economic Outlook forecast.

Indeed, there are positive signs in some of Australia’s key trading partners in Asia, with China, Japan and South Korea recording recoveries in export value growth in recent months. The recovery in export values partly reflects foreign exchange and commodity price movements, with oil prices regaining some ground over the past year from lows seen in early 2016.

Still, a range of uncertainties surround the forecasts for global growth. Heightened policy uncertainty has emerged in a range of countries. High levels of debt, potential financial imbalances and overcapacity in some sectors remain as risks to China’s economy, while Europe continues to face a range of persistent issues following the GFC and the European sovereign debt crisis.

The economic expansion in the United States following the GFC is forecast to extend to a decade of continuous annual growth. Consumption and housing investment should support growth, while consumer sentiment has increased markedly in recent months. The US unemployment rate has fallen back to near pre-GFC lows however, the policy platform of the new US Administration includes measures that could have a range of effects on the US and global economies. The exact impact will depend on the final mix of policies and how they are implemented. The U.S. economy is projected to expand at a faster pace in 2017 and 2018, with growth forecast at 2.3% and 2.5% respectively. The stronger near-term outlook reflects the momentum from the second half of 2016, driven by solid consumption growth and the assumption of a looser fiscal policy stance.

The Euro area recovery is expected to proceed at a broadly similar pace in 2017 and 2018 as in 2016. The modest recovery is projected to be supported by a mildly expansionary fiscal stance however the political uncertainty as elections approach in several countries, coupled with uncertainty about the European Union’s future relationship with the United Kingdom, is expected to weigh on activity. Output in the Euro area is expected to grow by 1.7% in 2017 and 1.6% in 2018.

Growth in the United Kingdom is projected to be 2.0% in 2017, before declining to 1.5% in 2018. The Conservative party’s position weakened further following the June 2017 election result as they failed to secure an absolute majority. The economy continues to face headwinds, with ongoing political uncertainty and Brexit negotiations, which will require careful navigation by business and the government.

Growth in China has gained some momentum over late 2016 and early 2017. This has been underpinned by increasing credit intensity with an associated build-up of risks in the property and financial sectors. Economic stability is expected to remain a top priority for authorities in the short term. This year, Chinese authorities are targeting 6.5% economic growth, not far from the 6.7% growth last year, slowing to 6.2% in 2018.

India’s economy has shown remarkable resilience in recent years and is expected to remain the world’s fastest growing major economy over the next three years. Growth slowed slightly in 2016 but a recovery is expected through 2017. Medium-term growth prospects are favourable, with growth forecast to rise to about 8% over the medium term due to the implementation of key reforms.

Australian Economic Outlook

While April 2017 marked 26 years of growth in Australia without a technical recession, the pace slowed to 1.7% over the year, the lowest rate since 2009 and a continuation of the below average growth trend since 2009.

Tropical Cyclone Debbie hit Australia on 28 March 2017, which significantly disrupted Australia’s coal exports and adversely affected the agricultural and tourism industries. Overall, Tropical Cyclone Debbie is expected to have reduced real GDP growth by 25bps in the June quarter of 2017, predominantly through lost coal exports.

Overall, the Australian economy is forecast to pick up to 2.75% in 2017/18, up from an expected growth of 1.75% in 2016/17 having been impacted by weather-related events. With non-mining business investment expected to pick up, supported by strengthening demand, solid business conditions and low financing costs, Australian economic growth is projected to increase to 3.00% in 2018/19.

Defying weakness in the household sector and sluggish GDP growth according to the National Australia Bank’s May business survey, operating conditions remained near the highest levels seen since the global financial crisis. Although levels of business confidence eased in May, the confidence index still remains above its long-run average. For the first time since 2010, all industries recorded positive business conditions with significant improvements also observed in Western Australia, which may signal that the worst of the mining sector drag may be in the past.

In contrast, consumer confidence fell in June for a third straight month, a trend observed in general since mid-2016. Concerns about an overheating housing market and soft domestic economy weighed on consumer sentiment.

