Q1 2023 – Melbourne Residential Market

April 26th 2023 | , Urban Property Australia

- Melbourne’s median house and unit prices have declined for five consecutive quarters, however prices appear to be close to stabilizing;

- Reflecting the growing housing shortage in Melbourne, median house rents increased by 4% over the year with unit rents rising by 15% over the year;

- Monthly housing finance commitments have decreased across all categories over the year with owner occupier finance levels down 33% and investor finance levels down 35%.

Residential Market Summary

While Melbourne’s median house and unit prices have declined for five consecutive quarters according to the REIV, the median house price of Melbourne remains above pre-pandemic levels. Looking ahead, although interest rates having risen and the economy is slowing, there are several factors placing upwards pressure on prices, including: increased population growth and the tight labour market. Reflecting the growing housing shortage in Melbourne, median house rents increased by 4% over the year with unit rents rising by 15% over the year.

Prices

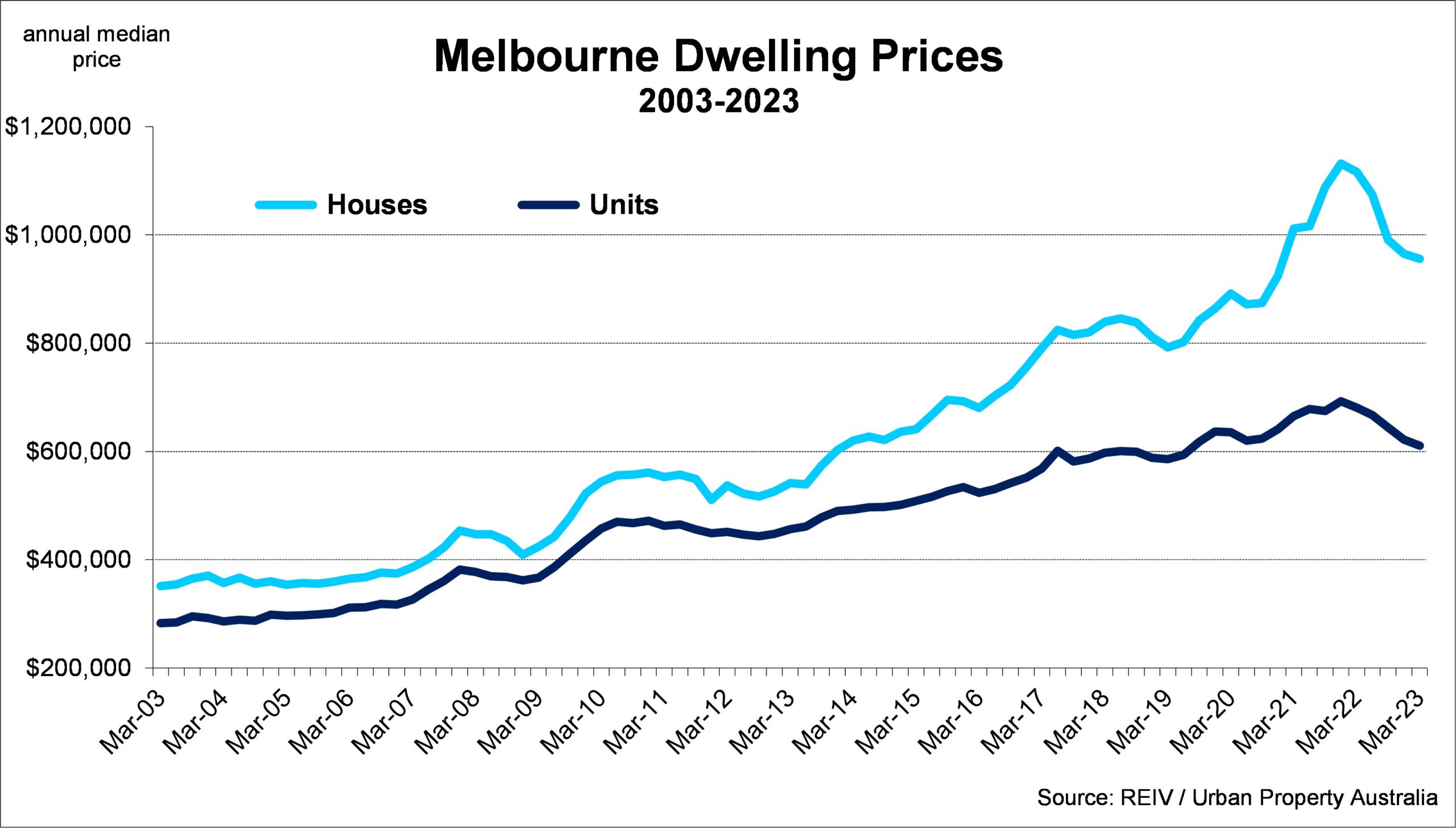

While Melbourne’s median house and unit prices have declined for five consecutive quarters according to the REIV, the median house price of Melbourne remains above pre-pandemic levels. As at March 2023, Melbourne’s median house price was $955,500 according to the REIV. Although the Melbourne median house price has declined through the year to March 2023, the rate of quarterly decreases has eased indicating that prices appear close to stabilising. Similar to the detached housing sector, Melbourne median unit prices have decreased since its peak of December 2021 to the current median unit price of $611,000. With the spread between the median price of Melbourne houses and units expanding to an all-time high of $439,000 in December 2021, more recently the spread has narrowed to $344,500, however remains well above the long-term average. Looking ahead, although interest rates having risen and the economy is slowing, there are several factors placing upwards pressure on prices, including: increased population growth and the tight labour market.

Supply

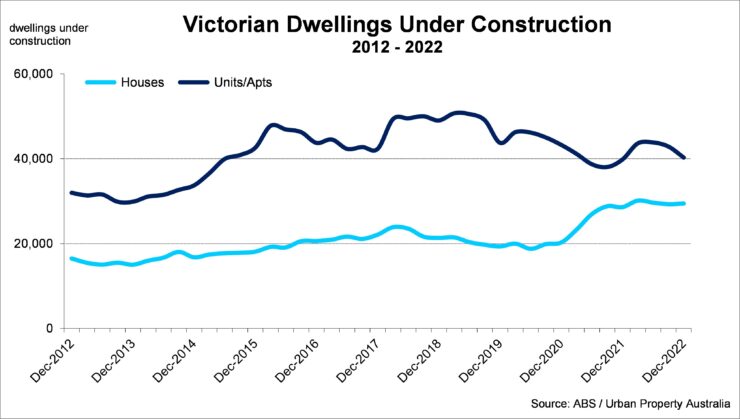

According to the ABS, there are currently 69,600 dwellings under construction across Victoria, close to all-time high levels. The number of dwellings currently under construction is 12% above the 10-year average having increased by 2% over the year. While the number of both houses and units under construction across Victoria are above their respective 10-year averages, with construction prices having risen by 25% over the past three years and higher financing costs, the level of new supply is likely to continue to decrease in coming years with commencements falling to two-year lows. Further ahead, over the year to February 2023, a total of 58,600 dwellings were approved in Victoria, below the 10-year average and the lowest level in three years. While the share of unit developments is picking up, its proportion is rising as a result of the house approvals decreasing from their peaks of 2021 with levels down 21% over the year.

