Q1 2023 – Global Economic Overview

April 26th 2023 | , Urban Property Australia

- While globally the economy will avoid a recession, economic growth is projected to trough this year as the supply-chain disruptions unwind;

- While there are positive signs emerging in 2023 that inflation has peaked, economic growth in Australia is projected to slow throughout 2023 under the impact of rising interest rates;

- Victoria’s labour market remains robust with almost 150,000 jobs added to the state over the past 12 months driven by full-time roles.

Economic Summary

Despite strong headwinds, which are mostly related to the ripple effects from the war in Ukraine and high global inflation, the global economy has proven resilient so far in 2023. Reflecting the synchronous tightening of monetary policy by most central banks across the world, inflation appears to have peaked. Global economic growth is forecast to increase by 2.8% this year, boosted China rebounding strongly having dropped most of its COVID-19 restrictions earlier than expected.

Q1 2023 – Global Economic Overview

Despite strong headwinds, which are mostly related to the ripple effects from the war in Ukraine and high global inflation, the global economy has proven resilient so far in 2023. Reflecting the synchronous tightening of monetary policy by most central banks across the world, inflation appears to have peaked albeit with projections to decline slower than previously anticipated.

While globally the economy will avoid a recession, economic growth is projected to trough this year as the supply-chain disruptions unwind. Global economic growth is forecast to increase by 2.8% this year before rising to growth of 3.0% in 2024 boosted China rebounding strongly having dropped most of its COVID-19 restrictions earlier than expected.

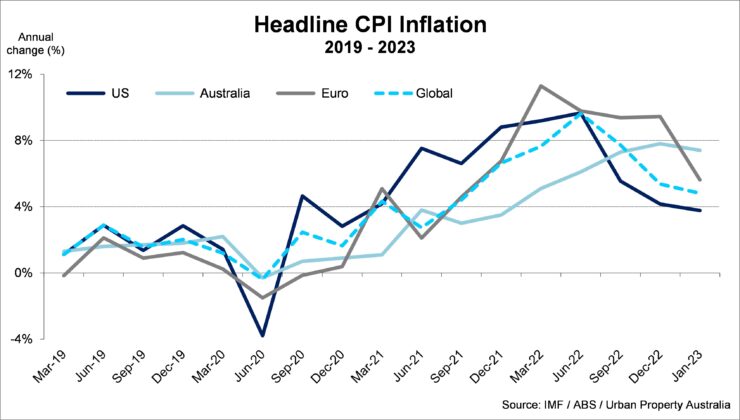

Having peaked in 2022, global inflation is forecast to decrease from 8.7% last year to 7.0% in 2023 and falling to 4.9% in 2024. While global inflation has declined, reflecting the sharp reversal in energy and food prices, core inflation, excluding the volatile energy and food components, has not yet peaked in many countries.

Although the sharp policy tightening has slowed inflation, the monetary policy tightening has contributed to a significant worsening of global financial conditions, which has triggered sizable losses on long-term fixed-income assets resulting in the collapse of a few regional banks. The unexpected failures of two specialised regional banks in the United States and the collapse of confidence in Credit Suisse is likely to entail lower lending and activity.

United States

In 2023, economic activity in the United States is projected to stagnate, with rising unemployment and falling inflation. Interest rates are projected to remain high initially and then gradually decrease in the next few years as inflation continues to slow. According to the IMF, the United States economy is forecast to grow by 1.6% in 2023 and 1.4% in 2024, with growth rebounding in the second half of 2024 in response to declines in interest rates. Businesses have ramped up investment since the initial impact of the pandemic, but levels are inconsistent with non-residential property rising but still below pre-pandemic levels while housing starts have slowed in the wake of higher interest rates.

China

China’s economic performance in 2023 to date remain quite mixed. Despite the reopening (since China abandoned its zero-COVID policies in early December), there has not yet been a wave of “revenge spending”. Given the likely weakness in demand for China’s exports in 2023, China’s recovery is projected to be consumer-led as the exit from the country’s zero-covid policy unleashes pent-up demand for goods and services (including outbound tourism). Economic growth in China is projected to rise to 5.2% in 2023 before expanding by 4.5% in 2024. Growth in China’s industrial production was somewhat stronger in January and February but remains below trends prior to the COVID-19 pandemic.

Europe

The Euro area has avoided a recession so far in 2023, owing to lower-than-expected energy demand due to mild temperatures with sentiment also improving. High inflation continues to weigh on spending however labour markets have continued to perform strongly, with the unemployment rate in the EU remaining at its historic lows. According to the IMF, the Euro area economy is forecast to grow by 0.8% in 2023 and 1.4% in 2024. Annual headline inflation in the euro area is projected to come down from 8.4% in 2022 to 6.2% in 2023 and 3% in 2024. While uncertainty surrounding the forecast remains high, domestic demand could grow stronger if declines in wholesale gas prices pass through to consumer prices more strongly.

United Kingdom

While the United Kingdom’s economy is forecast to contract this year (-0.3%) and one of two G7 countries to contract in 2023 (along with Germany), the first quarter of 2023 has been stronger than previously projected. The near-term economic downturn appears to be shorter and shallower than forecast with the labour market remaining strong. Inflation also is forecast to have peaked in the medium-term with inflation expected to fall sharply through 2023. With stronger than expected exports and household spending, business investment forecast is to grow by 0.2% in 2023 followed by 1.0% in 2024. The overall picture for 2024 shows a return to growth but only at a level which will see the UK economy finally get back to its pre-pandemic size in the final quarter of 2024.

India

Over 2023, India’s economy is projected to increase by 5.9% before rising to 6.3% in 2024 according to the IMF driven by private consumption and private investment on the back of government policies to improve transport infrastructure, logistics, and the business ecosystem. Despite the global slowdown, India’s economic growth rate is stronger than in many peer economies and reflects relatively robust domestic consumption and lesser dependence on global demand. Consumer demand among the affluent class remains strong as is evident from the robust growth in the retail industry and the better profit performance of consumer staples and discretionary companies in recent quarters.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.