Q1 2021 – Melbourne Office Market

April 12th 2021 | , Urban Property Australia

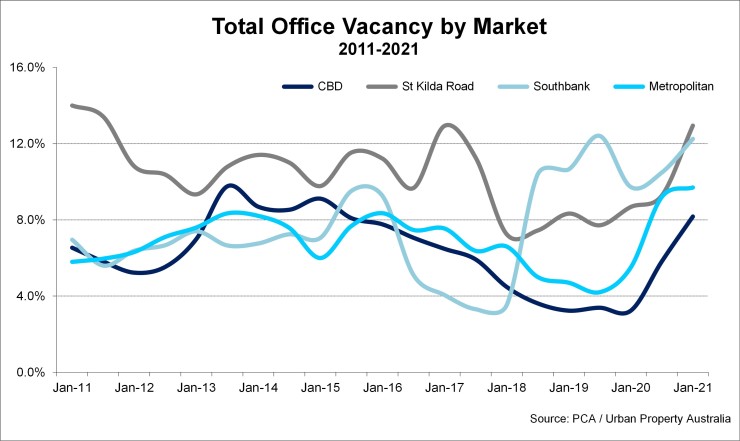

The vacancy rate of the Metropolitan office market has risen to 15-year highs having been adversely impacted by record levels of completions and constrained leasing activity;

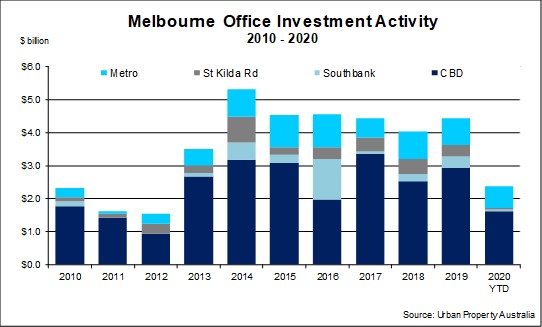

Transactional volume of the metropolitan office market in 2020 was the largest annual level since 2016 and accounted for 30% of all office sales in Melbourne, its highest share in 11 years;

In light of the pandemic, as businesses reconsider their office space needs the level of sub-lease vacancy in the Melbourne CBD office market has surged to 25-year highs.

Office Market Summary

Adversely impacted by the record levels of completions, the vacancy rate of the Melbourne metropolitan office market has increased to its highest level in 15 years. Despite tenants still cautious to make long-term commitments, investor activity in the Metropolitan office market was solid with sales volume reaching five-year highs in 2020, however transactions have been limited in 2021 to date. Elsewhere, within the CBD, the office vacancy rate also rose, driven by flood of sub-lease space as occupiers reconsidered their office needs.

Sales Volume/Yields

Urban Property Australia has recorded only $57 million of Melbourne metropolitan office sales in 2021 to date, with limited transactional activity this year. Transactional volume of the metropolitan office market in 2020 was the largest annual level since 2016 underpinned by five transactions in excess of $50 million. Private investors were also active in the metropolitan office market with 15 assets transacting below $20 million totalling more than $150 million. Purchaser interest in the metropolitan office market was robust in 2020 with the market accounting for 30% of all office sales in Melbourne, its highest share in 11 years.

Adversely impacted reduction of tenant demand and potentially a structural change of working styles, investor caution has led to a marginal rise in office yields over the 12 months to March 2021. Having fallen to historical lows in late-2020, prime metropolitan office yields eased to average 5.5% with secondary yields decompressing to 6.75%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

Having recorded 225,000sqm of new office space delivered to the Melbourne metropolitan office market last year, 40,000sqm is scheduled for completion in 2021. Like the trend observed in 2020, the City Fringe precinct accounts for 76% of new supply projected to be completed in the metropolitan office market in 2021. Beyond 2021, Urban Property is currently tracking a further 125,000sqm of new office projects currently under construction. Of all the total stock currently under construction in the metropolitan office market, 48% is already committed. The amount of uncommitted stock in the developments under construction is likely to put further upward pressure of the vacancy rate of the Melbourne metropolitan office market over the next two years.

Looking ahead, UPA expects that new supply in the metropolitan office market has peaked for the medium term with tenants cautious to commit to new leases in the current environment.

Tenant Demand

With the Victorian economy the hardest hit hardest by the COVID-19 pandemic, Victoria’s total employment has only just surpassed pre-COVID levels having lost approximately 240,000 jobs at the height of the virus. Although the unemployment rate appears to be trending down from its peak of 7.5% in June 2020, the current level of 5.6% remains above the pre-COVID level of 4.5%. Reflecting the growing business investment environment, as at February 2021, there were 45,700 jobs being advertised compared with only 26,600 in July 2020.

While employment levels have recovered to pre-COVID levels, leasing activity in the Melbourne metropolitan office market was still subdued with few tenants growing. Net absorption in the Melbourne metropolitan office market over 2020 was negative, with tenants relocating into other markets or reducing their office accommodation footprints.

Should Melbourne navigate the winter with fewer lockdowns and the roll-out of the vaccine is successful, tenant demand for metropolitan office is likely to surpass pre-COVID levels as occupies seek different types of office space to suit different ways of working as a result of the pandemic.

Vacancy/Rents

Unfavourably impacted by the record levels of completions and soft tenant demand, the vacancy rate of the Melbourne metropolitan office market increased to 10.5% as at January 2021, its highest level in 15 years. Urban Property forecast that the vacancy rate of the metropolitan office market will continue to rise over 2021 before stabilising in 2022 as the pipeline of new supply begins to dissipate.

Reflecting the elevated vacancy levels and modest leasing activity across the Melbourne metropolitan office market, prime rents have declined for the first time in five years. Metropolitan office rents have been affected by both a fall in net face rental levels and an increase in incentive levels. Looking ahead, Urban Property Australia forecasts that prime rents will continue to soften as tenants reassess their office requirements. Secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy increased from 5.8% in July 2020 to 8.2% as at January 2021, its highest level since 2015. The pandemic has also resulted in a surge of sub-lease space in the CBD with more than 200,000sqm anecdotally being currently being marketed, significantly higher than the “official” Property Council reported level of 67,100sqm (already a 25-year high). The level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs with subdued business outlook and decisions to reduce staff numbers with the conclusion of the JobKeeper program. The impact of the pandemic has also resulted in prime CBD office net effective rents which have declined back to their lowest levels in three years. Urban Property Australia forecasts that prime CBD office net effective rents will decline further through 2021 as employees and businesses remain wary of CBD-based office space.

Outside of the CBD, the vacancy rate of both the St Kilda Road and Southbank office markets rose as tenants contracted and relocated to other markets. As at January 2021, St Kilda Road’s office vacancy rate (12.9%) has risen to its highest rate since 2011 while Southbank’s office vacancy rate (12.3%) rose it is highest rate since July 2019. Similar to the CBD, both the St Kilda Road and Southbank office markets recorded an increase in sub-lease vacancy. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Sales activity in both Southbank and St Kilda Road office markets was limited in 2020 with only seven assets having transacted across both precincts in the year and subsequently transactional activity sat at five-year lows for both.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.