Q3 2024 – Melbourne Retail Market

October 22nd 2024 | , Urban Property Australia

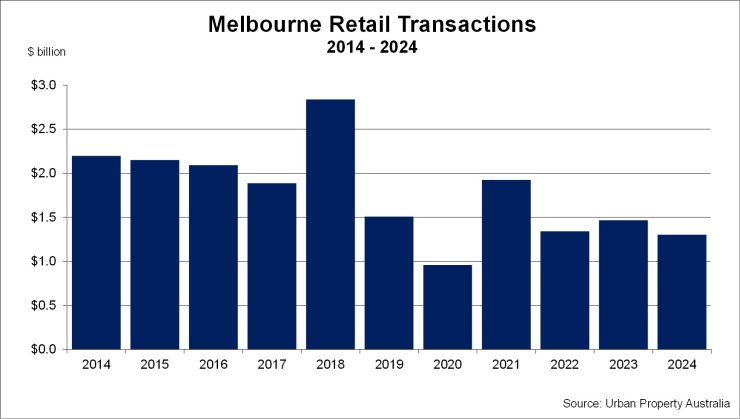

- More than $1.3 billion has been transacted in the Melbourne retail property market over 2024 to date, meaning that this year’s volume is on track to be the highest annual total since 2021;

- Rental growth was mixed across Victoria’s retail shopping centre assets over the past 12 months with rents in the Melbourne CBD retail market still lower than levels recorded 12 months ago;

- Retail trade in Victoria continues to outperform the national average, however with the increased cost of living retail trade growth has eased in recent years.

Retail Market Summary

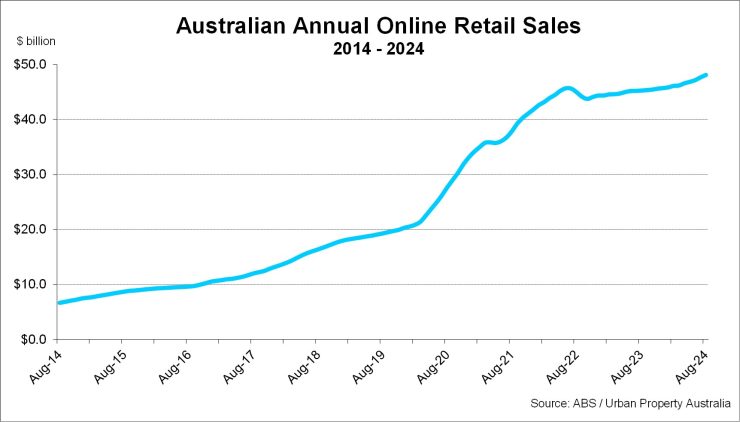

More than $1.3 billion has been transacted in the Melbourne retail property market over 2024 to date and is on track to be the highest annual total since 2021. The sales volume has been boosted average levels with five sales above $75 million recorded. Yields continue to soften, albeit expanding more modestly than previous quarters. Online retail trade in Australia continues to gradually take a larger share of overall spending with Australian consumers spending approximately $48 billion online over the past 12 months.

Sales Volume/Yields

Urban Property Australia research recorded more than $1.3 billion transacted in the Melbourne retail property market over 2024 to date, meaning that this year’s volume is on track to be the highest annual total since 2021. The sales volume has been boosted average levels with five sales above $75 million recorded in 2024 to date. Yields continue to soften, albeit expanding more modestly than previous quarters, with yields expanding by between 10 and 25 basis points. Urban Property Australia expects yields of retail assets are close to stabilising having decompressed over the past three years.

Demand

While retail trade in Victoria continues to outperform the national average the annual rate of increase in sales has eased through the 12 months to August 2024 with the increased cost of living adversely impacting retail trade. Over the year to August 2024, annual retail trade in Victoria grew by 1.8%, well below its 10-year average of 5.3%. In comparison, Australian annual retail trade grew by 1.7% over the year, also below its 10-year average too.

Increasingly more retail categories recorded contractions of retail sales over the year as consumers struggled to keep pace with the rising cost of living despite strong population growth and inflation. Retail trade growth remains strong in cafes and restaurants continues to outpace all other sectors with 8% of growth recorded with food retails sales also solid at 2% and accounts for 38% of all retail sales. In contrast, household goods (such as furniture and electrical goods) retail trade contracted over the year.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, as at August 2024, online sales made up 11% of total retail sales with Australian online sales with Australian consumers spending approximately $48 billion online over the past 12 months.

Rental growth was mixed across Victoria’s retail shopping centre assets over the year to September 2024 with rents in the Melbourne CBD retail market now 4% lower than levels recorded 12 months ago.

Retail Strips

Total vacancy of Melbourne’s prime retail strips appears to have stabilised with 11% of all shops vacant. The vacancy levels of Fitzroy Street, St Kilda is the highest at 25% with elevated vacancy rates at Chapel Street, South Yarra (11%), Glenferrie Road, Malvern (10%) and Lygon Street, Carlton (12%).

The food and beverage sector continued to grow its presence across the strips, growing in the majority of the precincts however a number of fashion retailers have vacated the prominent strips, impacted by store rationalisation and the growing influence of e-commerce.

Several strips are benefiting from nearby developments, increasing the local population which have increased foot traffic to the precincts leading to increased tenant demand.

With many strips having been re-discovered by locals now working from home, some retailers have successfully adjusted to the changing consumer trends. The elevated vacancy levels and rationalisation of some retailers has resulted in rental levels easing with some landlords also offering flexible lease terms and incentives to attract new occupiers.

Now that more normalised spending patterns have emerged, looking forward, Urban Property Australia expect to see a broader range of tenants seeking exposure in the retail strips market.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.