Q4 2024 – Melbourne Residential Market

January 20th 2025 | , Urban Property Australia

- Melbourne’s median house price decreased in the December 2024 quarter, with median prices now at their lowest level since September 2020;

- Metropolitan residential rents increased over the past year for both houses and units with levels now at all-time high levels having increased by 5% and 7% respectively;

- Housing finance commitments continue to recover led by non-first home buyer owner occupier finance levels rising by 9% with investor finance increasing by 5%.

Residential Market Summary

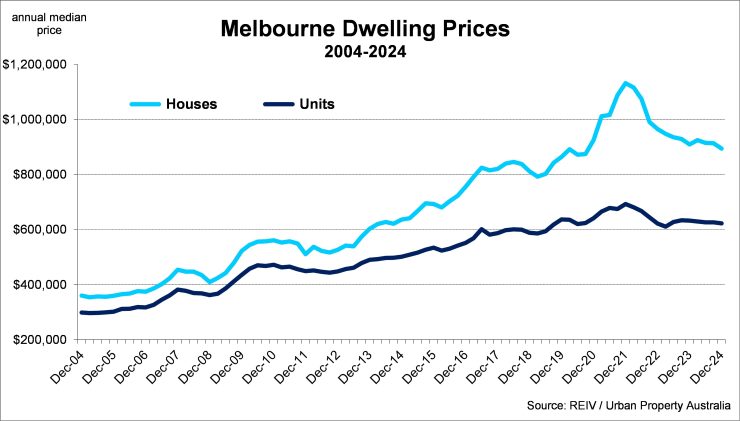

Melbourne’s median house price has fallen to its lowest level since September 2020, having declined in 11 quarters in the past three years. Currently, median prices of both Melbourne houses and units remain significantly below their peak levels with median house prices 21% lower and median unit prices 10% below their peak. Reflecting the slowdown of construction activity, the vacancy rate for Melbourne residential property remains low at 2.4%. Metropolitan residential rents across all precincts increased over the past year with all sitting at all-time high levels.

Prices

According to the REIV, Melbourne’s median house price decreased in the December 2024 quarter, with prices now having declined in 11 quarters in the past three years. As at December 2024, Melbourne’s median house price was $894,500, its lowest level since September 2020 according to the REIV. Melbourne’s median house price decreased by 2.1% over the quarter and is 1.6% lower than prices recorded 12 months ago. Similarly, Melbourne median unit prices decreased over the final quarter of 2024, decreasing to $622,500, down 0.6% in the quarter. Like the detached housing market, as at December 2024, the Melbourne median unit price remains lower than levels recorded 12 month ago with current levels 1.6% lower than those recorded in December 2023. Currently, median prices of both Melbourne houses and units remain significantly below their peak levels with median house prices 21% lower and median unit prices 10% below their peak. Outside of Melbourne, the median Victorian Regional house price decreased over the December 2024 quarter, falling to $595,000 – its lowest level since September 2021. The median Victorian Regional unit price also fell over the quarter, decreasing to $415,000, 5% off their peak recorded in 2022.

