Q4 2021 – Melbourne Apartment Market

January 26th 2022 | , Urban Property Australia

The vacancy rate for Inner-City precinct is projected to have peaked having fallen to its lowest level in 12 months;

Values for Inner-City Melbourne apartments have increased solidly over the year, reaching an all-time high with investors re-emerging;

Of the 38 new developments currently under construction, 50% of the apartments are located in the CBD Core, followed by 16% in Southbank and 11% are located in West Melbourne.

Inner-City Melbourne Apartment Summary

Despite the elevated vacancy levels of the Inner-City Melbourne precinct, values for Inner-City Melbourne apartments continue to increase. Pleasingly the residential vacancy rate for the Inner-City precinct fell to 5.0% – its lowest level since August 2020.

Prices

Despite the elevated vacancy levels of the Inner-City Melbourne precinct, values for Inner-City Melbourne apartments have increased solidly over the year. According to the REIV, median apartment prices increased to $670,500 as at December 2021, up 6.5% over the year, to an all-time high. Interestingly, 3-bedroom apartments in the Inner-City precinct recorded the strongest annual growth, increasing by 10% to $1,150,000 – a record high level. While the lack of international students has had a significant impact on the rents and vacancy rates, 1-bedroom apartment values have held steady, at $405,000. Like the trend of 3-bedroom Inner-City Melbourne apartments, values of 2-bedroom apartments also increased over the year, rising to $658,000, an annual increase of 3.5%. Having traversed the worst of the pandemic, Urban Property expects that the declining apartment pipeline will shelter any significant falls of Inner-City Melbourne apartment values.

Supply

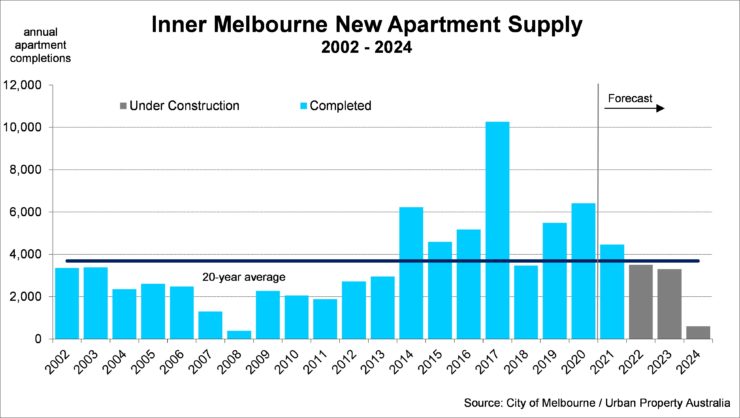

Currently there are 7,500 apartments under construction within the Inner-City Melbourne region. Over 2021, 4,400 apartments were completed in the Inner-City Melbourne, 21% above the 20-year average. Urban Property Australia research forecasts that 3,500 apartments will be completed this year, before falling to 3,300 in 2023. Of the 38 new developments currently under construction, 50% of the apartments are located in the CBD Core, followed by 16% in Southbank and 11% are located in West Melbourne. Looking ahead, while there are a further 33,200 apartments with plans approved in the Inner-City Melbourne region, Urban Property Australia’s research forecasts that the supply pipeline has peaked in the short term. New apartment supply in the Inner-City Melbourne precinct are projected to remain below the 20-year average for the next five years.

Demand

According to the City of Melbourne, the Inner-City precinct employment has fallen from 350,000 to 167,000 as a result of the pandemic. Looking ahead, employment in the Inner-City precinct is projected to take a number of years to recover with employment to near back to pre-COVID levels in 2025. Despite the substantial decline in occupancy, employment and international student levels in the Inner-City precinct, transaction activity for apartments in the region remains resilient. Transactional volumes for apartments in the Inner-City Melbourne precinct totalled 4,200 in 2021, 40% higher than levels recorded in the previous year, boosted by increasing investor interest. Looking ahead, Urban Property Australia’s research forecasts that the transactional activity of the Inner-City apartment market will remain below the average level for the medium term with investor demand softened coupled with a lack of new supply. Having once accounted for 45% of all housing finance in early 2015, investor lending in Victoria now accounts for 29% of all loans.

Vacancy

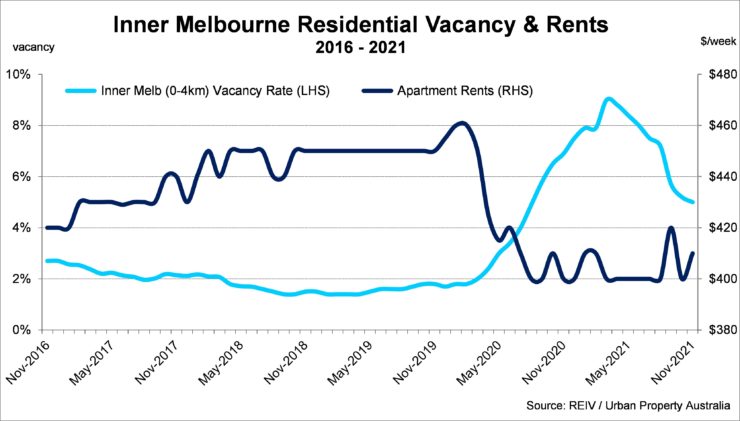

According to the REIV, as at November 2021, the residential vacancy rate for the Inner-City precinct (0-4km radius of the GPO) fell to 5.0% having peaked at 9.0% in March 2021 (an all-time high). While the vacancy rate has declined since March, the current level remains significantly above the 10-year average of 3.3%. Looking ahead, Urban Property forecasts that the vacancy rates for the Inner Melbourne precinct will continue to trend down as employment in the CBD picks up, however the Inner-City residential vacancy rate is likely to remain above the long-term average for the next two years impacted by the lack of international students.

Rents

While Inner Melbourne apartment rents fell to their lowest levels in 10 years in mid-2021, Inner-City apartment rents have now picked up. Having peaked at $460/week as at February 2020, Inner Melbourne apartment rents now average $410/week as at November 2021 according to the REIV. Urban Property Australia forecasts that although Inner Melbourne rents seem to have stabilised, demand would have to markedly lift to underpin rental growth and pre-COVID highs unlikely to be surpassed until 2023

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.