Q3 2024 – Melbourne Industrial Market

October 22nd 2024 | , Urban Property Australia

- Transactional activity in Melbourne’s industrial property market has surged in the third quarter of the year with more than $1 billion of sales recorded over the September 2024 quarter;

- Having increased substantially in recent years, industrial land values have eased through 2024, impacted by the rising construction costs and the cost of debt;

- Industrial leasing activity in the Melbourne industrial market has softened through 2024 as occupiers become more cautious with transport and logistics accounting for the majority of leased industrial space.

Industrial Market Summary

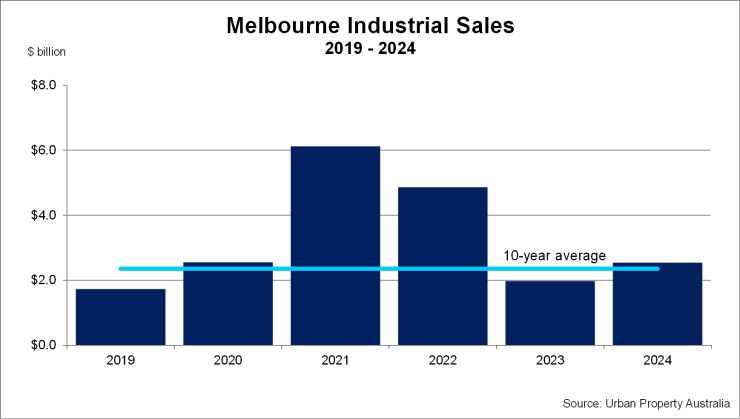

Transactional activity in Melbourne’s industrial property market has surged in the third quarter of the year with more than $1 billion of sales recorded over the quarter. Over 2024 to date, more than $2.5 billion of Melbourne industrial sales has now been recorded by Urban Property Australia, already higher than the 10-year annual average. Looking ahead, foreign investment levels may soften in Victoria due to the recently imposed absentee owner surcharge and land tax which may lead investors exploring other states.

Sales Volume/Yields

Transactional activity in Melbourne’s industrial property market has surged in the third quarter of the year with more than $1 billion of sales recorded over the quarter. Over 2024 to date, more than $2.5 billion of Melbourne industrial sales has now been recorded by Urban Property Australia, already higher than the 10-year annual average. Sales activity has been boosted by a number of major portfolio transactions, usually underpinned by offshore investors seeking to increase their exposure to the Australian industrial property market. Looking ahead, foreign investment levels may soften in Victoria due to the recently imposed absentee owner surcharge and land tax which may lead investors exploring other states. While sales activity has increased, Melbourne industrial yields continued to soften. Urban Property research estimate that average prime industrial yields sit at 5.95% with average secondary yields moving out to 6.75% over the 12 months to September 2024.

New Supply/Land Values

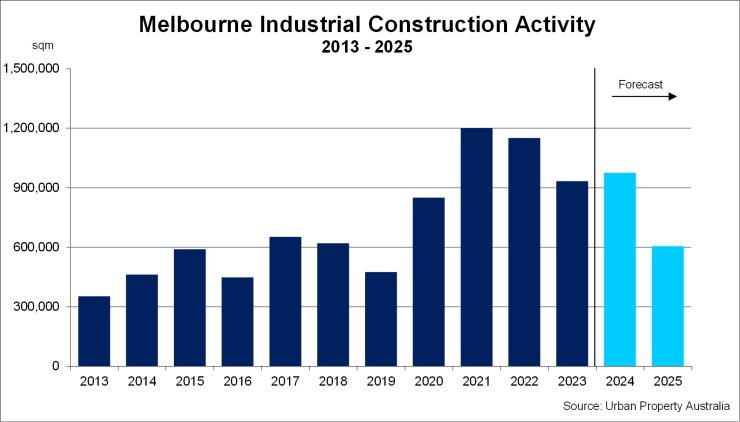

While the level of speculative construction is easing, new industrial supply in the Melbourne industrial market is forecast to reach 975,000 square metres in 2024 and is projected to surpass the long-term average for a six consecutive year. The bulk of the new supply currently under construction in the Melbourne industrial market is located in the Western region, accounting for 60% of all new supply. Having increased substantially in recent years, average industrial land values have eased over the past year, impacted by the rising construction costs and the cost of debt. Industrial land values in Melbourne key industrial markets average $825/sqm with industrial land values in the City Fringe market sit around $1,750/sqm.

Tenant Demand

Industrial leasing activity in the Melbourne industrial market has eased through 2024 as occupiers become more cautious. Transport and logistics continue to account for the majority of leased industrial space, albeit their share has diminished through the year. Boosted by the growing penetration of e-commerce and a growing importance of supply chain efficiencies, retailers and wholesale trade also remain prominent highlighted by Amazon’s commitment to its new 200,000sqm facility. The focus of the tenant demand in 2024 to date has been the Western region according to Urban Property Australia research.

Vacancy/Rents

Vacant industrial space across the Melbourne market continues to remain very low, although tenant demand has eased through the year, leasing levels continue to absorb new supply. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 2.0% as at September 2024, having increased since the start of the year with the North and East vacancy rates at 1.7%. Elsewhere, the vacancy rate of the South East region is 1.5% and the Western region standing at 2.2%.

While Melbourne industrial rents continue to increase, rates of growth have moderated by the level of new supply which was delivered to the market over the past 12 months. Prime industrial rents have grown on average by 4% over the 12 months to September 2024 with secondary rents having increased by 3% as leasing levels have softened. Prime rental growth was led by the Inner precinct given the limited pipeline of new supply in the region. Urban Property Australia expects that while rents will continue to increase, incentive levels have also increased as landlords competitively seek to attract occupiers.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.