Q1 2019 – Melbourne Residential Market

April 10th 2019 | , Urban Property Australia

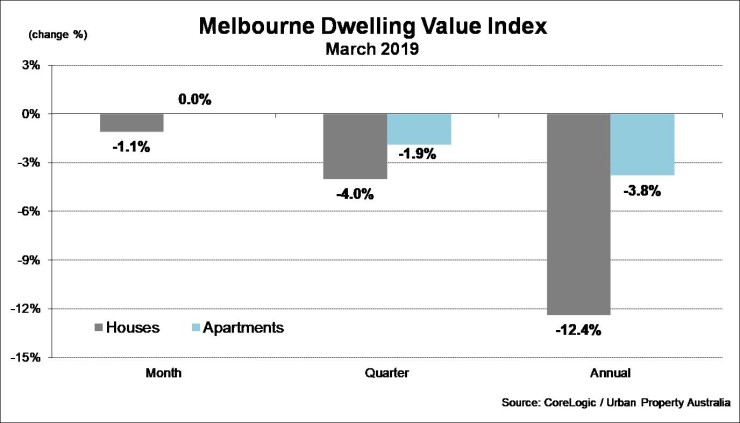

- Melbourne home value index has fallen by 12.4% in the 12 months to March 2019;

- The volume of Melbourne house sale transactions has fallen by 24% with apartment sale transactions down 23% in 2018;

- The level of dwellings under construction appears to have peaked in the short term;

- The vacancy rate for the Melbourne residential market remains tight at 2.2%.

Adversely impacted by the tightened lending environment and easing consumer confidence levels, Melbourne home value index has declined by 12.4% over the year. However, with Victoria’s nation-leading population growth coupled with a likely cut to interest rates, Urban Property Australia anticipates the Melbourne housing market to stabilize in the second half of 2019.

Prices

According to CoreLogic, Australian dwelling values slipped 2.3% lower in the March 2019 quarter, taking the annual fall to 6.9%. National dwelling values have been trending lower for seventeen months and have fallen by a cumulative 7.4% since peaking in October 2017. While the pace of falls has slowed in the March quarter, the scope of the downturn has become more geographically widespread. Over the year, dwelling values are lower across six of the eight capital cities, with Canberra values holding firm while Hobart values were 6.0% higher. Overall, the housing market has recently shown some tentative signs that the downturn in dwelling values is losing some steam with the 0.6% fall in March 2019 the smallest of the month-on-month decline since values fell by 0.5% in October 2018.

According to CoreLogic, values of detached houses in Melbourne have fallen by 12.4% in the 12 months to March 2019 with apartment prices 3.8% lower over the year. Reflecting the tightening lending conditions and purchaser caution (possibly affected by uncertainty related to the impending federal election), according to the ABS, the volume of Melbourne house sale transactions has fallen by 24% with apartment sale transactions down 23% in 2018.

While there are some headwinds for the housing market, UPA research predicts that Melbourne residential prices are nearing their decline with cuts to the cash rate and the relaxation of lending criteria from banks likely to provide some positive stimulus for the housing market later this year.

Supply

Despite Victoria’s population continuing to grow strongly, the level of dwellings under construction appears to have peaked in the short term, impacted by the tighter lending environment which has slowed the circulation of mortgage credit. According to the ABS, there are 71,600 dwellings currently under construction across Victoria, 3% lower than the peak of 73,500 in early-2018. Despite the decline of construction levels, both the number of houses and apartments under construction in Victoria remain above their respective 10-year averages.

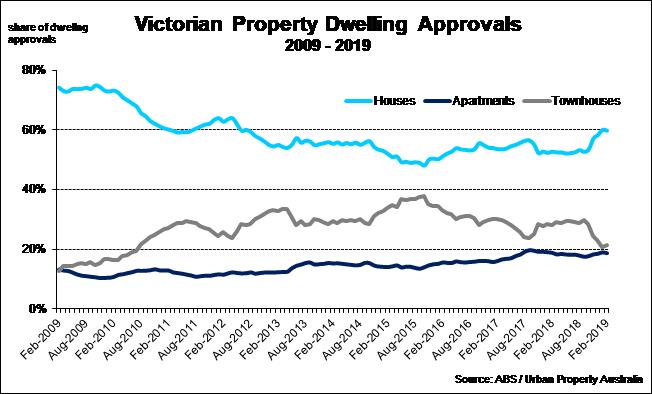

Looking even further ahead, reflecting the difficulty in developers sourcing development finance coupled with the soft environment of pre-sales, the level of dwellings approved continues to decline. In the 12 months to February 2019, a total of 65,300 dwellings were approved in Victoria, 10% lower over the preceding year. The decline in dwelling approvals was driven by the apartment market with approval levels down 23%. In contrast approvals for houses was up 3% in the 12 months to February 2019. Signalling the changing preferences of purchasers, approvals for houses now account for 60% of all dwellings while townhouse developments account for 21% of total approvals across Victoria, as first home buyers continue to grow market share.

Demand

Reflecting the easing supply levels and tightened lending environment, housing finance commitments in Victoria also appear to have peaked for the short term. In the 12 months to January 2019, total housing finance levels fell by 9% with investor loans falling 21% over the year. Impacted by the constrained lending conditions, investor loan finance in Victoria has fallen to its lowest level since November 2013. In line with the falling volume of finance commitments, the proportion of investor loans has also decreased, having now fallen to 27.5%, a decade low. In contrast, first home buyers are becoming more active. While overall owner occupier housing finance levels have fallen, first home buyers housing finance levels have increased by 14% over the year and now account for 25% of all finance commitments, their highest market share since November 2013.

Mirroring the housing finance loan activity and softening consumer confidence levels, the auction market has also weakened. In February 2019, there were 2,080 auctions across Melbourne with a clearance rate of 55.5% recorded, down from 71.9% a year earlier.

Vacancy

According to the REIV, as at February 2019, the vacancy rate for Melbourne residential property remains tight at 2.2%, slightly up from 1.9% in February 2018. Within Melbourne’s sub-regions, vacancy rates in the inner suburbs increased 10 basis points over the year to reach 2.0%. Vacant dwellings in the city’s outer suburbs was the lowest of all sub-regions at 1.7% with the middle suburbs increasing 30 basis points over the year to 3.3% as at February 2019. Outside of the metropolitan area, in regional Victoria vacancy decreased by 70 basis points over the year to just 1.2% as at February 2019. Vacancy rates in all the key regional cities of Bendigo, Geelong and Ballarat all remain below 2%.

Rents

According to the REIV, over the year to February 2019 the weekly median rent for houses in metropolitan Melbourne remained steady at $450 per week, while in regional Victoria, the weekly median rent for houses increased by 4.7% increasing to $335. The weekly median rent for units increased in metropolitan Melbourne to $430 per week rising by 2.4% over the 12 months while the median rent for units in regional Victoria increased by 14.6% to $275 per week over the year to February 2019. Across Melbourne precincts weekly median rent were largely stable over the year to February 2019. For regional Victoria, Ballarat outperformed both Bendigo and Geelong with the weekly median rent for houses up 10% to $330 as at February 2019.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.