Q4 2024 – Melbourne Office Market

January 20th 2025 | , Urban Property Australia

- Despite a pick-up in transactional activity in the CBD, investment activity in Melbourne’s office markets over the past 12 months fell in comparison to the previous year;

- With tenant demand subdued, the Melbourne metropolitan office market vacancy rate remains elevated at 15.2% more than double the long-term average;

- Sales activity in the CBD rose significantly over the past six months with more $930 million of office sales recorded, almost double the level recorded the previous year, albeit still well below the long-term average.

Office Market Summary

With tenant demand subdued, vacancy rates of Melbourne’s office markets all stand at decade highs, with the metropolitan office market vacancy rate of 15.2% the lowest in comparison to the CBD at 18.0% and St Kilda Road in excess of 27%. Tenants remain cautious in the ongoing uncertain economic conditions and structural impacts of remote work leading to downward pressure of rents with incentive levels at historical highs . Tenant demand remains focused on prime quality offices offering modern amenities in order to attract employees physically back into offices.

Sales Volume/Yields

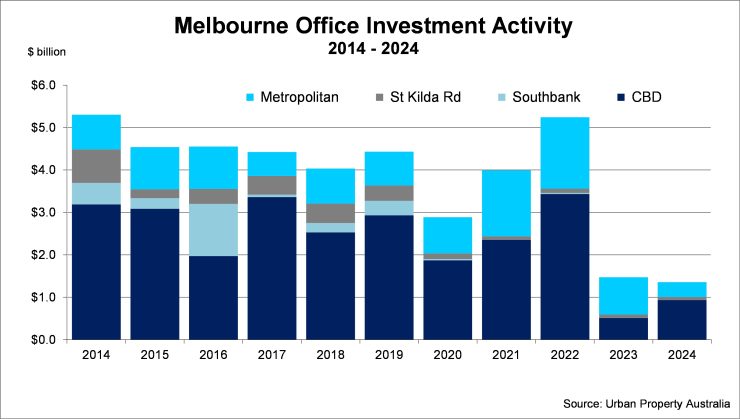

Despite a pick up in transactional activity in the CBD, investment activity in Melbourne’s office markets over the past 12 months fell in comparison to the previous year. In total, across all of Melbourne’s office markets, $1.3 billion was transacted, the lowest annual levels of sales in 15 years. The vast majority of sales recorded in 2024 were located in the CBD which accounted for 69% of the sales volume. Outside of the CBD, sales volume in the Metropolitan market was subdued with Urban Property Australia recording $350 million of office transactions – the lowest level in a decade. In vast contrast to recent years, there were no sales recorded in the Metropolitan office market more than $75 million. Reflecting the general investor uncertainty, prime metropolitan office yields remained steady at 7.25% whereas yields for secondary offices continued to ease with limited investor interest. Urban Property expects the yield spread between secondary assets is likely to continue to widen.

Supply

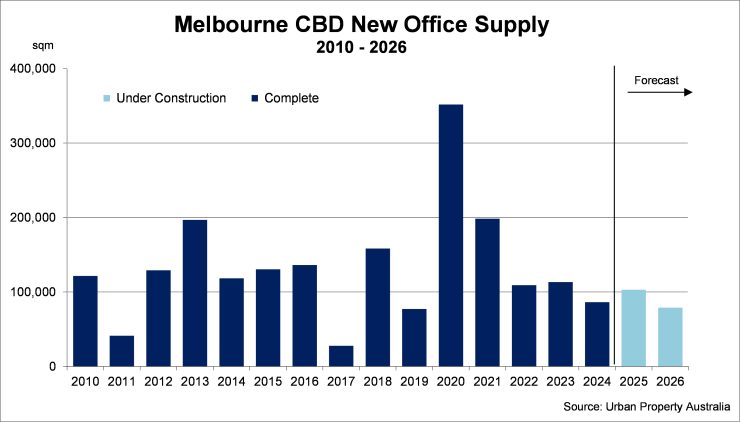

Urban Property is currently tracking 63,000sqm of new office projects currently under construction in the metropolitan office market. Of all the total stock currently under construction in the metropolitan office market, 31% is already committed. Much of the focus of the new development remains focused on the City Fringe with the precinct accounting for 40% of all new metropolitan office stock projected to be completed in the two years. With tenant demand strengthening and the level of new supply peaking in the Melbourne metropolitan office market in the short term, Urban Property projects that the vacancy rate has peaked and will trend down as tenants capitalise on the attractive leasing terms on offer to upgrade their office accommodation. Although the vacancy rate is anticipated to have peaked, with vacancy levels still elevated; looking ahead, the development pipeline is forecast to slow as funding requirements for new projects will constrain new supply for the medium term.

Tenant Demand

Over 2024, Victoria’s total employment has increased by 132,000, above the growth of 120,000 recorded 12 months ago, however the state’s unemployment rate rose to 4.4% as at December 2024, up from 4.0% as at December 2023. A similar trend was observed in the job market with 47,200 jobs advertised in Victoria as at December 2024, down from 61,800 a year earlier, with current levels now below the 10-year average of 48,000. Tenant enquiry was similarly subdued, with tenants cautious in the ongoing uncertain economic conditions and structural impacts of remote work. Tenant demand remains focused on prime quality offices offering modern amenities and high energy efficiency credentials to mitigate elevated energy costs with secondary assets of limited interest.

Vacancy/Rents

With tenant demand subdued, the Melbourne metropolitan office market vacancy rate remains elevated despite the declining development pipeline. The vacancy rate of the Melbourne metropolitan office market rose slightly, increasing to 15.2% as at January 2025, more than double the long-term average. Urban Property forecast that the vacancy rate of the metropolitan office has peaked for the short term as the pipeline of new supply reduces in coming years. Although the vacancy rate has stabilised, as tenants have increasingly become more cautious, prime rents face downward pressure as tenants explore alternative markets. Over the 12 months to January 2025, prime metropolitan office rents marginally increased while secondary metropolitan office rents declined marginally over the year. Looking ahead, Urban Property Australia forecasts that prime rents have stabilised for the short term with tenant demand subdued. In contrast, secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is highlighted from the recent trend of tenant moves.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to rise, increasing to 18.0% as at July 2024, its highest level since January 1997. While the headline sub-lease vacancy rate fell in the six months of July 2024 to 85,000 square metres across the CBD, Urban Property Australia is currently tracking an additional 40,000 square metres also being offered for sub-lease, almost three times the long-term average. Tenant demand in the CBD office market over the first half of 2024 was negative, with most occupation levels of most grades contracting, with the exception of Premium-grade office stock. As a result of the tenant vacations, the A-grade office vacancy rate in the CBD has increased to 18% – its highest level since 1995. Net effective rents for Melbourne CBD office stock have stabilised through 2024, albeit with incentives remaining elevated in response to increasing vacancy rates and subdued tenant demand. Sales activity in the CBD rose significantly over the second half of 2024 as purchasers and vendors become more aligned to value of CBD office assets. Over 2024, $930 million of office sales according to Urban Property research, almost double the level recorded the previous year, albeit still well below the long-term average of $2 billion.

Outside of the CBD, the vacancy rate of the St Kilda Road office market fell marginally in the six months to July 2024, easing to 27.4%. Elsewhere the vacancy rate of the Southbank office market increased to 18.6% as at July 2024, its highest level since 1995. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the completion of the Anzac railway station in September and the completion of the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Similar to Melbourne’s other office markets, transactional activity remains relatively subdued in both Southbank and St Kilda Road office markets with two offices sold for more than $10 million across the two office markets with sales volume totalling almost $70 million over 2024.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.