Q1 2019 – Inner City Melbourne Apartment Market

April 10th 2019 | , Urban Property Australia

- In 2018, 3,462 apartments were completed in the Inner-City Melbourne precinct – the lowest annual level since 2013;

- Apartment rents in the Inner-City Melbourne precinct continue to grow strongly, rising by 5% over the year to reach an all-time high;

- Inner-City Melbourne median apartment prices recovered over the year to be now 3.0% higher but remain 2.8% than their peak in early 2016.

Despite the volume of apartment transactions decreasing, Inner-City Melbourne median apartment prices have been relatively resilient to date, reflecting the strong rental demand and housing affordability pressures. Looking ahead with the supply pipeline diminishing, values are likely to be supported from significant declines with population growth projected to remain robust.

Median Prices & Rents

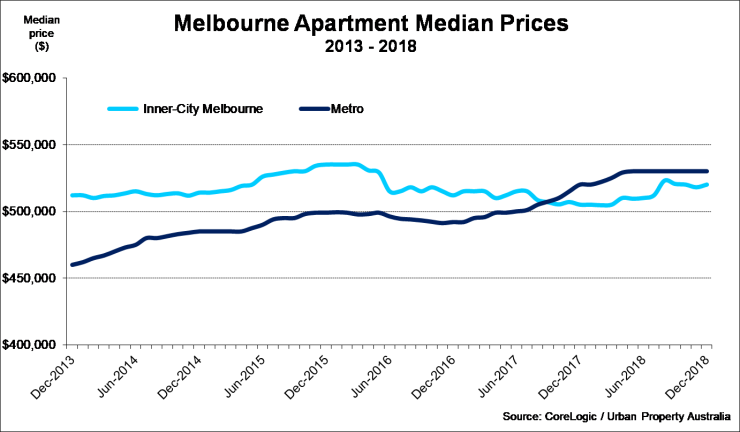

Although Inner-City Melbourne median apartment prices recovered over the year to be now 3.0% higher, reaching $520,000 as at December 2018, values remain below the peak of $535,000 in early 2016 according to CoreLogic data. In contrast, median prices of apartments for the broader metropolitan Melbourne market continue to increase with median prices increasing by 1.9% over 2018 to an all-time high of $530,000 according CoreLogic. Since September 2017, median values of apartments in the broader metropolitan area have been higher than those based in the Inner-City Melbourne area. Interestingly over the past year, the average vendor discount has increased for apartments in the broader metropolitan area whereas average vendor discounts for Inner-City Melbourne apartments have declined marginally.

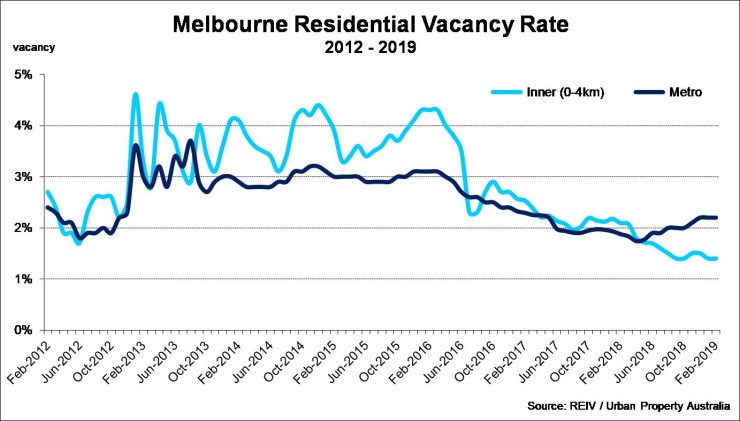

Buoyed by the low vacancy rates, apartment rents in the Inner-City Melbourne precinct continue to grow strongly, rising by 5% over the year to reach an all-time high of $520/week. Rents for apartments for the broader metropolitan area have echoed those in the inner-city precinct, increasing by 5% also to a new high level of $420/week.

The introduction of the Victorian government’s vacant residential property tax (VRPT) on January 2018 was intended to loosen vacancy and put downward pressure on rental levels by increasing rental supply, however the tax appears to not have had an impact to date.

Looking ahead, Urban Property Australia Research expect rents to increase in the Inner-City precinct along with the broader metropolitan area supported by strong interstate and international migration.

Development

Between 2001 and 2016, 16,400 apartments were added to the City of Melbourne, increasing the stock by 52% over the period. In 2018, 3,462 apartments were completed in the Inner-City Melbourne precinct – the lowest annual level since 2013. Of the apartments completed in 2018, 32% were located in the CBD Core followed with 28% located in Southbank and 11% based in the Docklands.

Currently there are 17,700 apartments under construction within the Inner-City Melbourne region. With 350 apartments already completed in 2019, Urban Property Australia research forecasts that 5,000 apartments will be completed this year. Of the 102 new developments currently under construction, 46% of the apartments are located in the CBD Core, followed by 26% in Southbank and 7% are located in Carlton.

Looking ahead, while there are a further 36,000 apartments with plans approved in the Inner-City Melbourne region, Urban Property Australia’s research forecasts that the supply pipeline has peaked in the short term. Although supply levels in 2019 through to 2022 are expected to be above average; from 2023, completions are projected to significantly decline. With development lending from major banks constrained, a number of projects previously being actively marketed have been withdrawn. UPA research analysis reveals that 3,000 apartments have had their plans shelved with major residential developments recently withdrawn for other uses including the 555 Collins Street, 85 Spring Street and 383 La Trobe Street projects.

Demand

In addition to the reduction of availability of housing finance, foreign investment demand has weakened significantly, impacted by a range of factors including the Chinese government’s updated guidelines on outbound investment coupled with the introduction of state-based taxes on foreign investors.

Latest Australian Foreign Investment Review Board (FIRB) data revealed that foreign residential real estate approvals continued to decline over the 2017/18 period. In 2017/18, foreign investment approvals for new dwellings fell by 24% compared to the previous year according to FIRB data. In fact, foreign residential real estate approvals have now declined by 63% since the peak of 2016/17.

Following more than a year of tightened lending conditions focussed on limiting the growth of investor loans for both domestic and offshore purchasers. Over the past year, sale transaction volumes for apartments in the Inner-City Melbourne precinct have fallen 23%.

While purchaser demand has been constrained, rental demand remains strong reflected by the current vacancy level of the Inner-City Melbourne precinct at only 2.0% as at February 2019, below the metropolitan average of 2.2%. According to the Australian Bureau of Statistics, the Inner-City area of Melbourne experienced the third largest growth in Victoria in 2017/18, increasing by 10,800 people (6.8%). The major driver of this growth was net overseas migration, which accounted for 82% of the population growth of the Inner Melbourne precinct.

Population projections indicate that the population within the City of Melbourne will increase to 181,325 by 2031. In order to accommodate that population growth, UPA forecast that a further 40,400 dwellings are required to be delivered in the precinct.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.