Melbourne Industrial Market Mid 2017

July 5th 2017 | , Urban Property Australia

Supported by Victoria’s still growing economy, demand for industrial space in Melbourne has seen vacancy rates fall to five-year lows. The entrance of Amazon is expected to support the expansion of small online traders, further boosting the demand and development of distribution centres and warehouses.

Sales Activity & Yields

Although investor appetite remains strong for industrial assets, Melbourne investment sales volumes in the 12 months to July 2017 fell from the preceding 12 months, impacted by a scarcity of investment opportunities. In the 12 months to July 2017, $850 million was recorded, down from $1.2 billion recorded in the preceding year. Transactional activity was boosted by a number of significant sales with two transactions above $100 million recorded in the Melbourne industrial market over the past year.

Domestic institutional investors led all other purchaser types for Melbourne industrial property, followed by foreign investors and domestic private investors. Purchases made owner occupier decreased in comparison to the previous 12 months.

Both prime and secondary Melbourne industrial yields now sit lower than their long term averages and now also below the benchmark yield lows of 2008. Melbourne prime industrial yields range between 6.50% and 7.25%. Limited prime assets offered for sale has led to a rise in demand for secondary properties, resulting in secondary yields compressing more than prime assets in the year to July 2017. Secondary yields for Melbourne industrial properties range between 7.75% and 9.00%.

New Supply

Boosted by Victoria’s population growth and the Government’s increased infrastructure investment, industrial new supply is projected to reach 10-year highs in 2017. New supply will largely be concentrated within the South Eastern and Western industrial precincts, with a number of large pre-leased developments scheduled for completion this year. The largest completion in 2017 to date was Target’s 63,000sqm distribution centre in Laverton North. Woolworths’ purpose built 68,700sqm distribution facility is scheduled for completion later this year.

Positive take-up conditions have also led to an increase in speculative development. DEXUS and Frasers Property have recently launched speculative developments with 200,000sqm of speculative development expected to be completed over the year. Looking ahead further, new supply levels are projected to remain elevated in 2018 with already a number of pre-leased projects under construction and scheduled for completion next year.

Analysis of the current stock of the Melbourne industrial market revealed that smaller buildings (from 1,000sqm to 5,000sqm) make up the vast majority (close to 95%) of the stock of industrial buildings but only account for 52% of the built industrial floorspace. In contrast, the 1,019 large buildings of over 5,000sqm make up the remaining 48% of floor space. The Western industrial precinct has the highest proportion of very large buildings (in excess of 10,000sqm).

Tenant Demand & Rents

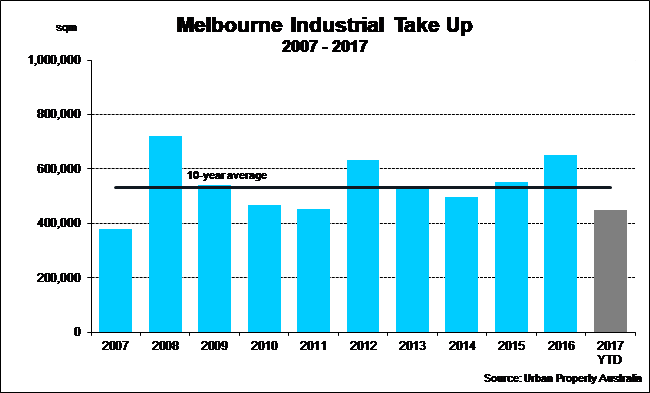

Supported by Victoria’s still growing economy, demand for industrial space in Melbourne has seen vacancy rates fall to five-year lows. Industrial take-up levels for 2017 to date are well above the long-term average with demand concentrated in the West and North. Demand for industrial accommodation has been led by occupiers from the Wholesale Trade, Manufacturing and Logistics sectors.

The entrance of Amazon (anticipated in 2018) is not only expected to result in a warehouse facility for the US-retailer but should support the expansion of small online traders, further boosting the demand and development of distribution centres and warehouses to fulfil consumers’ requirements of prompt delivery of online purchases.

On the back of improved leasing conditions and a reduction of vacancy buildings prime and secondary net face rents across Melbourne increased over the year to July 2017. With pre-lease conditions remaining competitive and increasing levels speculative development, Melbourne industrial rents are projected to only increase marginally in the year ahead.

Land Values

According to the Department of Environment, Land, Water and Planning there are 25,859 hectares of industrially zoned land across metropolitan Melbourne with 6,874 hectares of that vacant. Over the 15 year period between 2000/01 and 2015/16, there was a net increase of 3,921 hectares of land zoned for industrial use across metropolitan Melbourne.

Compared to previous years the 2015/16 period saw relatively little rezoning of industrial land to other uses. Overall, a net 76 hectares of industrial land was rezoned to non-industrial uses. Consumption for the 2015/16 period is the greatest since the Global Financial Crisis (GFC) with a net 298 hectares consumed in the last year. Prior to the GFC, industrial land consumption across metropolitan Melbourne averaged around 300 hectares per year. Following the GFC, consumption declined significantly, but began to increase from 2011/12.

While there have been limited industrial land transactions in Melbourne over the past three years, with diminishing available serviced industrial land, particularly within estates, increasingly developers are seeking englobo sites to restock their industrial pipeline with the increasing tenant demand. Keen to capitalise on the tenant demand developers have taken to acquiring secondary assets in key locations and demolish buildings given the lack of englobo land opportunities in traditional industrial precincts.

Average land values for sites smaller than 5,000sqm have increased across the majority of Melbourne industrial precincts over the year to July 2017 with particular growth observed in the Western and South Eastern precincts. For larger serviced industrial lots, greater than 1 hectare with growth recorded in the West and South East while land values remained stable in the North and City Fringe.

As a result of the Victorian Government’s plans to expand the Fishermans Bend urban renewal project, the quantum of inner city industrial zoned land has reduced further. As part of an expanded capital city zone, the proposed Fishermans Bend precinct will increase from 250 to 455 hectares. This diminishing availability of industrial zoned land within the City Fringe has resulted in a significant increase of industrial land values in the precinct.