Q2 2024 – Melbourne Residential Market

July 29th 2024 | , Urban Property Australia

- Melbourne’s median house price fell in the June 2024 quarter, losing the growth achieved in the previous quarter and is now 2.6% lower than prices recorded 12 months ago;

- The level of new dwellings completed in Victoria in 2024, is likely to be the lowest level in 10 years with the current level of approved dwellings in Victoria 15% lower than the 10-year average;

- Boosted by below-average vacancy rates, Melbourne residential rental rates grew by more than 9% for both houses and units over the past 12 months.

Residential Market Summary

The vacancy rate for Melbourne residential property decreased since the start of the year to 2.2% and also remains below the 10-year average of 3.0%. Reflecting the low vacancy environment, metropolitan residential rents across the precincts increased over the past year. The weekly median rent for houses in metropolitan Melbourne increased by 9% with rents for Melbourne units recorded even stronger rises having increased by 10% over the year. Despite the low vacancy rate and strong rental growth, the pipeline of new housing supply continues to decrease.

Prices

According to the REIV, Melbourne’s median house price fell in the June 2024 quarter, losing the growth achieved in the previous quarter. As at June 2024, Melbourne’s median house price was $911,500 according to the REIV, having decreased by 1.5% over the quarter, and 2.6% lower than prices recorded 12 months ago. Likewise, Melbourne median unit prices decreased over the second quarter of 2024, falling to $629,000, down 0.1% in the quarter. In contrast to the detached housing market however, as at June 2024, the Melbourne median unit price remains higher than 12 month ago with current levels 0.2% higher than those recorded in June 2023. Currently, median prices of both Melbourne houses and units remain significantly below their peak levels with median house prices 19% lower and median unit prices 9% below their peak. Outside of Melbourne, the median Victorian Regional house price increased by 0.2% over the June 2024 quarter, rising to $601,500 – 4% below the peak of 2022. In contrast, the median Victorian Regional unit price fell by 1.4% to $415,000, and remains below the levels recorded two years ago. While the undersupply of housing maintains upward pressure on prices, the outlook for values remains subdued given the persistent cost of living pressures and elevated interest rate environment.

Supply

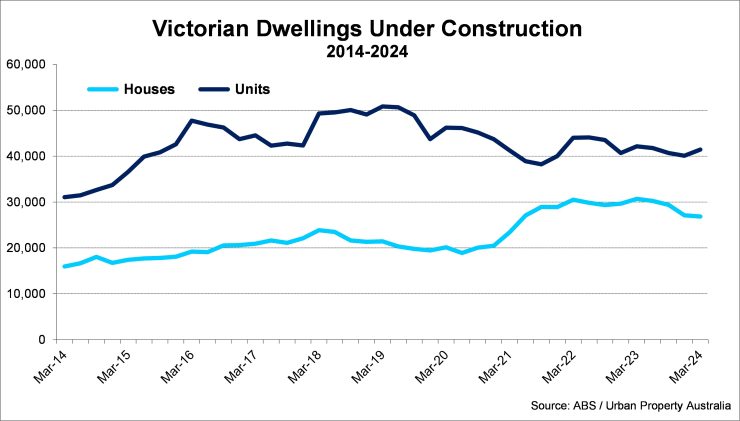

Despite the Victorian Government’s Housing Statement ambition to build 800,000 dwellings in Victoria over the next decade, the number of dwellings under construction across Victoria has fallen over the past 12 months. According to the ABS, there are currently 68,100 dwellings under construction across Victoria, 6% lower than the activity recorded 12 months ago, largely impacted by the slowdown of high-density apartment development. While the number of detached houses currently under construction in Victoria is above its 10-year average, the number of apartments currently under construction is below its 10-year average and is 19% down on the peaks of 2019. The level of new dwellings completed in Victoria in 2024, is likely to be the lowest level in 10 years. Looking forward, with construction prices having risen by 25% over the past three years and higher financing costs, the level of new supply is likely to continue to decrease in coming years with commencements falling to their lowest levels since 2014. The decline in the pipeline of housing stock is further evidenced by decreasing level of approved dwellings in Victoria with current levels 15% lower than the 10-year average.

Demand

Victoria’s population is growing at close to record levels, increasing by over 186,000 over 2023, the highest level of any Australian state. Victoria’s population growth was driven by overseas migrants with the state still losing people moving to other states (albeit the lowest level since 2020). While total annual Victorian housing finance commitments sit 12% above the 10-year average in May 2024 with $85.9 billion financed, annual levels have fallen through the year. Interestingly, monthly finance commitments have increased across all categories in recent months but remain below levels recorded 12 months ago. While annual owner occupier finance levels have decreased by 1% compared to the previous year; first home buyers remain active with their levels 10% higher than last year. Investors now account for 32% of total housing finance commitments in Victoria, compared to their share 27% three years ago. Looking ahead, with strong rental growth and a shortage of housing, Urban Property Australia expects that investors will grow their share of housing loans as affordability challenges restrict owner occupiers despite increases in land taxes.

Vacancy

According to the REIV, as at June 2024, the vacancy rate for Melbourne residential property decreased since the start of the year to 2.2% and also remains below the 10-year average of 3.0%. All precincts’ current vacancy rates now sit below their respective 10-year averages; with most Melbourne’s residential precincts vacancy rates holding steady over the year to June 2024. The vacancy rate of the Outer region recorded the tightest rate at 1.5%, albeit rising through 2024 to date from 1.1% at the start of the year. The Middle Melbourne region holds the highest vacancy rate at 2.7% while the vacancy rate of the Inner region sits at 2.2%. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain low with falling supply levels coupled with population growth of Melbourne currently at close to record high levels.

Rents

Reflecting the low vacancy environment, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over the year to June 2024, the weekly median rent for houses in metropolitan Melbourne increased to $580 per week, up from $530 per week a year earlier. Across Melbourne, rents for houses located in the Outer region increased the most, increasing by 10%, with rents in the Middle region increasing by 9% and the rents in the Inner precinct rising by 5%. Rents for Melbourne units recorded even stronger rises having increased by 10% over the year with unit rents rising across all precincts. Looking forward, Urban Property expects that residential rents will continue to rise, however the growth rates will moderate as affordability pressures begin to impact capacity of renters to absorb the significant growth observed in recent years.

Regional

Median prices appear to have stabilised in the Victorian Regional market, with median prices of both houses and units have generally been stable since June 2022. In contrast to the performance of median prices in Regional Victoria, rental levels in the Regional markets have remained resilient with the average weekly rental levels for both houses and units sitting at all-time highs as at June 2024. The vacancy rate for Regional Victoria remains very tight at 2.1%, slightly higher than the metropolitan average of 2.2%.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.