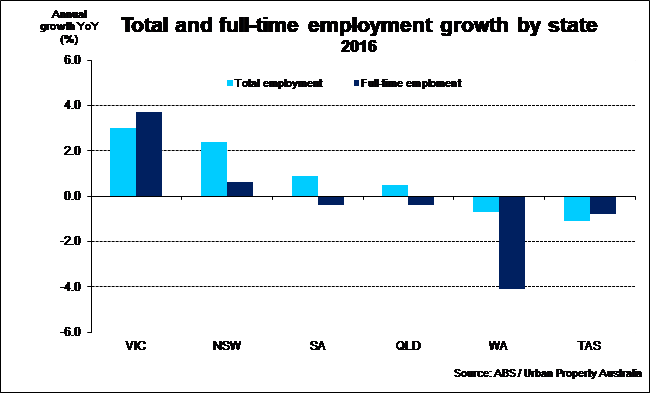

Australian employment continues to strengthen with 141,000 jobs created between February and May 2017 – driven mostly by full-time employment. This recent improvement in employment has seen the unemployment rate drop sharply from 5.9% in March to 5.5% in May – the lowest rate since March 2013. The strong rise in employment is consistent with the strength in job advertisements since the start of 2017. The current level of job advertisements suggest that employment growth is likely to continue through the remainder of 2017.

The Reserve Bank has left the official cash rate on hold for its ninth meeting in a row, amid growing signs the property market has peaked. The cash rate has been held at its record low of 1.5% since August 2016, following an earlier cut to in May 2016. Soft GDP growth, stubbornly low wages and soft construction and limited growth in household consumption were all factors offered in the RBA’s board statement to hold the cash rate. While the sustained improvement in the labour market in recent months decreased the probability of further interest rate cuts; the projected slow economic growth and weak underlying inflation is likely to result in the current cash rate level being maintained throughout 2017 and 2018.

Reflecting subdued growth in household income, household consumption growth has been relatively slow in recent years compared with long-run historical growth rates. In the period since the GFC, average consumption per capita growth has fallen well below the averages of the past few decades. Household consumption expenditure is forecast to continue to grow faster than household income over the next three years, resulting in a lower household saving rate.

Dwelling investment has grown strongly over the past three years, providing support for the economic transition. It grew by 10.6% in 2015/16 — the fastest growth observed since the early 2000s. Dwelling investment is expected to continue to support growth in the near term, with a strong pipeline of residential construction work yet to be done. Building approvals have softened since around mid-2016, with a moderation in detached house approvals and significant falls observed in approvals for medium-to-high density dwellings. As a result, the level of dwelling investment is expected to grow by only 1.5% in 2017/18 and to fall by 4% in 2018/19 once the current elevated pipeline of building work comes to completion.

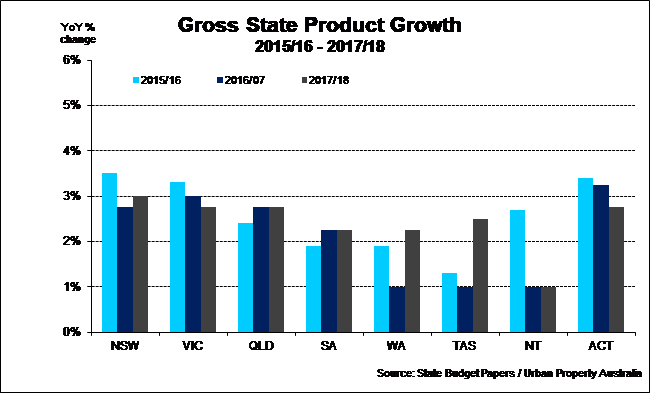

Solid labour market conditions and the housing sector continue to support growth in New South Wales and Victoria. Economic growth in Queensland and Western Australia appears to be gathering momentum underpinned by an improvement in the labour market and the recent pick-up in resource prices. In South Australia and Tasmania, economic growth remain close to trend growth with the labour market and household sector conditions relatively subdued.

Victorian State Economic Outlook

The national transition from mining investment to broader-based sources of growth, including construction and other service industries, is well underway and benefiting Victoria. In 2015/16, Victoria’s real gross state product (GSP) expanded by 3.3%.

The outlook for the economy is generally positive, with growth forecast to remain robust. Real GSP is expected to remain relatively strong over the next three years. Victoria’s real GSP growth is forecast to increase by 2.75% in 2017/18 and remain at that level to 2020/21. Household consumption, business investment, dwelling investment and the Government’s infrastructure investment are expected to contribute to growth.

In 2016, employment in Victoria grew by an average of 3.0%, the strongest among the states. Looking forward, employment is forecast to grow at an above-trend pace in 2017/18, driven by strong demand and modest wages growth. With above-trend employment growth in the near term, the unemployment rate is forecast to decline to 5.5% in 2017/18.

Over the year to June 2016, Victoria’s population grew by 2.1%; again, the highest growth rate of all the states. Net overseas migration has been the largest contributor to population growth, accounting for more than 50%of the state’s population increase over the year to June 2016. Victoria also recorded the highest net interstate migration of all states, reflecting the relative attractiveness of Victoria as a place to live and work.