Melbourne Industrial Market Outlook – July 2018

July 25th 2018 | , Urban Property Australia

Buoyed by robust leasing activity and declining vacancy levels, Melbourne industrial rents grew solidly across Melbourne’s industrial precincts. Increased infrastructure spending in Victoria and strong population growth will continue to underpin industrial tenant demand.

New Supply

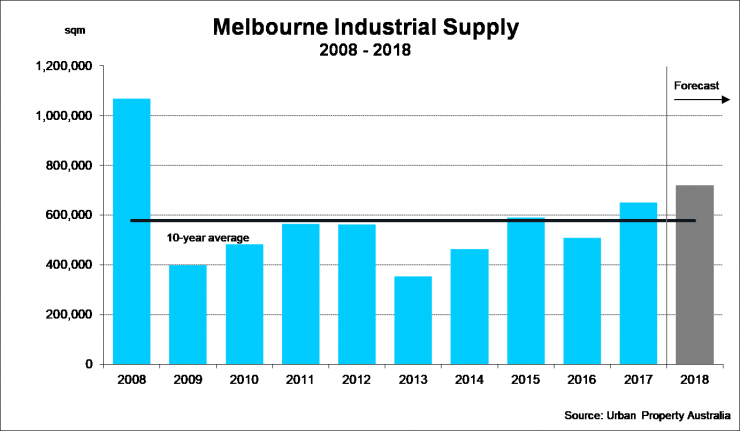

Melbourne’s nation-leading population growth continues to support new industrial supply with Melbourne forecast to grow more than any other industrial market in Australia in 2018. With already 350,000sqm completed in the first half of 2018, industrial new supply in the Melbourne market is forecast to reach its highest level since 2008. Interestingly, the Northern sub-region will lead all other regions for new industrial supply in Melbourne in 2018 with more than 400,000sqm projected to be completed – its highest level on record. New supply in the North has been underpinned by demand from food groups, third-party logistic companies and manufacturing occupiers who require proximity to the Melbourne Airport and/or the Melbourne Wholesale Food Market. The largest completion in 2018 to date was Woolworth’s 68,750sqm distribution centre in Dandenong South.

As occupiers’ supply chains become more complex, increasingly industrial accommodation is becoming more specialised, pre-lease development has risen. Of the new industrial space this is under construction 75% is pre-committed. Looking ahead further, new supply levels are projected to remain elevated in 2019 with already a number of pre-leased projects under construction and scheduled for completion next year.

Tenant Demand & Rents

Tenant demand remains robust with Melbourne’s industrial vacancy levels have fallen to three-year lows as at July 2018. The continued growth in e-commerce (with online retail sales up 17.2% over the year to May 2018), was demonstrated with by the strong take-up of industrial facilities by retailers and associated suppliers.

Over the year to July 2018, logistic & transport companies, retailers and wholesale traders accounted for 65% of all leasing activity in the Melbourne industrial market. With online retail sales continuing to grow, industrial occupiers are increasingly investing more capital to improve and consolidate their supply chains. While manufacturing classed tenants accounted for 22% of industrial leasing activity in Melbourne over the 12 months to July 2018, the category was boosted by food and beverage manufacturing based occupiers supported by Australia’s population growth.

Buoyed by robust leasing activity and declining vacancy levels, Melbourne industrial rents grew solidly across Melbourne’s industrial precincts in the year to July 2018. Increased infrastructure spending in Victoria and strong population growth will continue to underpin demand from logistics and Wholesale Trade occupiers which should support steady rental growth over the next five years for the Melbourne industrial market.

Land Values

According to the Department of Environment, Land, Water and Planning there are 26,017 hectares of industrially zoned land across metropolitan Melbourne with 6,669 hectares of that vacant. Over the 16-year period between 2000/01 and 2016/17, there was a net increase of 4,084 hectares of land zoned for industrial use across metropolitan Melbourne.

To ensure continual growth in freight, logistics and manufacturing investment in Victoria, there was a net increase

of 329 hectares of land zoned for industrial purposes. This comprised 549 hectares of land zoned for industrial purposes while 221 hectares of industrial land was rezoned for non-industrial purposes. Most of the 549 hectares of land zoned for industrial came from the approval of 371 hectares of industrial land in the Craigieburn North precinct and 162 hectares of industrial land in Wollert.

Prior to the GFC, industrial land consumption across metropolitan Melbourne averaged 300 hectares per year Following the GFC, consumption declined significantly, but began to increase from 2011/12. Over the last three years however, consumption of industrial land has increased to levels approaching those prior to the GFC. In the year to July 2017, 279 hectares on Melbourne industrial land was consumed, the third highest level in 11 years, reflecting the robust leasing activity.

Land values continues to increase in all precincts across the Melbourne industrial market in the year to July 2018.

In particular, land values grew significantly in the City Fringe and South Eastern regions. Land values in the City Fringe have been driven by owner occupiers pursuing properties to ensure their certainty in the precinct against developers seeking redevelopment opportunities. The strong growth of land values in the South East is reflective of the diminished stock of developable land due to residential conversion and re-zoning across the sub-region.

Englobo land demand continues to escalate as zoned land supply remains scarce on the back of pre-lease activity and strong land sales.

Sales Activity & Yields

While investment activity in the Melbourne industrial market picked up in the 12 months to July 2018, compared to the preceding year, sales activity in 2018 to date has been relatively muted. In the 12 months to July 2018, $1.12 billion was recorded, up from $850 million recorded in the preceding year.

Continuing the trend of the past two years, foreign investors remained the most dominant purchaser type, accounting for 41% of all buyers followed by domestic institutions at 13%. The majority of the offshore industrial investment has been as a result of portfolio transactions. were largely involved in the portfolio purchases.

Developers were the most significant vendors accounting for 20% of the divestment activity, followed by owner occupier (as part of sale and leaseback transactions) with 16% in the 12 months to July 2018.

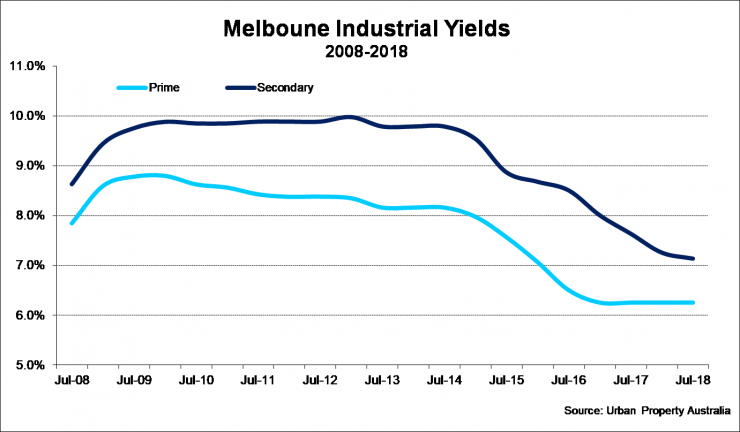

Both prime and secondary Melbourne industrial yields compressed marginally over the 12 months to 2018 with signs that values have peaked for the medium term. Melbourne prime industrial yields range between 5.75% and 6.25%, well below the long-term average, albeit with historically low interest rates and 10-year bond rates still offering an arbitrage. Limited prime investment opportunities continued the annual trend of secondary yields compressing more than prime assets, with secondary yields for Melbourne industrial properties now ranging between 6.50% and 8.00%.