Q1 2023 – Australian Economic Overview

April 26th 2023 | , Urban Property Australia

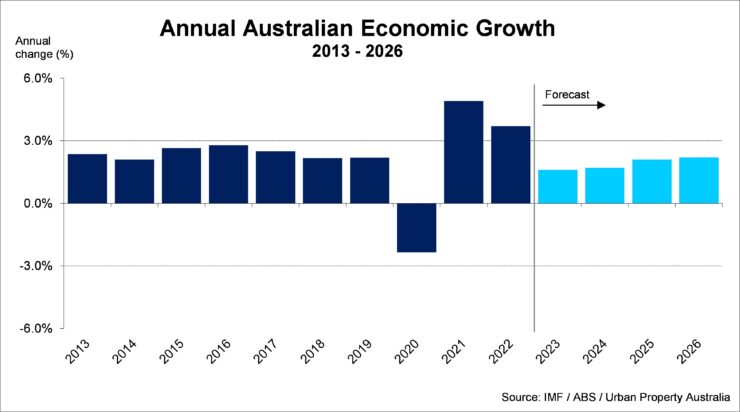

While there are positive signs emerging in 2023 that the inflation surge which has been plaguing most countries around the world is starting to ease, economic growth in Australia is projected to slow throughout 2023 under the impact of rising interest rates. According to the IMF, Australia’s economy will increase by 1.6% this year with the economy projected to expand by 1.7% in 2024.

Impacted by a combination of global and domestic factors including supply chain pressures, higher energy and food prices inflation in Australia rose leading to the Reserve Bank to raise interest rates sharply from 0.1% to its current level of 3.6%.

With inflation in Australia seemingly having peaked at 7.8% in the December 2022 quarter, the RBA decided toleave the cash rate unchanged at 3.6% in the April 2023 Board meeting to understand the impacts of the previous 10 consecutive increases in the cash rate since May 2022.

The recent turbulence in the global banking system has raised concerns over the impact of rapidly tightening monetary policy on financial stability. But this has a lesser impact on Australia, given its banks are well capitalised and do not have liquidity issues due to strict macroprudential regulations.

Household consumption, which makes up more than half of the Australian economy’s GDP, has been under stress lately. Household consumption growth moderated to 0.3% in the December 2022 quarter, decelerating from 1.0 % in the previous quarter. High interest rates have played a major role in discouraging consumption, as a higher share of household budgets were being allocated to mortgage payments. Furthermore, households are now being impacted by substantial cost of living increases with inflation reaching record highs by the end of 2022.

The outlook for household is not expected to improve through to the medium term either albeit it is being underpinned by resilient labour markets and some remaining excess savings. Inflation remains outside the RBA’s target range, and although the RBA is now slowing down the pace of rate hikes, it will still need to maintain a tight monetary policy stance to bring inflation within the target range of 2-3%.

The labour market in Australia has continued to experience tight conditions into 2023. After a small rise in the unemployment rate in January, February and March’s labour data reaffirmed the underlying strength in Australia’s labour market with the unemployment rate falling back to 3.5%. This level of unemployment remains at one of the lowest readings since the 1978, with the participation rate similarly at near record highs.

Looking ahead, Australia’s labour market strength is expected to ebb gradually until the end of the year. Leading labour market indicators, namely jobs ads shows that labour demand pressures may have already started to fall. Jobs ads, albeit higher than pre-Covid levels, now sits 20% below the May 2022 peak.

Investment activity fell marginally by 1.4% in the December 2022 quarter, with both private and public investment dropping during the quarter. The largest decline was led by a fall in private investment, which constitutes more than three-quarters of total investment in the economy.

Dwelling investment fell marginally, with renovation dwelling investment dropping throughout 2022, although this was cushioned by a rise in new and used dwellings investment. High interest rates continued to impact activity in the property sector, as reflected in the fifth consecutive drop in ownership transfer costs during the quarter. In addition, house sales were subdued, as prospective house owners’ funding capacity has been diminished by higher borrowing costs.

A drop in public investment accentuated the decline in total investment. In the near term, significant public expenditure has already been earmarked for road and rail infrastructure upgrades in Victoria and New South Wales. Looking ahead, spending on major infrastructure projects is projected to rise through 2023 with peak quarterly expenditure expected at just under $20 billion in the December 2024 quarter and then staying elevated until the end of 2025.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.