Q2 2023 – Global Economic Overview

July 23rd 2023 | , Urban Property Australia

- Elevated inflation levels, sharp rises in interest rates and tighter financial conditions are all expected to constrain growth in advanced economies in 2023 to well below the pre-pandemic average;

- The Australian economy is not immune to the global slowdown and there are clear signs that domestic demand is responding to higher interest rates and other cost-of-living pressures;

- Victoria’s economy is forecast to grow by 1.5% in the 12 months to June 2024 and is now estimated to be 8% larger than it was as at June 2019.

Economic Summary

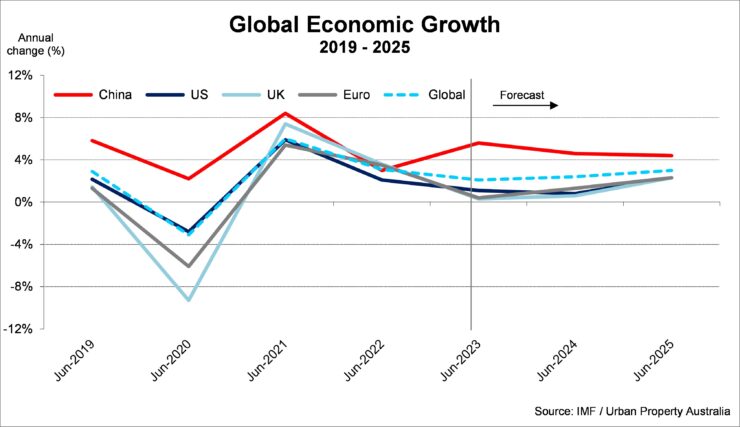

The global economy is showing signs of improvement but remains fragile. Global economic growth in 2023 is projected at 2.6%, the lowest annual rate since the global financial crisis, with the exception of the 2020 pandemic period. The earlier-than-anticipated reopening of China’s economy has led to an upgrade in Australia’s major trading partner growth with Australia’s growth is expected to exceed all major advanced economies this year. The recent announcement of the Victorian Government’s decision to cancel its commitment to host the 2026 Commonwealth Games indicates that the state Government is increasingly struggling to manage its growing debt costs.

Q2 2023 – Global Economic Overview

Elevated inflation levels, sharp rises in interest rates and tighter financial conditions are all expected to constrain growth in advanced economies in 2023 to well below the pre-pandemic average. These pressures will more than offset the boost from the earlier-than-anticipated reopening of China’s economy and unexpected resilience to date in advanced economies, most notably in the United States and Euro area.

Global growth is expected to slow to 2.1% in the year to June 2023 before a modest pick up to 2.4% is projected in 2023/24, as inflation and financial conditions begin to ease. Inflation in advanced economies is expected to gradually decline over 2023 and 2024. Food and energy inflation is expected to subside as commodity markets continue to adjust to Russia’s invasion of Ukraine.

Overall, growth over 2023 and 2024 is projected to be the weakest two years in over two decades, excluding the Global Financial Crisis and the pandemic. The earlier-than-anticipated reopening of China’s economy has led to an upgrade in Australia’s major trading partner growth by 0.25% to 3.25% in 2023. Australia’s growth is expected to exceed all major advanced economies in 2023.

The full effect of the rapid tightening in monetary policy has yet to flow through the global economy. Growth in some advanced economies has been surprisingly resilient, including the United States, but there are clear signs that higher interest rates are weighing on demand, particularly in the housing sector. Financial market participants anticipate policy rates have now peaked in the United States and are expected to fall over the course of the year.

United States

The United States economy is forecast to grow by 0.8% in the year to June 2024, 2.3% in 2024/25 and 2.1% in 2025/26. The cumulative effects of monetary policy tightening and tighter credit conditions due to banking sector stresses are expected to see US growth slow sharply over the remainder of 2023, with a recession remaining a risk. This follows unexpectedly solid growth in late 2022 and early 2023, underpinned by still firm employment growth and the inflation-indexed increase in income tax brackets. Weakness in interest rate-sensitive components of domestic demand, including housing and commercial property investment, will lead the slowdown and in turn flow through to slower employment, income and consumption growth.

China

China’s economy is forecast to grow by 5.6% in the year to June 2023, 4.6% in 2023/24 and 4.4% in 2024/25. The sudden removal of strict COVID-19 containment measures led to a strong rebound in the services sector in the first quarter of 2023, as consumption of services picked up. There are also early signs of an improvement in China’s property sector following the policy support introduced in late 2022, which will flow through to dwelling construction. With Chinese consumer confidence still fragile, the rebound in consumption over the rest of the year is expected to moderate. Near-term risks to the Chinese economy are broadly balanced, however a faster-than-expected slowing of global demand may lead to further falls in exports and weaker growth.

Europe

The Euro area economy is forecast to grow by 0.4% for the 12 months to June 2023 as uncertainty and high inflation weighed on household consumption. Despite growth stalling, this outcome was stronger than the expected economic contraction, with milder than expected winter temperatures and significant fiscal packages buffering the impact of the earlier energy price shock. Looking ahead with core inflation higher than the beginning of the year, the European Central Bank responded by continuing to raise interest rates at its recent policy meetings. Beyond 2023, a pick-up is expected as moderating inflation generates an improvement in real household incomes and allows some mild easing in policy interest rates with growth of 1.3% projected in the year to June 2024.

United Kingdom

The United Kingdom economy is forecast to narrowly avoid a recession in the 12 months to June 2023 with growth of 0.3% expected as the impacts of monetary tightening continue to build, household purchasing power remains weak and increases in personal and company taxes take effect. As inflation moderates, improvements in real household incomes and some easing of financial conditions are expected to lead to a pick-up in growth over 2024 and 2025. Risks are tilted to the downside and the United Kingdom economy is vulnerable to being adversely affected by financial sector stress. Domestic inflationary pressures and wage growth have continued to be strong, and markets expect further interest rate hikes from the Bank of England.

India

India is defying the overall global economic slowdown. While growth is expected to moderate somewhat over the next decade, India is expected to remain a key driver of global growth. India’s economy is forecast to grow by 6.3% in the year to June 2023, followed by 6.4% in 2024/25 and 6.5% in 2025/26. While growth is expected to slow this year, India will remain one of the fastest growing major economies. Growth has been resilient in recent quarters but momentum has slowed as the pandemic rebound has faded. Elevated inflation and higher interest rates are likely to weigh on domestic demand in the near term, while strong government investment is expected to be a key source of growth.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.