Adelaide – Property & Economic Update

April 14th 2018 | , Urban Property Australia

Adelaide is the capital city of the state of South Australia, which has the most centralised population of any state in Australia, with more than 75% of its 1.3 million residents living in greater Adelaide. South Australia’s largest employment sectors are health care, followed by retail trade. Adelaide is also home to a large proportion of Australia’s defence industries, which contribute over $1 billion to the state’s economy. Major defence technology organisations located in Adelaide include BAE Systems Australia, Lockheed Martin Australia, Saab Systems and Raytheon.

Economy

South Australia has enjoyed a period of strong growth recently, driven by robust consumption. Strong household consumption has helped drive state final demand growth of 4.9% in 2017. South Australia’s state final demand not only exceeds the national GDP growth but was also the highest of all Australian states in 2017. South Australia has remained quite resilient despite the loss of the its car manufacturing industry and weakened output from the mining and agriculture sectors. Labour conditions have remained robust. Looking forward, the South Australian economy is beginning to benefit from the new shipbuilding program centred at Techport near Port Adelaide with organic growth in office demand from defence-related industries being one by-product. Public investment in state infrastructure is also helping to buoy the jobs market with a significant rise in job advertisements noted recently that will support employment over the short to medium term. South Australia’s economy is projected to increase by 1.9% in 2018 with growth rising to 2.3% in 2019.

The South Australian economy is beginning to benefit from the new shipbuilding program with a significant rise in job advertisements.

