Q4 2024 – Melbourne Industrial Market

January 20th 2025 | , Urban Property Australia

- Approximately 950,000 square metres of new industrial space was delivered to the Melbourne industrial market in the past 12 months, almost double the long-term average.

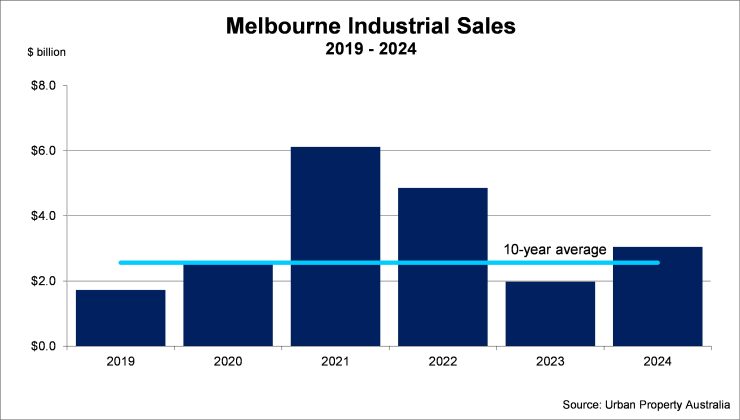

- Transactional activity in Melbourne’s industrial property market totaled more than $3 billion over 2024, a significant rebound in volume from the previous year, 18% higher than the 10-year annual average;

- The vacancy rate of the Melbourne industrial market has risen through 2024 and currently stands at 2.8%, impacted by soft leasing activity leading to vacancy rates rising in all industrial regions.

Industrial Market Summary

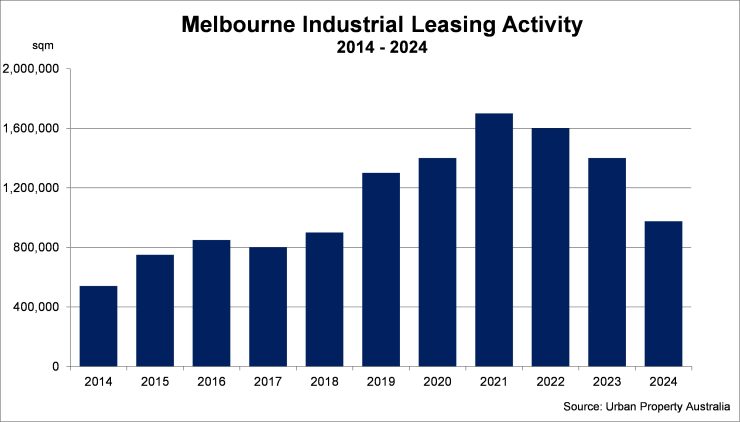

Adversely impacted by the weak consumer consumption environment, leasing activity in the Melbourne industrial market was below the long-term average in 2024 with occupiers increasingly cautious, leading to the weakest level of leasing activity since 2018. Leasing activity in the Melbourne industrial market was dominated by stock located in the Western region which accounted for 65% of all leasing activity, with transport and logistics accounting for the majority of leased industrial space.

Sales Volume/Yields

Sales activity in Melbourne’s industrial property market totalled just over $3 billion over 2024 according to Urban Property Australia research, a significant rebound in volume from the previous year. Despite the impact of the doubling of the foreign owners’ land tax surcharge in the State, the volume of sales recorded in 2024 was 18% higher than the 10-year annual average. Despite the increase in tax for foreign owners, offshore investor appetite in Melbourne’s industrial market remains strong (in 2024 at least) with many properties selling to offshore groups. Recent transactional evidence suggests that Melbourne industrial yields have stabilised. Urban Property research estimate that average prime industrial yield sit at 6.00% with average secondary yields at 6.75% as at December 2024. Looking ahead, foreign investment levels may soften interest Victoria due to the recently imposed absentee owner surcharge and land tax.

New Supply/Land Values

According to Urban Property Australia research, over 2024 approximately 950,000 square metres of new industrial space was delivered to the Melbourne industrial market, almost double the long-term average. The bulk of the new supply completed was located in the Western region with almost half of new supply currently under construction also located in the Western region in 2025 and 2026. Reflecting the economic headwinds and soft consumer environment, tenant demand has been subdued in recent years leading to fewer pre-committed facilities. Of the stock scheduled for completion in 2025, only 25% of new industrial supply is currently pre-committed. While industrial land values in Melbourne key industrial markets remained stable through 2024, values face downward pressure across the regions resulting from rising construction costs impacting feasibilities. As at January 2025, industrial land values average $850/sqm across the Western, Northern and South East regions with industrial land values in the City Fringe market approximately $1,750/sqm.

Tenant Demand

Adversely impacted by the weak consumer consumption environment, leasing activity in the Melbourne industrial market was below the long-term average in 2024 with occupiers increasingly cautious, leading to the weakest level of leasing activity since 2018. Similar to the new supply trend, leasing activity in the Melbourne industrial market was dominated by stock located in the Western region which accounted for 65% of all leasing activity, which is relatively in line with the long-term breakdown of share of leasing activity. Transport and logistics continue to account for the majority of leased industrial space with 58% of all industrial leases from this category, followed by retail and wholesale trade.

Vacancy/Rents

The vacancy rate of the Melbourne industrial market has risen through 2024 and currently stands at 2.8%, the highest level in five years according to Urban Property Australia research. While supply levels have eased, soft leasing activity has led to vacancy rates rising in all industrial regions over 2024. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 2.8% as at January 2025 in the North followed by 2.5% in the West and 1.6% in the South East.

While Melbourne industrial rents continue to increase, rates of growth have moderated by the subdued tenant demand environment. Over the 12 months to January 2025, according to Urban Property Australia research Melbourne prime industrial rents have grown on average by 5% with secondary rents having increased by 3% with tenants becoming increasingly discerning to key attributes to properties. Incentive levels have also risen through 2024 as landlords competitively seek to attract occupiers and Urban Property Australia expects that incentive levels will continue to increase due to the rising vacancy rate.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.