Supply

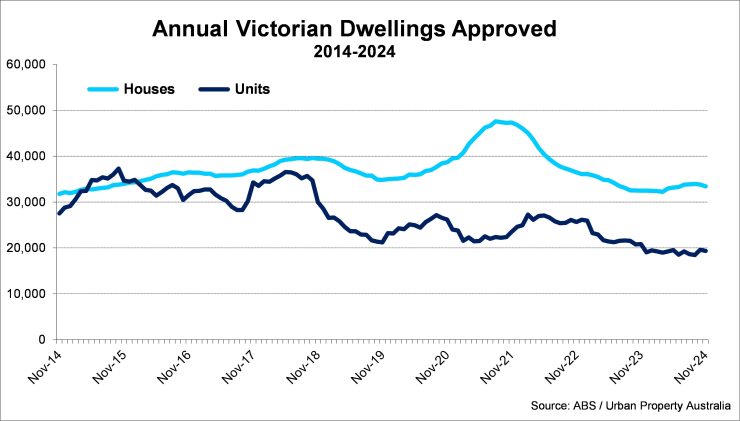

According to the ABS, there are currently 63,700 dwellings under construction across Victoria, 11% lower than the activity recorded 12 months ago, largely impacted by the slowdown of high-density apartment development. In contrast, while the number of detached houses currently under construction in Victoria is above its 10-year average, levels have fallen by 19% over the 12 months. The level of new dwellings completed in Victoria in 2024, is anticipated to be the lowest level in 10 years with commencements continuing to ease having decreased by 4% over the year. The decline in the pipeline of housing stock is further evidenced by decreasing level of approved dwellings in Victoria with current levels 13% lower than the 10-year average. In order to encourage supply, the Victorian state government has recently announced two policies that aim to give developers an incentive to build. Firstly, stamp duty will be reduced from October 2024 and be in place for 12 months and available for off-the-plan units, townhouses and apartments for properties at any price point. Secondly, to encourage more density around railway and tram lines, the government has identified 50 new activity centres where the planning process for multi-storey residential dwellings will be streamlined to fast-track development.

Demand

Victoria’s population is growing at close to record levels, increasing by over 165,000 over the 12 months to June 2024, the highest level of any Australian state. Victoria’s population growth was driven by overseas migrants with the state also recording net growth of interstate movement. Total annual Victorian housing finance commitments continue to recover having steadily increased through the year and now sit 14% above the 10-year average as at September 2024 with $86.6 billion financed. Monthly finance commitments have increased across all categories over the past 12 months. Non-first home buyer owner occupier finance levels have increased by 9% compared to the preceding year; with first home buyers also active with their levels 7% higher than last year. Investors now account for 31% of total housing finance commitments in Victoria, compared to their share 27% three years ago. Looking ahead, with strong rental growth and a shortage of housing, Urban Property Australia expects that investors will grow their share of housing loans as affordability challenges restrict owner occupiers despite increases in land taxes.

Vacancy

According to the REIV, as at November 2024, the vacancy rate for Melbourne residential property remained steady at 2.4% compared to its rate a year earlier but remains below the 10-year average of 3.0%. All precincts’ current vacancy rates now sit below their respective 10-year averages; with the Inner precinct decreasing marginally over the year in contrast to the Middle and Outer precincts which recorded increases in vacancy rates over the year. The vacancy rate of the Inner (4-10km) region recorded the tightest rate at 1.6%, down from 1.7% 12 months earlier. The Middle Melbourne region holds the highest vacancy rate at 2.6% while the vacancy rate of the Outer region sits at 1.7%. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain low with falling supply levels coupled with population growth of Melbourne currently at close to record high levels.

Rents

Reflecting the low vacancy environment, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over the year to November 2024, the weekly median rent for houses in metropolitan Melbourne increased to $580 per week, up from $550 per week a year earlier. Across Melbourne, rents for houses located in the Middle region increased the most, increasing by 7.2%, with rents in the Inner region increasing by 6.7% and the rents in the Outer precinct rising by 5.8%. Rents for Melbourne units also recorded solid annual rises with average rents increasing by 6.7% over the year with all precincts recording rental growth of units. Looking forward, Urban Property expects that residential rents will continue to rise, however the growth rates will moderate as affordability pressures begin to impact capacity of renters to absorb the significant growth observed in recent years.

Regional

The median Victorian Regional house price decreased over the December 2024 quarter, falling to $595,000 – its lowest level since September 2021. The median Victorian Regional unit price also fell over the quarter, decreasing to $415,000, 5% off their peak level recorded in 2022. In contrast to the performance of median prices in Regional Victoria, rental levels in the Regional markets have remained resilient with the average weekly rental levels for both houses and units increasing at all-time highs as at November 2024. The vacancy rate for Regional Victoria remains very tight at 2.0%, below the metropolitan average of 2.4%.

Copyright © 2025 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.