Q3 2023 – Global Economic Overview

November 13th 2023 | , Urban Property Australia

- The tightening of monetary policy across most developed countries over the past year aimed at containing inflation is now resulting in the global economy growing at below-trend levels;

- The Australian economy continues to show surprising strength and resilience in a world of growing geopolitical tensions and unrest, however, is projected to slow in the 12 months to June 2024;

- Victoria’s economy is forecast to grow by 1.5% in the 12 months to June 2024 and is now estimated to be 8% larger than it was as at June 2019.

Economic Summary

Economic activity has held up better than generally expected in a number of advanced economies, however the tightening of monetary policy aimed at containing inflation is now resulting in the global economy growing at below-trend levels. The world economy is expected to grow over the next two years at the slowest levels since the Global Financial Crisis. The Australian economy continues to show surprising strength and resilience in a world of growing geopolitical tensions and unrest. The Australian economy is projected to slow to 1.75% in the 12 months to June 2024 before strengthening to 2.25% 2024/25.

Q3 2023 – Global Economic Overview

Economic activity has held up better than generally expected in a number of advanced economies, particularly in the United States. This is despite the cumulative effects of tighter monetary policy. This resilience reflects the combined effects of fiscal policy, tight labour markets and healthy household balance sheets.

Business investment has been a key driver of economic growth across several advanced economies through 2023, particularly in the United States and the United Kingdom, however, business investment intentions have been easing across several advanced economies, as tighter financial conditions and uncertainty about global growth weigh on the outlook.

The tightening of monetary policy across most developed countries over the past year aimed at containing inflation is now resulting in the global economy growing at below-trend levels. Importantly, this monetary tightening appears to be achieving its desired outcome with headline inflation now falling across most economies.

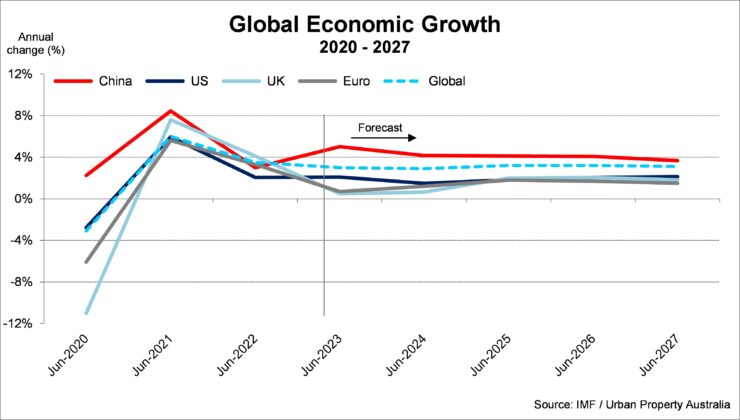

The world economy is expected to grow over the next two years at the slowest levels since the Global Financial Crisis, excluding the pandemic years themselves. According to the IMF, global growth is projected to slow from 3.5% in 2022 to 3% this year and 2.9% in 2024, a downgrade from earlier projections, well below the historical average.

GDP growth in Australia’s major trading partners is expected to be around 3.5% in 2023, before slowing to 3% in 2024. This overall outlook is little changed from three months ago, with stronger forecast growth in the United States and Japan offset by weaker forecast growth in east Asian economies (outside of China and Japan).

However, the continuation of conflicts between and within states, including the Russia-Ukraine conflict along with the recent escalation of fighting between Israel and Hamas and the risk of these conflicts damaging global trade is rising and has clouded the short term economic outlook.

United States

The United States economy is forecast to grow by 2.1% in the year to June 2024, 1.5% in 2024/25 and 1.8% in 2025/26. Growth in private consumption and investment is expected to moderate in response to the tightening in monetary and financial conditions and as savings are further depleted. As demand slows, employment is expected to fall and the unemployment rate is projected to gradually rise towards 4.5% in 2024. With labour market tightness abating, wage growth is expected to moderate, prompting a gradual decline in services inflation. Nonetheless, core inflation is not projected to return to around the Federal Reserve 2% target before late 2024.

China

The Chinese economy continued to recover through 2023, but economic growth remains below the trend expected prior to the pandemic. The services sector has been the primary driver of growth in 2023, due to the removal of pandemic-related restrictions at the end of 2022, however conditions in the Chinese property sector remain weak, with new housing sales, starts and investment all remaining at very low levels. Aside from the direct impact of weak activity in the property sector, the continued stress on developers and flow-on effects to the financial system could weigh on economic growth in the medium term. China’s economy is forecast to grow by 4.2% in the year to June 2024 and 4.1% in 2024/25.

Europe

While starkly different across countries in the Euro area, the fiscal stance is projected to remain restrictive for the Euro area as a whole in 2023 and even more so in 2024. The Euro area economy is forecast to grow by 1.2% in the 12 months to June 2024 before strengthening to 1.8% in 2024/25. Private consumption will be supported by strong labour markets, but higher costs of financing and uncertainty will weigh on private investment. The tight labour market will continue to fuel wage growth in 2023, before wages start gradually easing in 2024. Lower energy and food prices will help reduce headline inflation in 2023, but core inflation will remain elevated.

United Kingdom

The United Kingdom economy is forecast to improve moderately to 0.6% in the 12 months to June 2024. Government consumption and investment will continue to prop up the economy, before a gradual strengthening of private expenditure due to falling wholesale gas prices and improved global conditions. Headline inflation is projected to slow on the back of declining energy prices and to come down close to target by the end of 2024. However, weak household income growth will weigh on consumption despite the fall in inflation, monetary tightening will slow both housing and already sluggish business investment, and uncertainty will continue to reduce the contribution of trade to growth.

India

While indicators suggest that India’s growth is stable for now, headwinds from the impact of rapid monetary policy tightening in the advanced economies, heightened global uncertainty and the lagged impact of domestic policy tightening will progressively take effect. Weak global demand and the effect of monetary policy tightening to manage inflationary pressures will constrain the economy over the next 12 months, limiting economic growth to 6.3%. Moderating inflation and monetary policy easing in the second half of 2024 will help discretionary household spending regain momentum. This, along with improved global conditions, will help economic activity to accelerate in 2024/25. With slower growth, inflation expectations, housing prices and wages will progressively moderate, helping headline inflation converge allowing interest rates to be lowered from mid-2024.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.