Q3 2024 – Australian Economic Overview

October 22nd 2024 | , Urban Property Australia

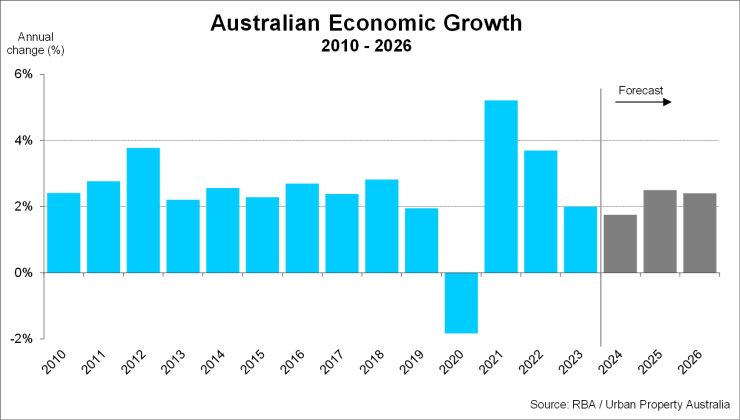

While the Australian economy has stalled in the first half of 2024, recording growth of only 0.2% in the June 2024 quarter; economic growth is projected to pick-up through the final quarter of 2024 boosted by growth in household consumption and public sector demand.

Household consumption projections have been upgraded, reflecting the upward revisions to population growth recorded this year to date; however overall, growth in private demand is expected to remain subdued for the rest of 2024 adversely impacted by the restrictive financial conditions.

Australia’s economy is expected to increase further in 2025, reflecting stronger than previously forecast public spending. The stronger outlook for public demand reflects ongoing spending and recent announcements by federal and state and territory governments.

The Australian economy is forecast to grow by 2.5% next year with growth of 2.4% projected in 2026.

Household consumption growth is expected to return to around its pre-pandemic average by mid-2025, supported by an increase in real income growth from the Stage 3 tax cuts and declining inflation.

Housing price growth has been stronger than expected and growth in advertised rents remains strong, as new supply continues to fall short of growth in underlying demand. Underlying demand for housing has remained strong, but growth in demand appears to have moderated in recent months.

New dwelling supply remains weak, reflecting ongoing cost pressures affecting project feasibility and labour shortages for certain trades. Dwelling investment growth is forecast to pick up from late-2025, supported by increasing demand for new housing as sentiment improves.

Business investment activity fell for the third consecutive quarter through to June 2024, largely as a result of a declining investment in both non-residential construction and machinery and equipment. Looking ahead, business investment growth is expected to be supported by the large pipeline of infrastructure work, digitisation and the renewable energy transition.

Government investment was the single largest contributor to economic growth in the June quarter 2024. Public investment rose by 1.5% over the quarter with state and local governments leading the uptick in spending across government sectors. At a Commonwealth level, defence-related investment activity rose by 5.3% during the quarter with significant investment also recorded in renewable energy projects.

Labour market conditions have continued to ease gradually but recent data suggest there is less capacity than previously thought. The unemployment rate increased as expected from the trough of 2022, however, remains very low against historical levels, illustrated by the current unemployment rate of 4.1% as at September 2024.

Underlying inflation is now expected to return to the RBA’s target slightly later than was forecast, and now expected to be inside the target range of 2–3% in late 2025. With inflation easing, the cash rate is predicted to have peaked with a 25-basis point reduction forecast in early 2025, and the cash rate expected to decline to around 3.3% by the end of 2026.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.