Q1 2024 – Melbourne Retail Market

April 26th 2024 | , Urban Property Australia

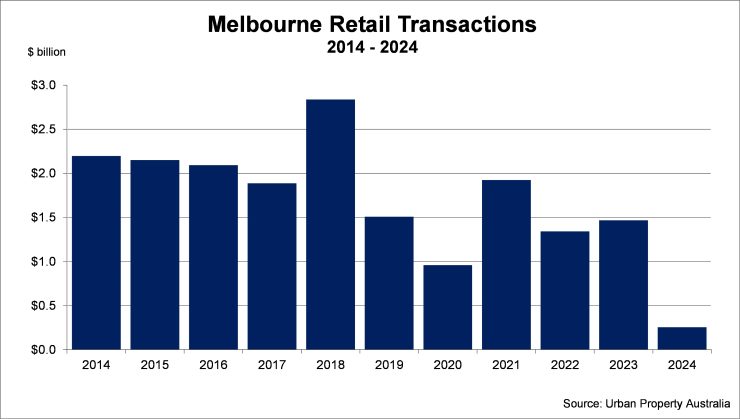

- Transactional activity in the Melbourne retail property market recorded in 2024 to date has been subdued with only two sales above $50 million recorded leading to total sales volume of $250 million;

- Retail trade in Victoria eased through the 12 months to February 2024 as consumer confidence weakened with annual retail trade in Victoria increasing by 2.7%, its lowest rate since 2021;

- Rental growth across most of Victoria’s retail assets over the year to March 2024 was modest, however rental levels in the Melbourne CBD retail market continued to decline.

Retail Market Summary

While retail trade in Victoria continues to outperform the national average the annual increase in sales has eased through the 12 months to February 2024 as consumer confidence weakens and the increased cost of living adversely impacts retail trade. Over the year to February 2024, annual retail trade in Victoria grew by 2.7%, its lowest rate since 2021 and well below its 10-year average of 5.3%. Online retail trade in Australia continues to gradually take a larger share of overall spending. Online sales made up 11% of total retail sales with Australian online sales with Australian consumers spending approximately $46 billion online over the past 12 months.

Sales Volume / Yields

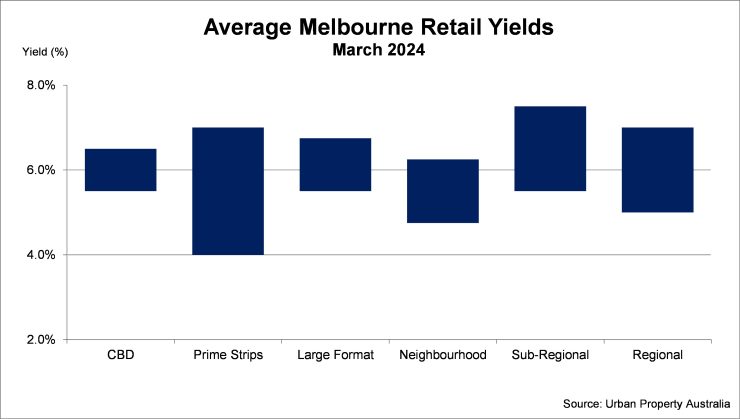

Urban Property Australia research recorded more than $250 million transacted in the Melbourne retail property market over 2024 to date, well below average levels with only two sales above $50 million recorded in the first quarter of 2024. Yields softened across all retail asset classes over the year with yields expanding by between 25 and 75 basis points. Urban Property Australia expects yields of retail assets are close to stabilising having decompressed over the past three years.

Demand

While retail trade in Victoria continues to outperform the national average the annual increase in sales has eased through the 12 months to February 2024 as consumer confidence weakens and the increased cost of living adversely impacts retail trade. Over the year to February 2024, annual retail trade in Victoria grew by 2.7%, its lowest rate since 2021 and well below its 10-year average of 5.3%. In comparison, Australian annual retail trade grew by 2.4% over the year, also below its 10-year average.

Increasingly more retail categories recorded contractions of retail sales over the year as consumers struggled to keep pace with the rising cost of living despite strong population growth and inflation. Retail trade growth remains strong in cafes and restaurants continues to outpace all other sectors with 13% of growth recorded with food retails sales also solid at 4% and accounts for 30% of all retail sales. In contrast, household goods, electrical retail trade contracted over the year.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, as at February 2024, online sales made up 11% of total retail sales with Australian online sales with Australian consumers spending approximately $46 billion online over the past 12 months.

Rental growth across most of Victoria’s retail shopping centre assets over the year to March 2024 was modest however rental levels in the Melbourne CBD retail market continued to decline, now 10% lower than levels recorded 12 months ago.

Retail Strips

Total vacancy of Melbourne’s prime retail strips has fallen from its all-time highs with around 12% of all shops vacant. The vacancy levels of Fitzroy Street, St Kilda is the highest at 28% with elevated vacancy rates at Chapel Street, South Yarra (12%), Glenferrie Road, Malvern (15%) and Lygon Street, Carlton (13%), albeit there is some gradual improvement in the latter.

The food and beverage sector increased its presence across the strips, growing in the majority of the precincts however a number of fashion retailers have vacated the prominent strips, impacted by store rationalisation and the growing influence of e-commerce.

With many strips having been re-discovered by locals now working from home, some retailers have successfully adjusted to the changing consumer trends. The elevated vacancy levels and rationalisation of some retailers has resulted in rental levels easing with some landlords also offering flexible lease terms and incentives to attract new occupiers.

The retail sector has improved at a remarkable pace and well beyond any forecasts. Now that more normalised spending patterns have emerged and if the economic recovery continues to gather pace, looking forward, Urban Property Australia expect to see a stabilisation of service-based consumption and a shift towards goods-based consumption moving forward which will benefit the retail strips markets.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.