Q1 2025 – Global Economic Overview

April 26th 2025 | , Urban Property Australia

- Uncertainty has surged to unprecedented levels due to the announcement of the US tariffs, given uncertainty over where trade policy could settle, global growth is projected to fall 2.8% in 2025;

- Australia’s annual output is projected to be $13 billion lower in 2025 than forecast in January 2025, with Australia’s economy predicted grow by 1.6%, impacted by the US tariffs;

- The Victorian economy is forecast to grow by 2.5% in the 12 months to June 2026, driven by stronger household consumption, as inflation eases and employment and wage growth.

Economic Summary

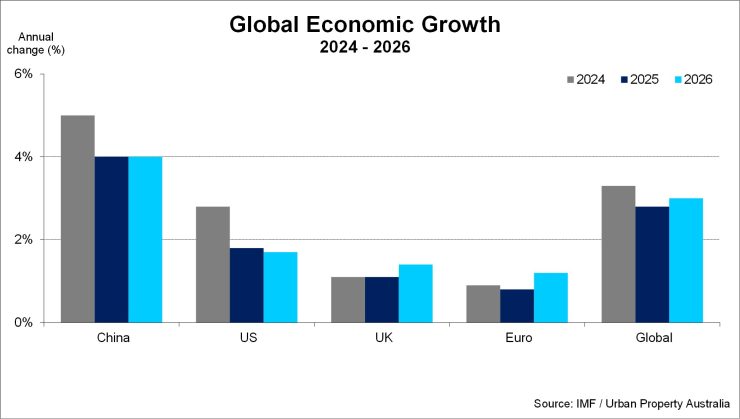

The swift escalation of trade tensions and extremely high levels of policy uncertainty are expected to have a significant impact on global economic activity. Global growth is projected to drop to 2.8% in 2025 and 3% in 2026, down from 3.3% for both years compared to previous forecasts. Australia’s economy is also projected to be adversely impacted by the US tariffs with its economy predicted grow by 1.6%. Despite heightened global uncertainty, growth has picked up and a soft landing is looking increasingly likely for Australia. Beyond this year, the economy is expected to gain further momentum with growth of 2.25% projected in the 12 months to June 2026.

Q1 2025 – Global Economic Overview

After signs of stabilisation emerging through much of 2024, major policy shifts are resetting the global trade system and giving rise to uncertainty. Since February 2025, the United States has announced multiple waves of tariffs against trading partners, some of which have invoked countermeasures.

Uncertainty has surged to unprecedented levels with the degree of the surge depending on exposures to protectionist measures through trade and financial linkages as well as broader geopolitical relationships.

Given uncertainty over where trade policy could settle, global growth is projected to fall 2.8% in 2025 before recovering to 3% in 2026 (a decline by 0.5 percentage points for 2025 and 0.3 percentage points in 2026). The downgrades are broad-based across countries and reflect in large part the direct effects of the new trade measures and their indirect effects through trade linkage spillovers, heightened uncertainty, and deteriorating sentiment.

United States’ economic growth is projected to decrease in 2025 to 1.8% (1 percentage point lower than the rate for 2024) because of greater policy uncertainty, trade tensions, and a softer demand outlook. Tariffs are also expected to weigh on growth in 2026, which is projected at 1.7% amid moderate private consumption.

Growth in the Euro area is expected to decline slightly to 0.8% in 2025, before picking up modestly to 1.2% in 2026. Rising uncertainty and tariffs are key drivers of the subdued growth in 2025. Offsetting forces that support the modest pickup in 2026 include stronger consumption on the back of rising real wages and a projected fiscal easing in Germany.

The United Kingdom is expected to grow by 1.1% in 2025 reflecting the impact of recent tariff announcements, an increase in gilt yields, and weaker private consumption amid higher inflation as a result of regulated prices and energy costs.

China’s economic growth is revised downward to 4.0% which reflects the impact of recently implemented tariffs, which offset the stronger economic legacy from 2024. Growth in 2026 is also revised downward to 4.0% (down from 4.5% as at January 2025 forecasts) on the back of prolonged trade policy uncertainty and the tariffs now in place.

India’s economic outlook is relatively more stable at 6.2% in 2025, supported by private consumption, particularly in rural areas (albeit 0.3 percentage points lower than previous forecasts) on account of higher levels of trade tensions and global uncertainty.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.