Q1 2019 – Global Economic Overview

April 10th 2019 | , Urban Property Australia

- Leading indicators suggest the global economy will continue to soften in 2019;

- Australia’s economic growth outlook continues to be under downward pressure, given recent declines in the housing market;

- Victoria’s economy is growing at its fastest rate in seven years and the highest of all Australian states.

Economic Summary

Along with the global economy, the Australian economy has also softened with annual growth easing to its lowest rate in two years. Despite strong employment conditions, recent declines in the housing market have led to downward revisions to Australia’s economic outlook.

Global Economic Overview

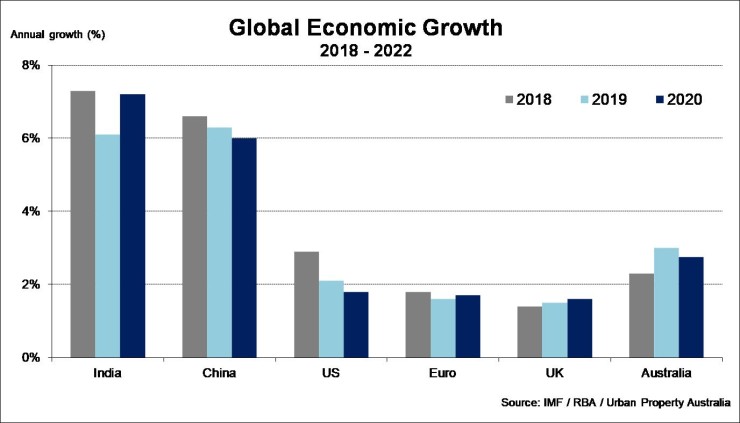

Leading indicators suggest that the global economy will continue to soften in 2019 with annual growth forecast of 3.4%, lower than the growth achieved of 3.8% in 2017 and 3.6% in 2018. Notwithstanding the slower growth, labour markets in the major advanced economies have remained tight however, this has not translated into materially higher inflation.

Trade tensions remain a continued source of uncertainty for the global outlook. While the increases in tariffs implemented in 2018 continue to weigh on trade between the United States and China; the overall slowdown in growth goes beyond trade issues, with weak domestic demand in a range of countries.

United States

The large fiscal stimulus had boosted GDP growth in the United States over 2018, well above expectations. The US unemployment rate is currently close to 4%, and the country has added jobs every month for a record 101 months in a row. In 2019, US economic growth is expected to slow from last year’s rapid pace due to the fading fiscal policy boost coupled with the effect of past monetary policy tightening. Early indicators such as retail sales and US manufacturing indicate that conditions have in fact eased in recent months. The U.S. economy is projected to grow by 2.1% in 2019 (down from 2.9% in 2018) and to ease further in 2020 with growth of 1.8% forecast.

China

In China, GDP growth was 6.6% in 2018, but growth is expected to moderate in 2019, largely because of the previous tightening in financial conditions. In the near term, the pace of slowing is expected to be tempered by recent targeted fiscal and monetary stimulus, which should also help offset any negative effects arising from trade conflict with the United States. Ongoing trade tensions and the need to manage financial risks mean that there is considerable uncertainty around how these easing measures will affect future growth in China and other economies with strong trade links to China.

Europe

Economic growth across the Euro area also continues to ease with this slowing quite broad based across countries. Growth in the Euro area is set to moderate from 1.8% in 2018 to 1.6% in 2019 and 1.7% in 2020. Some of the loss of momentum has come from weaker external demand, particularly from China along with disruptions to German automotive production industry impacted by compliance issues around emissions standards. Economic growth in Italy remains subdued due to weak domestic demand and higher borrowing costs while growth in France is also projected to be modest as a result of negative impact of street protests and industrial action.

United Kingdom

UK GDP growth is forecast to remain subdued in 2019 as Brexit-related uncertainty, global trade tensions and higher interest rates weigh on the economy. Still, the unemployment rate is expected to remain close to its lowest level since the mid-1970s and wage growth is likely to remain modest. Given the prolonged ambiguity about the Brexit outcome, the economy in the UK is projected to remain subdued with growth of 1.5% forecast in 2019 and 1.6% projected in 2020 (assuming that a Brexit deal is reached this year and that the UK transitions gradually to the new regime).

India

Growth in India has eased in recent quarters. Private consumption growth has declined a little, partly due to earlier increases in fuel prices In contrast, investment growth remains strong and continues to support industrial production. Crude steel production in India has moderated a little in recent months, but output remains at high levels, which is supporting coking coal imports from Australia. Indian export shipments have grown solidly over the past year, but have moderated a little in recent months, possibly related to the slowdown in global trade. This year India’s economy is projected to grow at 7.1% and 7.2% in 2020, from 7.3% recorded last year.

Economic trends have generally softened – growth in major advanced and emerging market economies slowed from late 2018, and more leading indicators suggest further slowing. The slowdown goes beyond global trade concerns, with weak domestic demand in a range of countries.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.