Perth – Property & Economic Update

April 14th 2018 | , Urban Property Australia

Perth is the capital and largest city of the Australian state of Western Australia. It is the fourth-most populous city in Australia, with a population of around 1.94 million. Western Australia’s economy is largely driven by extraction and processing of a diverse range of mineral and petroleum commodities. Western Australia’s overseas exports accounted for 46% of Australia’s total exports boosted by global demand for minerals and petroleum, especially in China (iron-ore) and Japan (for LNG). Six of the world’s seven top international energy companies are headquartered in Perth – Australia’s largest concentration of global oil and gas company headquarters.

Economy

The Western Australian economy’s transition out of the mining investment boom is coming to an end, but growth remains weak. Western Australia recorded state final demand of 1.2% for 2017, substantially higher than when state final demand contracted by 7.6% over 2016. Labour conditions also appear to be improving with employment growing by 3.9% over 2017, outperforming the national average of 3.5%. The Metronet infrastructure project is likely to create further jobs and boost the state’s economic recovery. The slowdown in mining continues to impact the state’s population growth. Population growth in Western Australia has not surpassed 1% since late 2014. Western Australia’s population increased by 0.9% in the year to September 2017. Western Australia’s economy is projected to increase by 1.7% in 2018 with growth rising to 2.3% in 2019.

