Q3 2023 – Melbourne Industrial Market

November 13th 2023 | , Urban Property Australia

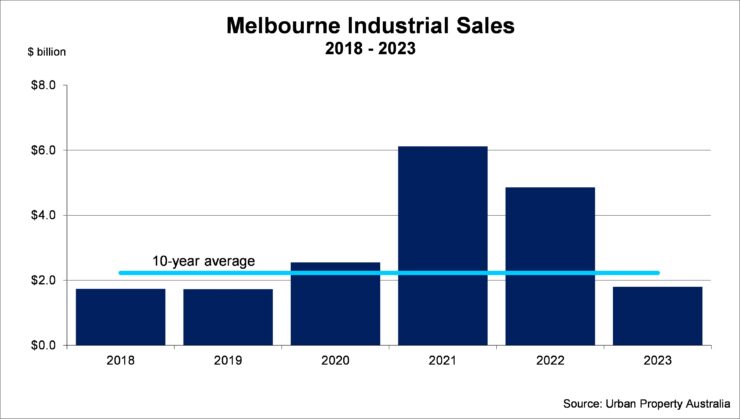

- Investment volume in the Melbourne industrial market has declined sharply with this year, falling by 60% compared to last year, impacted by higher capital costs;

- Prime industrial rents have grown on average by 15% over the 12 months to September 2023 with secondary rents having increased by 13% as tenants struggle to source accommodation of all qualities with vacancy rates very low;

- Industrial leasing activity in the Melbourne industrial market totalled 650,000 over 2023 to date, with transport and logistics occupiers accounting for 55% of take up of industrial space this year.

Industrial Market Summary

Buoyed by the ongoing tenant demand and rental growth, investor appetite remains solid with offshore groups and domestic funds active with portfolio sales boosting investment volumes. Despite the investor interest to the industrial sector, yields have continued to ease as access to capital remains constrained coupled with cost of debt increasing. Melbourne’s low vacancy rates have supported strong rental growth across all precincts in the Melbourne industrial market with prime and secondary rents growing by more than 10% over the past year.

Sales Volume / Yields

After two record-breaking years of transactional activity, investment volume in the Melbourne industrial market has declined sharply with this year, falling by 60% compared to last year, impacted by higher capital costs. In 2023 to date, $1.8 billion has been transacted across the Melbourne industrial market. Buoyed by the ongoing tenant demand and rental growth, investor appetite remains solid with offshore groups and domestic funds active with portfolio sales boosting investment volumes. Despite the investor interest to the industrial sector, yields have continued to ease as access to capital remains constrained coupled with cost of debt increasing. As at September 2023, average prime industrial yields rose to 5.25% with average secondary yields moving out to 6.25%. Although the higher cost of debt has impacted yields, Urban Property Australia anticipates that yields will remain relatively steady looking ahead supported by the strong outlook for rents.

New Supply / Land Values

For the third consecutive year, new industrial supply is projected to surpass one million square metres with the majority of new stock completed in the Northern and Western regions of the Melbourne industrial market. Despite the elevated supply levels, high pre-commitment rates and limited existing vacancy rates has resulted in the majority of new development already leased prior to completion. Looking ahead new supply levels will remain elevated with tenant demand remaining robust driven by the transport and logistics sector. Urban Property research forecast that new industrial supply in 2024 will surpass 800,000sqm. Having increased substantially in recent years, average industrial land values have remained steady in 2023 to date, as higher development costs beginning to impact perspective developers.

Tenant Demand

Industrial leasing activity in the Melbourne industrial market totalled 650,000 over 2023 to date, with transport and logistics occupiers accounting for 55% of take up of industrial space this year. Boosted by the growing penetration of e-commerce and a growing importance of supply chain efficiencies, retailers and wholesale trade also remain prominent. The focus of the tenant demand in 2023 to date has been in the Western region according to Urban Property Australia research.

Vacancy / Rents

Vacant industrial space across the Melbourne market continues to remain very low, as the growth of e-commerce has driven tenant demand outpacing new supply. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 1.0% as at September 2023 with the North vacancy rate below 1%. Elsewhere, the vacancy rate of the South East region is 1.1% and the Western region standing at 1.2%.

Melbourne’s low vacancy rates have supported strong rental growth across all precincts in the Melbourne industrial market. Prime industrial rents have grown on average by 15% over the 12 months to September 2023 with secondary rents having increased by 13% as tenants struggle to source accommodation of all qualities. Prime rental growth was led by the South Eastern precinct. Urban Property Australia expects that while rents will continue to increase, the rate of rental increases is moderating as tenants must accommodate a range of increased costs. The underlying strength in the retail trade and logistics demand is contributing to a rise in leasing activity with strong demand for larger facilities to accommodate automated supply chain requirements.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.