Q4 2022 – Australian Economic Overview

February 10th 2023 | , Urban Property Australia

The Australian economy is facing serious challenges – a sharp global economic slowdown, high inflation, rising interest rates and falling real wages. The global outlook has deteriorated more sharply than expected and inflation has proved more persistent.

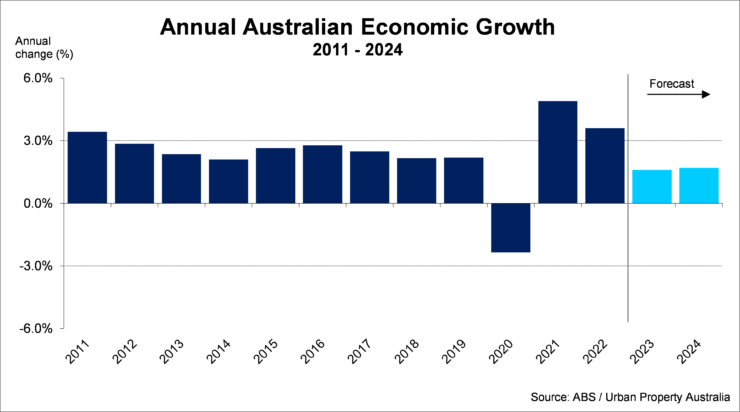

Tighter financial conditions and elevated inflation will weigh on consumption and investment following the strong recovery from the pandemic. Australia’s economy is projected to increase by 2% this year and 1.5% in 2024, a downgrade from previous projections.

With inflation having risen to 7.8% in the December 2022 quarter, inflation is forecast to be more persistent but is projected to have peaked and will moderate through the year and trending down to 3.5% in the June quarter 2024 and 2.5% in from mid-2025.

With elevated inflation, the Reserve Bank raised its cash rate target by 0.25%, increasing the RBA’s cash rate target to 3.35% in February 2023, up from a record low of 0.1% at the start of May 2022, and the highest it has been in a decade. Most economists forecast that the Reserve Bank will continue to increase the cash rate further, albeit the cash rate is close to its peak.

Household consumption has been growing strongly but is expected to slow considerably once the current recovery in discretionary services spending starts to fade and pressures on household budgets begin to mount.

While some household groups have built up savings buffers over recent years, however many indebted households will come under greater pressure in response to higher interest rates. In particular, low-income households will face pressures as essentials, such as housing costs and energy, make up a larger share of their expenses. A weaker outlook could see households exhibit precautionary savings behaviour and drag on consumer spending.

The labour market has continued to tighten, with strong employment growth driving the unemployment rate to near 50-year lows of 3.5%. Unemployment is forecast to remain at around 3.75% through 2023. As economic activity slows in the face of global and domestic headwinds, the unemployment rate is forecast to rise to 4.5% in mid-2024 but remain below pre-pandemic levels of around 5%.

Growth in business investment is being supported by a large backlog of investment projects, off the back of a period of prolonged lower business investment. Supply disruptions and poor weather have hindered commercial construction activity and mining projects recently. Beyond the current La Niña event, these factors are expected to wane, with business investment forecast to grow by 6% this year and 3.5% in 2024.

However, supply chain tensions and elevated input costs could further delay projects or prompt a reversal of existing investment decisions. Weakening demand, as interest rate rises pass through to activity, may also discourage investment by more than currently expected.

Real growth in government spending is expected to be negative this year as pandemic related spending unwinds. With the Federal government committed on repairing the Budget some decisions to reschedule the timing of some projects may occur to help ease the significant labour and material shortages which are limiting the speed of the infrastructure.

The outlook for dwelling investment in the coming year is dominated by effects of supply disruptions and capacity constraints, which are reflected in rapidly escalating building costs. Unseasonably heavy rain, floods and COVID 19 absenteeism have impacted activity to date, adding to existing pressures from both a record pipeline of construction work and global supply chain issues.

Capacity constraints and a third consecutive La Niña event are expected to continue to limit activity. As a result, and despite a large backlog of work for detached houses, dwelling investment is expected to be weaker than forecast and is now expected to fall by 2% over the coming 12 months. Rising interest rates and falling housing prices will see activity fall by a further 1% in 2024.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.