Office Market

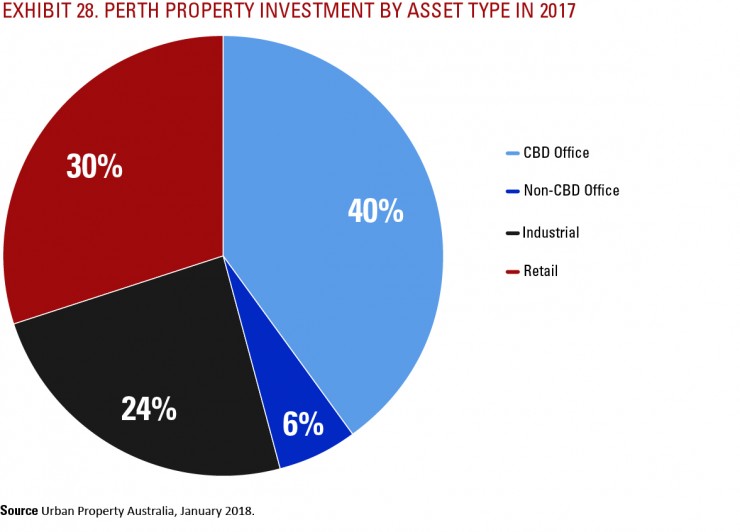

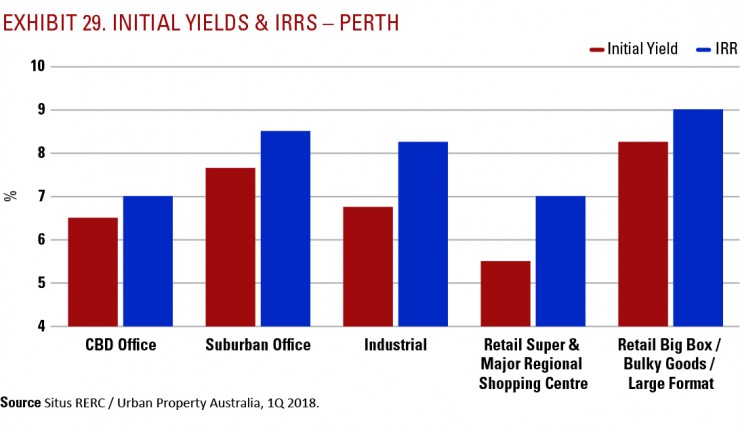

Although the Perth CBD office still has the highest vacancy rate of any Australian capital city, Perth continues to show promising signs of recovery. The Perth CBD office vacancy rate declined from 21.1% to 19.8% in the six months to January 2018. For the first time since 2012, the CBD has recorded positive demand for two consecutive six-month periods. Positively, the Perth CBD office market vacancy declined by 270 basis points over 2017, the greatest decline of any Australian office market. Sub-lease vacancy also decreased over 2017 to 1.5% of total stock – its lowest level since mid-2012. As a sign of improving conditions in the wider Perth market, sub-lease vacancy has been declining since 2016, as multiple occupiers either re-occupied or no longer marketed their premises for sub-lease. Mirroring the increasing tenant demand, transactional activity within the Perth CBD also increased over 2017 indicating that countercyclical purchasing has commenced and the appetite for assets with the right leasing profile is strong. Total sales volume reached $625 million in 2017, representing a 25% increase over 2016. Investment activity by asset type for Perth can be found in Exhibit 28. The 1Q 2018 Situs RERC/UPA survey results reveal that the average unlevered yield for prime Perth CBD assets is 6.5% with an average IRR of 7.0% (see Exhibit 29 for initial yields and IRRs by property type).

Perth CBD office vacancy declined by 270basi s points over 2017, the greatest decline of any Australian office market.

Relocation to the CBD remains a feature of the West Perth office market, with a number of tenants relocating from West Perth to the CBD, contributing to the rise in the vacancy rate over the second half of 2017. The vacancy rate of the West Perth office market rose to 16.7% from 15.0% over the second half of 2017. Offsetting some relocations to the CBD has been a notable increase of suburban tenants moving into West Perth, upgrading their office accommodations. Traditionally, few major assets above $25 million transact in the West Perth office market, with just two assets being exchanged in this price bracket over the last five years. While the wide yield spread between West Perth and other Fringe markets remains very attractive for investors seeking counter-cyclical opportunities, recent investment has predominantly been led by opportunistic investors operating under a value-add or repositioning strategy. Over 2017, five offices in the West Perth market have sold, totalling $85 million. Responses from the 1Q 2018 Situs RERC/UPA survey reveal that the average unlevered yield for prime Perth suburban office assets is 7.65 % with an average IRR of 8.5%.

Industrial Market

While tenant demand is improving, leasing activity in the Perth industrial market remains below average levels as has been the trend since 2015. Leasing activity has been largely driven by smaller-sized tenants with only three leasing commitments above 10,000 square metres signed during 2017. Over 2017, demand for Perth industrial property was led by the wholesale trade, transport and manufacturing sectors. With tenant demand relatively muted, new supply is minimal with just three projects currently under construction, totalling 40,000 square metres. With a lack of prime vacant stock, tenants have elected to pre-lease accommodation requirements. Since 2015, 90% of all new supply has been pre-committed with speculative development over the past three years negligible. As a result of soft occupier demand and increasing vacancy, Perth prime industrial rents have declined over the past four years. Perth prime industrial rents are not expected to grow until 2019 with incentives remaining elevated for the short term. Highlighting the lack of leased, large-scale investment-grade opportunities across the Perth industrial market, transactions over 2017 totalled $380 million, down from $600 million transacted in 2016. According to to the 1Q 2018 Situs RERC/UPA survey results the average unlevered yield for prime Perth industrial assets is 7.75% with an average IRR of 8.25%. Both metrics tightened, illustrating the improving investor sentiment for Western Australia.

Retail Market

The retail environment in Perth remains challenging. Retail turnover in Western Australia contracted by 0.4% over 2017. A slowdown in housing market construction and housing turnover have driven the slowdown in retail spending in the household goods sector. Other significant economic drivers weighing on the retail sector include subdued employment growth and house price movement (which declined 2.3% over 2017), diminishing household wealth and consumer confidence. The slowdown of population growth – from 3.2% in 2012 to 0.8% in 2017 – is also weighing on retail turnover. The state’s population and employment are predicted to improve over the next five years, leading to above-average retail turnover. Over 2017, retail transactions in Western Australia totalled $475 million, down from the $625 million transacted in 2016. The 1Q 2018 Situs RERC/UPA survey results reveal that the average unlevered yield for Perth Super & Major Regional Shopping Centre assets is 5.5% with an average IRR of 8.25% and that the average unlevered yield for prime Perth large-format retail assets is 8.25% with an average IRR of 9.0%.

Retail turnover in Western Australia is forecast to grow above average over the next five years, driven by improving population and employment growth.