Melbourne Office Market Mid 2017

July 5th 2017 | , Urban Property Australia

With Victoria leading all other Australian states for employment growth, Melbourne’s office markets performed well. With new supply relatively constrained across the markets in the next two years coupled with falling vacancies, strong rental growth is projected.

Sales Activity

Investment sales activity in the Melbourne metropolitan office market over 2016/17 totalled $720 million, its third highest level on record, but lower than the record high achieved in 2015/16. The fall in sales volume was not an indication of a deterioration in demand, but rather a lack of investment opportunities. Overwhelmingly domestic investors were the largest purchasers of metropolitan offices with unlisted funds and local private investors active. The significant weight of capital seeking Melbourne metropolitan office investments from all buyer groups continued the trend of yield compression for both prime and secondary assets. As CBD office asset prices continue to rise amid the lack of opportunities, investors are likely to continue being driven up the risk curve and target metropolitan assets.

New Supply

Having only exceeded the historical average only once in the past seven years, new metropolitan office supply is forecast to remain below average in the short term. New supply is projected to total around 40,000sqm this year. Major projects completed in 2017 to date include: GPC Asia Pacific’s new purpose built office at Stamford Business Estate in Rowville and the second stage at Caribbean Park in Scoresby. With vacancy in the CBD office market forecast to decrease further, increasingly a number of developers are considering speculative development in the metropolitan office market to capitalise on Melbourne’s employment growth. Sites mooted for office development include: Alfasi’s 20,000sqm proposal at Church Street, Richmond, Zig Inge’s $30 million proposed office at Balmain Street, Cremorne and GURNER’s 14,000sqm proposed 14,000sqm office development at Queens Parade, Fitzroy North.

Tenant Demand

Australian employment continues to strengthen with 141,000 jobs created between February and May 2017 – driven mostly by full-time employment. This recent improvement in employment has seen the unemployment rate drop sharply from 5.9% in March to 5.5% in May – the lowest rate since March 2013.

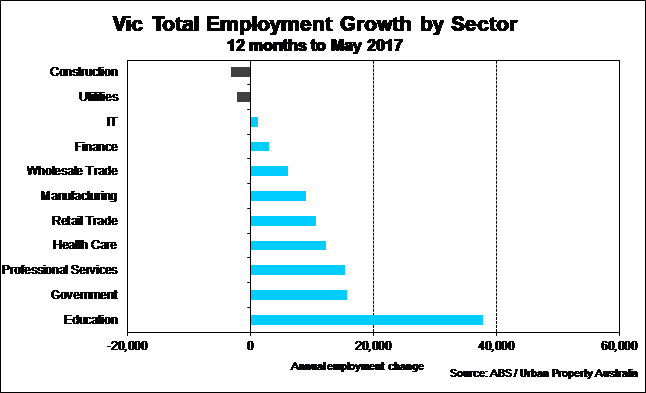

In 2016, employment in Victoria grew by an average of 3.0%, the strongest among the states. According to the Australian Bureau of Statistics, over the year to May 2016, Victorian employment growth was largely driven by the traditional white collar employment sectors with government and professional services both increasing significantly. The Education and Health Care sectors also recorded strong employment growth in Victoria over the year.

Looking forward, employment is forecast to grow at an above-trend pace in 2017/18, driven by strong demand and modest wages growth. With above-trend employment growth in the near term, the unemployment rate is forecast to decline to 5.5% in 2017/18.

White collar employment growth is forecast to continue to gather momentum across Victoria with employment in the CBD projected to increase at a faster rate, despite the tightening vacancy rate, than both the metropolitan and St Kilda Road office markets, with tenants’ focused on the attraction and retention of staff rather than lower cost.

Vacancy & Rents

Reflecting the employment growth across Victoria, the Melbourne metropolitan office market recorded its highest annual tenant demand levels of the decade. Total metropolitan office vacancy has fallen to 6.6%, in line with the long-term average of the market. However, impacted by major tenant relocations and speculative development, A-grade vacancy rate has now reached a five-year high. Looking ahead, the Melbourne metropolitan office vacancy rate is forecast to trend down with new supply constrained for the short term. With total suburban office vacancy having fallen, average prime suburban office net face rents increased at their fastest rate in six years. With diminishing options in Melbourne’s other office markets, Melbourne metropolitan office rents are projected to continue to increase.

CBD, St Kilda Road & Southbank office markets

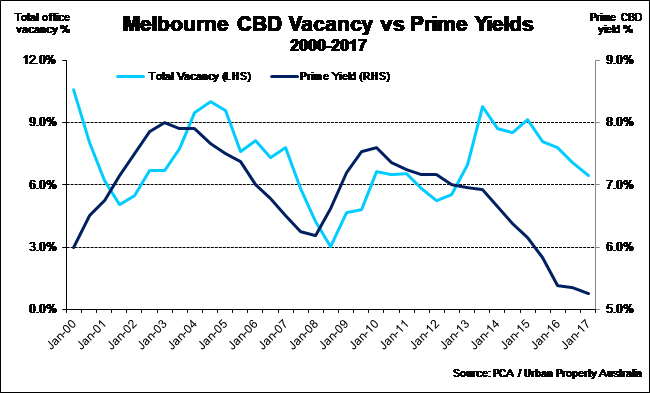

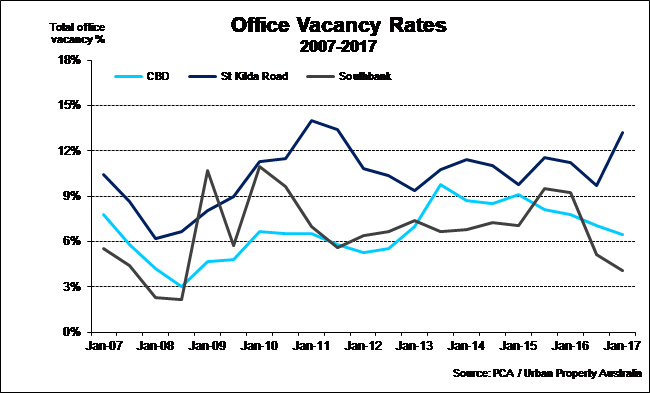

As a result of above-average levels of tenant demand, the overall vacancy rate of the Melbourne CBD office market fell from 7.0% to 6.4% in the six months to January 2017. Melbourne continues to host the second lowest vacancy rate amongst all of Australia’s CBDs. The overall vacancy rate in the CBD is anticipated to continue trend down over the next two years, before rising moderately in 2019 when the next development cycle commences While there is 360,200sqm currently under construction in the Melbourne CBD to be completed by 2020; however, over the next two years completions are limited. On the back of vacancy falling to its lowest level in four years, prime CBD effective rents grew at their strongest rate in seven years. In the investment market, supported by Melbourne’s rental outlook, marginal yield compression is anticipated. Looking ahead, investment volumes are anticipated to remain above the five year average this year but unlikely to match volumes recorded in 2014 and 2015, impacted by the scarcity of investment opportunities rather than diminishing investor appetite.

The total vacancy rate in the St Kilda Road office market increased to 13.2% in the second half of 2017 up from 9.7% in July 2016. The increase in total vacancy largely resulted from Victoria Police and Tabcorp moving into the CBD. Vacancy in the Southbank office market is the lowest across all major Australian office markets. Total vacancy in the Southbank office market has fallen to 4.1% largely as a result of the withdrawal of secondary grade buildings for conversion to residential. Office investment activity in the 2016 calendar year reached an all time-time high in the St Kilda Road and Southbank office markets.