Q1 2025 – Melbourne Industrial Market

April 26th 2025 | , Urban Property Australia

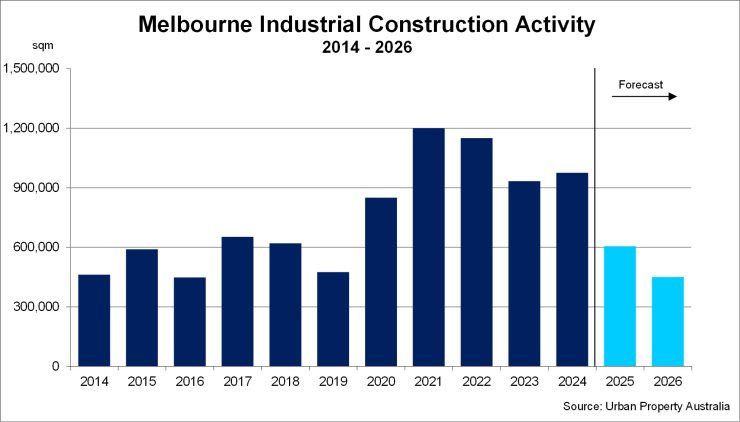

- Approximately 600,000 square metres of new industrial supply in the Melbourne industrial market is forecast to complete this year as speculative development has tempered;

- Underpinned by the solid leasing activity of 2025 to date and declining supply pipeline, the vacancy rate of the Melbourne industrial market fell over the first quarter of 2025, its first decline in two years;

- While sales activity in Melbourne’s industrial property market has been relatively limited to date this year with almost $200 million transacted, yields appear to have stabilised.

Industrial Market Summary

Leasing activity has picked up in the Melbourne industrial market albeit still below the long-term average with interest from manufacturing businesses increasing. Underpinned by the solid leasing activity of 2025 to date and a declining supply pipeline, the vacancy rate of the Melbourne industrial market fell over the first quarter of 2025, its first decline in two years. Despite the increase in tax for foreign owners, investor appetite in Melbourne’s industrial market remains strong with solid interest particularly from private investors.

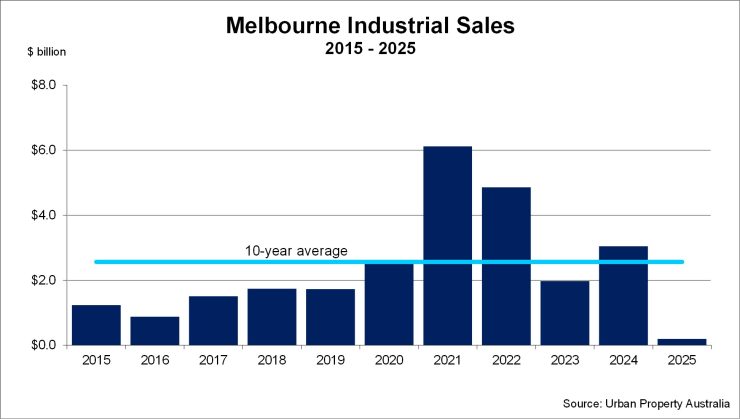

Sales Volume/Yields

While sales activity in Melbourne’s industrial property market has been relatively limited to date this year with almost $200 million transacted, yields appear to have stabilised. Despite the increase in tax for foreign owners, investor appetite in Melbourne’s industrial market remains strong with solid interest particularly from private investors. Urban Property research estimate that average prime industrial yields sit at 6.00% with average secondary yields at 6.75% as at March 2025.

New Supply/Land Values

According to Urban Property Australia research, new industrial supply in the Melbourne industrial market is forecast to total 600,000 square metres this year, significantly lower than the 950,000 square metres of new stock delivered last year. New supply levels have moderated in the Melbourne industrial market as developers have adopted a pre-lease strategy while speculative development has tempered. The bulk of the new supply scheduled for completion this year is in the South Eastern region accounting for 40% of new supply currently under construction in the Melbourne industrial market. Of the stock scheduled for completion in 2025, only 32% of new industrial supply is currently pre-committed. While industrial land values in Melbourne key industrial markets remained stable through the 12 months to March 2025, values face downward pressure across the regions resulting from rising construction costs impacting feasibilities. As at March 2025, industrial land values average $850/sqm across the Western, Northern and South East regions with industrial land values in the City Fringe market approximately $1,750/sqm.

Tenant Demand

Leasing activity has picked up in the Melbourne industrial market albeit still below the long-term average with interest from manufacturing businesses increasing. Leasing demand was dominated for stock in the Western and South Eastern regions which accounted for almost 85% of all take up Urban Property Australia research recorded in the first quarter of 2025. Transport and logistics continue to lead occupier types accounting for 35% of leased industrial space in 2025 to date, followed by retail and wholesale trade businesses.

Vacancy/Rents

Underpinned by the solid leasing activity of 2025 to date and the declining supply pipeline, the vacancy rate of the Melbourne industrial market fell over the first quarter of 2025, its first decline in two years and currently stands at 2.7%, according to Urban Property Australia research. In line with the increased leasing activity, vacancy fell in the South Eastern and Western regions whereas the North recorded an increase in industrial vacancy levels as at March 2025. Urban Property Australia research estimates that the industrial vacancy rate in the South East has declined to 1.5% as at March 2025 with industrial vacancy rate of the West at 2.3% and 2.7% in the North.

Melbourne industrial rents have remained stable over the 12 months to March 2025, according to Urban Property Australia research, however tenants have become increasingly discerning to key attributes to properties. Incentive levels have also risen through the past 12 months as landlords competitively seek to attract occupiers and Urban Property Australia expects that incentive levels will continue to remain elevated with the shallow tenant demand environment.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.