Office Market

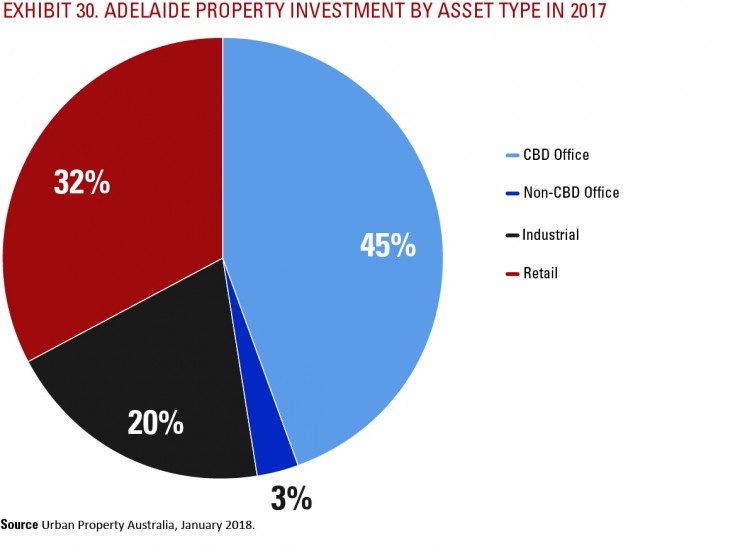

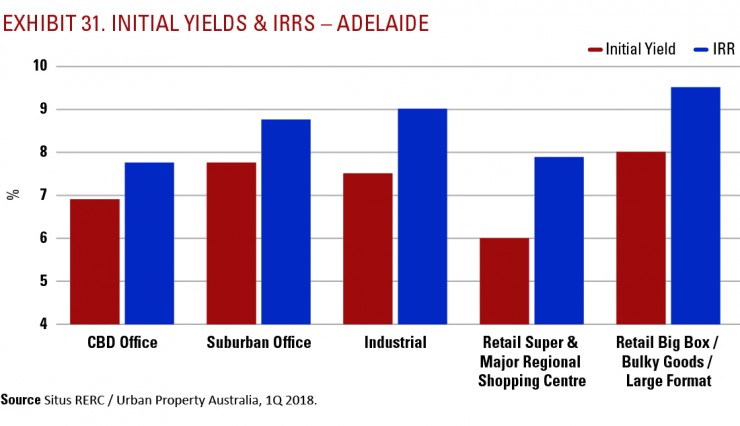

Although the Adelaide CBD office market is one of the smallest markets nationally with 1.4 million square metres, it has traditionally had a diverse industry base that has made it a highly attractive place to live and do business. Being at the centre of Australia’s road, rail and air logistics networks has provided time and cost advantages to many businesses, including those in the resources and most significantly defence industries. Over 2017, the Adelaide CBD office market vacancy rate decreased to 15.4%, down from 16.2%. Tenant demand for Adelaide CBD office space is also recovering with annual net absorption totalling 14,300 square metres, the highest annual level since 2008. In line with 2016 transaction volume, continued weight of capital has led to another strong year of investment activity in the Adelaide CBD office market in 2017. In 2017, CBD sales totalled $480 million, above the long-term average, with Adelaide increasingly a destination for offshore capital. Investment activity by asset type for Adelaide can be found in Exhibit 30. The 1Q 2018 Situs RERC/UPA survey results reveal that the average unlevered yield for prime Adelaide CBD assets is 6.9% with an average IRR of 7.75% (see Exhibit 31 for initial yields and IRRs by property type).

The Adelaide Fringe office market vacancy rate increased marginally over 2017, up to 11.4% from 11.3%. Vacancy increased as a result of refurbished space returning to market, the largest in a 12-month period since 2013. There continues to be some organic demand on the back of defence projects, with leasing activity in the Fringe office market on par with the long-term average. Investor demand for prime-grade assets in the Fringe remains high and opportunities remain limited. Over 2017, $30 million was transacted in the Adelaide Fringe area, across three transactions. Historically, few major assets are traded in the Fringe. Responses from the 1Q 2018 Situs RERC/UPA survey reveal that the average unlevered yield for prime Adelaide Fringe office assets is 7.75% with an average IRR of 8.75%.

Industrial Market

The government continues to boost its infrastructure program to create jobs during the transition period between naval shipbuilding projects and the closure of automotive manufacturing, with a record $9.5 billion being invested towards a series of infrastructure projects over the next four years. Although the closure of the Holden car manufacturing plant in October 2017 has adversely impacted the broader manufacturing sector, recently there has been a shift towards high-value, low-volume technology manufacturing. A combination of improving occupier demand and an undersupply of modern industrial accommodation has resulted in an increase in prime Adelaide industrial rents. Investment volumes have remained above trend, with the increase in major transactions noticeable in the last 12 months underpinned predominantly by institutional investors, including: Blackstone, Ascot Capital and Charter Hall. Investment activity over 2017 in the Adelaide industrial market reached $215 million, higher than the $110 million transacted in 2016. According to the 1Q 2018 Situs RERC/UPA survey results, the average unlevered yield for prime Adelaide industrial assets is 7.5% with an average IRR of 9.0%.

Improving occupier demand and an under supply of modern industrial accommodation has resulted in an increase in prime Adelaide industrial rents.

Retail Market

Retail spending in South Australia continues to outperform the national average, and most other states, having increased 4.2% over 2017. South Australia’s retail trade growth is the second strongest of all Australian states and well above the national growth rate of 2.5%. The positive trade growth is a result of ongoing strength in both take home and dining out food categories. Retail spending in South Australia has been supported recently by falling unemployment. Over 2017, the South Australian unemployment has fallen to 5.9%, down 70 basis points over the year. Although retail transactional activity levels increased 150% in 2017 over 2016 with $350 million sold, investment volumes remain below the long-term average. The 1Q 2018 Situs RERC/UPA survey results reveal that the average unlevered yield for Adelaide Super & Major Regional Shopping Centre assets is 6.0% with an average IRR of 7.88%. Sales of large-format retail centres in Adelaide totalled $75 million, accounting for 21% of all South Australian retail transactions in 2017. Responses from the 1Q 2018 Situs RERC/UPA survey reveal that the average unlevered yield for prime Adelaide large-format retail assets is 8.0% with an average IRR of 9.5%.