Q1 2019 – Melbourne Industrial Market

April 10th 2019 | , Urban Property Australia

- Speculative development has increased across Melbourne’s industrial market;

- Vacancy levels now down to the third lowest level in five years;

- Industrial land values have increased strongly across Melbourne with land values in the West up 40% over the 12 months to March 2019;

- The combination of strong investor demand and limited investment opportunities resulted in prime and secondary yields compressing over the year.

With the reliance and need for more logistics space at an all-time high, occupier and investor demand remain robust. Melbourne’s strong projected population growth will continue to boost trade activity and e-commerce and retail sales which has been a significant driver of industrial take-up recently.

New Supply

Driven by the demands of consumers and meet next-day and same-day delivery, occupiers are increasingly investing in their supply chains, increasingly tenants are relocating into alternative warehouse premises with higher specification as their former buildings cannot meet more complex automation infrastructure.

While new industrial supply across Melbourne reached 10-year highs last year, constrained by limited serviced land, Urban Property Australia forecasts new supply to decline in 2019 and 2020. Underpinned by the strong population growth of Melbourne, over 2018, 650,000sqm was completed, the highest level of new supply across Australia. New supply over 2018 was focused in the Western sub-region with the precinct accounting for 62% of new supply delivered to Melbourne. Motivated by the combination of low vacancy and strong tenant enquiry levels for new builds, speculative development has increased. Looking ahead, already 200,000sqm of speculative stock is already under construction with most speculative developments located in the West and the South East. With land availability decreasing across Melbourne’s industrial market and pre-committed developments scheduled for completion this year, new supply in 2019 is forecast to fall to its lowest annual level since 2013.

Tenant Demand & Rents

Strong tenant demand continues to drive Melbourne’s industrial market leading to industrial vacancy levels now down to the third lowest level in five years as at January 2019. Rising growth of e-commerce (with online retail sales up 13.8% over the year to February 2019), continues to underpin take-up of industrial space in Melbourne. Over 2018, logistic & transport companies, retailers and wholesale traders accounted for 56% of all leasing activity in the Melbourne industrial market. With online retail sales continuing to gather momentum, industrial occupiers are increasingly investing more capital to improve and consolidate their supply chains. While manufacturing classed tenants accounted for 32% of industrial leasing activity in Melbourne in 2018, the category was boosted by food and beverage manufacturing based occupiers being supported by Melbourne’s nation leading population growth.

With tenant demand exceeding supply, Melbourne industrial rents grew by 4% over 2018. As landlords capitalise on the falling vacancy levels coupled with strong demand from the logistics and retail sectors seeking specialised warehouse space, Urban Property Australia research anticipates prime rental growth to continue over the next 12 months.

Land Values

According to the Department of Environment, Land, Water and Planning there are 26,017 hectares of industrially zoned land across metropolitan Melbourne with 6,669 hectares of that vacant. Over the 16-year period between 2000/01 and 2016/17, there was a net increase of 4,084 hectares of land zoned for industrial use across metropolitan Melbourne.

To ensure continual growth in freight, logistics and manufacturing investment in Victoria, there was a net increase of 329 hectares of land zoned for industrial purposes. This comprised 549 hectares of land zoned for industrial purposes while 221 hectares of industrial land was rezoned for non-industrial purposes. Most of the 549 hectares of land zoned for industrial came from the approval of 371 hectares of industrial land in the Craigieburn North precinct and 162 hectares of industrial land in Wollert.

Prior to the GFC, industrial land consumption across metropolitan Melbourne averaged 300 hectares per year Following the GFC, consumption declined significantly, but began to increase from 2011/12. Over the last three years however, consumption of industrial land has increased to levels approaching those prior to the GFC. In the year to July 2017, 279 hectares on Melbourne industrial land was consumed, the third highest level in 11 years, reflecting the robust leasing activity.

The difficulty of securing investment stock coupled with tightening yields have led owners developing assets to access the industrial sector. With institutions now starting to exhaust their land holdings, a flurry of development sites have transacted across Melbourne over the last 18 months resulting in land values continuing to grow significantly. Over the year to March 2019, land values have increased in the Western sub-region by 40%.

Sales Activity & Yields

Demand for industrial property in Melbourne continues to rise – particularly as institutional investors seek greater exposure in the industrial sector and build their industrial investment portfolios. The combination of strong investor demand and limited investment opportunities resulted in prime and secondary yields compressing in the 12 months to January 2019. Melbourne prime yields now range between 5.50% and 6.75%. Strong ongoing demand for industrial assets is likely to cause yields to tighten further in the next 12 months, albeit at a slower rate as purchasers appreciate that the cycle of the industrial sector.

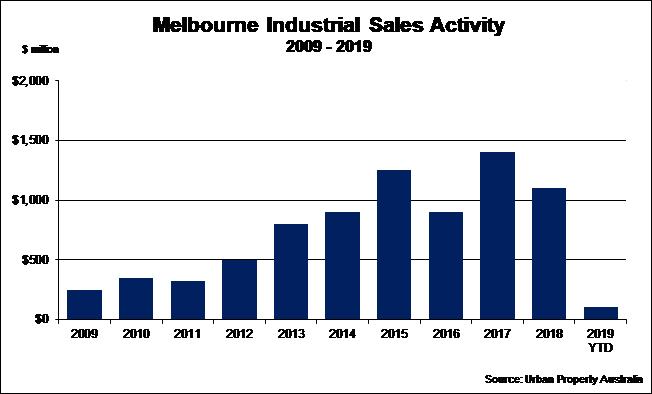

Investment activity in the Melbourne industrial market totalled $1.1 billion in 2018, falling from $1.4 billion in the preceding year (albeit 2017 was a record high). Domestic institutions (AREITs and unlisted funds) were the most dominant purchaser type, accounting for 42% of all buyers followed by foreign investors at 18%.

Looking ahead, it appears that sales activity will trend lower again with transactions in 2019 date totalling $105 million, impacted by a lack of assets being brought to the market rather than diminishing investor demand.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.