Q1 2022 – Melbourne Office Market

April 22nd 2022 | , Urban Property Australia

- Sales activity in Melbourne’s metropolitan office market has surpassed $250 million in 2022 to date, accounting for almost 40% of all sales transacted across Melbourne this year;

- With an improving level of tenant demand, the vacancy rate of the Melbourne metropolitan office market has remained stable at 12%, however all office markets remain above their 10-year averages;

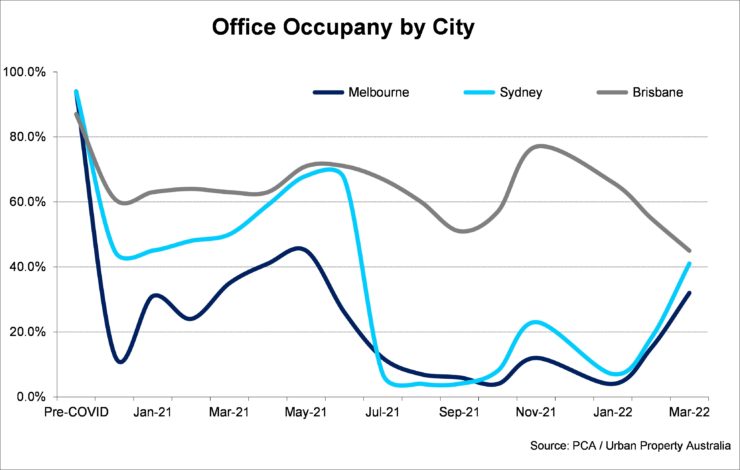

- While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels with Melbourne office occupancy levels the lowest of all Australia’s capital.

Office Market Summary

With an improving level of tenant demand, the vacancy rate of the Melbourne metropolitan office market has stabilised, however all Melbourne office markets remain above their 10-year averages. Sales activity in Melbourne’s metropolitan office market has surpassed $250 million in 2022 to date, accounting for almost 40% of all sales transacted across Melbourne this year. Despite potentially structural changes of working styles, yields compressed in the metropolitan office market as institutions become more active in the sector.

Sales Volume/Yields

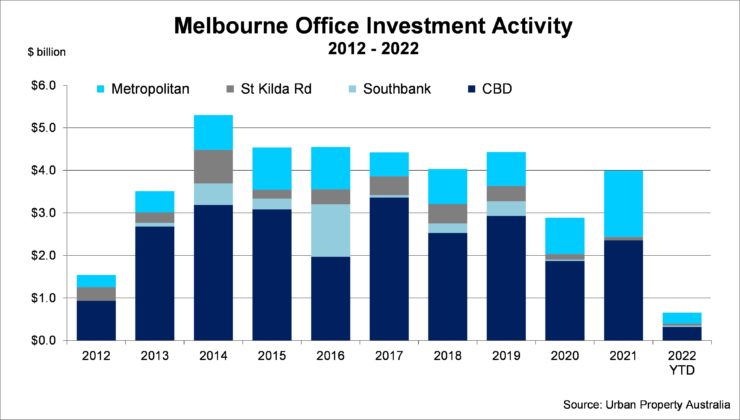

Sales activity in Melbourne’s metropolitan office market has surpassed $250 million in 2022 to date, accounting for almost 40% of all sales transacted across Melbourne this year. Transactional activity across the metropolitan office market this year has been dominated by institutions with three property sales totalling $232 million. With sales activity above average for the past four consecutive years, investment activity is expected to remain elevated with investor demand for Melbourne property robust for quality assets with strong covenants.

Despite potentially structural changes of working styles, yields compressed in the metropolitan office market as institutions become more active in the sector. Prime metropolitan office yields compressed to average 5.25% with secondary yields compressing to average 6.5%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

Urban Property is currently tracking a 250,000sqm of new office projects currently under construction. Of all the total stock currently under construction in the metropolitan office market, 45% is already committed. The amount of uncommitted stock in the developments under construction is likely to put further upward pressure of the vacancy rate of the Melbourne metropolitan office market over the next two years. Looking ahead, UPA expects that new supply in the metropolitan office market has peaked for the medium term with tenants cautious to commit to new leases in the current environment.

Tenant Demand

With the Victorian economy the hardest hit hardest by the pandemic, Victoria’s total employment has increased by 64,000 over the year to March 2022. Reflecting the employment growth of Victoria, the State’s unemployment rate has fallen to 4.0% as at March 2022, down from 7.3% as at June 2020. Highlighting the growing business investment environment, as at March 2022, there were 75,500 jobs being advertised compared with only 28,500 in March 2020. Mirroring the employment growth, tenant enquiries and leasing activity has similarly recovered back to long-term averages. While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels with Melbourne office occupancy levels the lowest of all Australia’s capital cities at 32% as at March 2022.

Vacancy/Rents

With an improving level of tenant demand, the vacancy rate of the Melbourne metropolitan office market has remained stable at 12% as at January 2022, having significantly increased over the past two years. Urban Property forecast that the vacancy rate of the metropolitan office market has peaked for the short term and will stabilise through 2022 as the pipeline of new supply begins to dissipate.

Reflecting the stabilising vacancy levels and improving leasing activity across the Melbourne metropolitan office market, prime rents have once again started to rise with both growth in net face rental levels and a marginal decrease in incentive levels albeit still below the peaks of late 2019. Looking ahead, Urban Property Australia forecasts that prime rents will continue to rise as tenant demand gathers momentum. Secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is being currently demonstrated from enquiries.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to increase having risen to 11.9% as at January 2022, its highest level in more than 20 years. The pandemic has also resulted in a surge of sub-lease space in the CBD with more than 400,000sqm anecdotally being currently being marketed, significantly higher than the “official” Property Council of 127,000 – already the highest level on record. The level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs. The impact of the pandemic has also resulted in prime CBD office net effective rents which have declined back to their lowest levels in four years. Urban Property Australia forecasts that prime CBD office net effective rents will stabilise in 2022 with many landlords having aggressively reduced asking rents to entice new tenants in CBD space.

Outside of the CBD, the vacancy rate of the Southbank office market rose to 16.3% as at January 2022, its highest level on record. While the vacancy rate of the St Kilda Road office market fell to 15.8% as at January 2022 down from 16.3% as at July 2021, it remains well above the 10-year average. Similar to the CBD, both the St Kilda Road and Southbank office markets have elevated sub-lease vacancy levels. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Sales activity in both Southbank and St Kilda Road office markets remains limited with only two assets having transacted across both precincts in the year to date.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.