Demand

With Australia’s borders reopen to overseas migrants, Victoria’s population is once again growing, increasing by 108,300 over the year to September 2022. Victoria’s population growth was driven by overseas migrants with the state still losing people moving to other states. While total annual Victorian housing finance commitments sit 31% above the 10-year average in February 2023 with $93.7 billion financed, levels have fallen by 14% over the past year. Monthly finance commitments have decreased across all categories compared to levels 12 months ago with owner occupier finance levels down 33% and investor finance levels down 35%. First home buyers’ levels have fallen significantly, with current activity below the 10-year average for the first time in four years, having declined by 36% over the year. While investor financing volumes have fallen over the year, investors now account for 31% of total housing finance commitments in Victoria, compared to their share 23% two years ago. Looking ahead, with strong rental growth and a shortage of housing, Urban Property Australia expects that investors will continue to grow their share of housing loans.

Vacancy

According to the REIV, as at March 2023, the vacancy rate for Melbourne residential property fell to 2.2%, down from its peak of 6.5% of March 2021, and now sits below the 10-year average of 3.1%. With the exception of the Middle Melbourne region, all precincts current vacancy rates now site below their respective 10-year averages. Vacancy rates have decreased across all Melbourne’s precincts over the year to March 2023 with the Outer region the tightest at 1.3%. The Middle Melbourne region holds the highest vacancy rate at 4.1% while the vacancy rate of the Inner region sits at 2.2%. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain low with falling supply levels coupled with population growth of Melbourne gathering momentum.

Rents

Mirroring the improving vacancy trends, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over the year to March 2023, the weekly median rent for houses in metropolitan Melbourne increased to $520 per week, up from $500 per week a year earlier. Across Melbourne, rents for houses located in the Outer region increased by 9.1%, with rents in the Inner region increasing by 7.5% and the rents in the Middle precinct rising by 5.1%. Interestingly, rents for Melbourne units increased by 15.5% (triple the rise observed in Melbourne houses) over the year with unit rents rising across all precincts. Looking forward, Urban Property expects that residential rents will steadily increase as prospective buyers will have a lower borrowing capacity impacted by higher interest rates.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.