Q1 2022 – Global Economic Overview

April 22nd 2022 | , Urban Property Australia

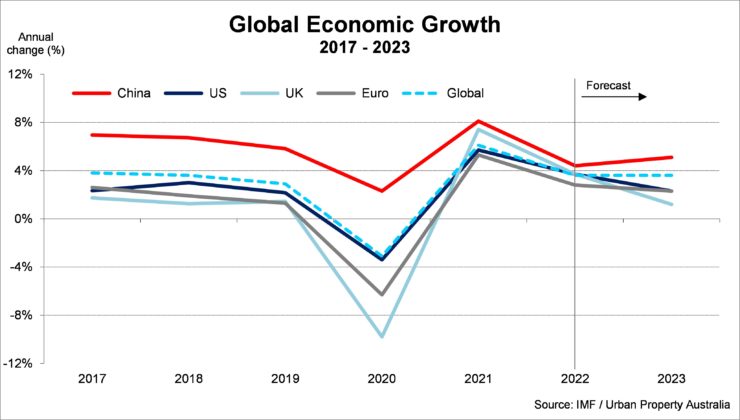

- Russia’s invasion of Ukraine has now deteriorated the global economic outlook with global growth of 3.6% forecast in 2022, down from growth of 4.4% previously projected;

- A strong economic recovery is well underway in Australia with a record proportion of Australians in work. The unemployment rate is now forecast to reach 3.75% in the September quarter of 2022, the lowest rate in close to 50 years;

- While the Victorian economy continues to recover, the current period of low population growth will have an enduring effect on the Victorian economy.

Economic Summary

The Australian economy has proved remarkably resilient to the ongoing impacts of the pandemic, consistently outperforming expectations and all major advanced economies. Forecasts for economic activity have been revised up significantly, reflecting stronger-than-expected momentum in the labour market and consumer spending. The ongoing pandemic, Russian invasion of Ukraine, strained supply chains and rising inflationary pressures all present risks to the global and domestic outlooks. Nonetheless, the resilience of the Australian economy throughout the pandemic demonstrates that the economy is well placed to adapt to these new developments.

Q1 2022 – Global Economic Overview

Having previously expected the global economy to strengthen following the short-lived impact of the Omicron variant. Russia’s invasion of Ukraine has now deteriorated the outlook. The war is expected to severely set back the global recovery, with global growth of 3.6% forecast in 2022, down from growth of 4.4% previously projected.

Both Russia and Ukraine are projected to experience large GDP contractions in 2022. The severe collapse in Ukraine is a direct result of the invasion, destruction of infrastructure, and exodus of its people. In Russia, the sharp decline reflects the impact of the sanctions with a severing of trade ties, greatly impaired domestic financial intermediation, and loss of confidence.

With a few exceptions, employment and economic growth will typically remain below pre-pandemic trends through 2026. Damaging effects are expected to be much larger in emerging market and developing economies than in advanced economies—reflecting more limited policy support and generally slower vaccination.

Unusually high uncertainty surrounds global economic forecasts with downside risks to the global outlook including a possible worsening of the war, escalation of sanctions on Russia, a sharper-than-anticipated deceleration in China and a renewed flare-up of the pandemic should a new, more virulent virus strain emerge.

United States

The United States’ economy is forecast to grow by 3.7% in 2022, 2.3% in 2023 and 2.0% in 2024. Growth is expected to moderate as private demand slows due to energy and other price pressures, declining levels of fiscal support and the normalisation of monetary policy. A very tight labour market will support stronger nominal wage increases, but high inflation will limit real wage growth in the near term. Upside risks to inflation from higher energy prices pose a further downside risk, but as the world’s largest oil producer with capacity to expand production, the US economy will be partially insulated the impact of from higher oil prices.

China

China’s economy is forecast to grow by 4.4% in 2022, 5.1% in 2023 and 5.0% in 2024. Chinese growth is expected to be hampered this year by challenges managing the pandemic, higher prices for energy imports and an already slowing property sector. China is likely to experience more frequent and severe COVID-19 outbreaks this year than in 2021, with a continuation of its aggressive suppression approach to managing the virus likely to lead to more frequent lockdowns and disruptions to industrial production and normal consumption patterns. These headwinds will be partly offset by more supportive macroeconomic policy settings which have signalled to support their ambitious growth target.

Europe

The Euro area economy is forecast to grow by 3.5% in 2022, 2.25% in 2023 and 1.5% in 2024. This represents a downgrade to 2022 growth mainly due to the conflict in Ukraine. Growth had already moderated significantly at the end of 2021 due to supply constraints and significant energy price inflation. The Ukraine invasion will exacerbate these inflationary pressures, as Europe is a large importer of Russian energy exports, and persistent high prices will significantly dampen the underlying momentum in private demand. More severe disruptions to the supply of Russian energy or other raw materials would further constrain growth.

United Kingdom

The IMF has downgraded its expectations the United Kingdom’s economy having been adversely impacted by the cost of living crisis and war in Ukraine. The IMF is forecasting that the UK’s economy will grow by 3.7% this year (the slowest rate for any ‘advanced’ economy), down from the 4.7% growth predicted by the IMF earlier this year. The UK economy is projected to increase by 1.2% in 2023 (down from previous forecasts of 2.3%). In the United Kingdom, consumption is projected to be weaker than expected as inflation erodes real disposable income, while tighter financial conditions are expected to cool investment.

India

India is the world’s fastest-growing major economy in the world, according to the IMF, with its economy forecast to grow by 8.25% in 2022, followed by 6.5% in 2023 and 7.25% in 2024. A strong rebound in private consumption underpinned by a recovery in domestic confidence is expected to drive growth. However, India’s high exposure to oil and other commodities imports presents a key risk to growth.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.