Q1 2023 – Melbourne Retail Market

April 26th 2023 | , Urban Property Australia

- Retail trade in Victoria continues to outperform the national average having grown by 11% over the past year;

- Impacted by rising interest rates and higher borrowing costs, yields have softened across assets in the 12 months to March 2023;

- Online retail trade in Australia continues to gradually take a larger share of overall spending, making up 10% of total retail sales with $44 billion spent online over the past 12 months;

Retail Market Summary

Over the 12 months to February 2023, annual retail trade in Victoria grew by 11%, double the 10-year trade and has now outperformed the national average since September 2021. Online retail trade in Australia continues to gradually take a larger share of overall spending with Australian consumers spending approximately $44 billion online over the past 12 months. Impacted by rising interest rates and higher borrowing costs, yields have softened across assets in the 12 months to March 2023.

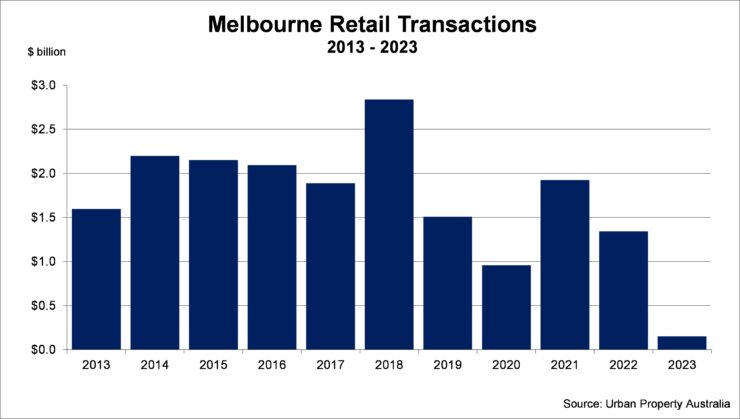

Sales Volume / Yields

Urban Property Australia research has revealed that total transactions in the Melbourne retail property market in 2023 so far has been constrained with only $150 million transacted, compared with $110 million in the first quarter of 2022. Impacted by rising interest rates and higher borrowing costs, yields have softened across assets in the 12 months to March 2023. Urban Property Australia expects yields of retail assets will expand further in 2023 in line with increased borrowing costs.

Demand

Retail trade in Victoria continues to outperform the national average as consumers regained their freedoms in comparison to other geographies of Australia. Over the year to February 2023, annual retail trade in Victoria grew by 11%, double the 10-year trade average of 4.6%. In comparison, Australian annual retail trade grew by 4.7% over the year to February 2023. Victoria has now outperformed the national average since September 2021.

Most discretionary spending industries experienced strong rises once again as consumer cautiousness lessened, leading to an increase in mobility and improved business conditions with clothing and footwear sales now 32% higher than levels last year whereas retail trade of supermarkets increased by 0.1%.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, as at February 2023, online sales made up 10% of total retail sales with Australian online sales with Australian consumers spending approximately $44 billion online over the past 12 months.

Retail Strips

Total vacancy of Melbourne’s prime retail strips has risen to all-time highs with around 13% of all shops vacant. The vacancy levels of Bridge Road, Richmond is the highest at 20% with elevated vacancy rates at Chapel Street, South Yarra (19%), Fitzroy Street, St Kilda (11%) and Lygon Street, Carlton (15%), albeit there is some gradual improvement in the latter.

The food and beverage sector increased its presence across the strips, growing in the majority of the precincts however a number of fashion retailers have vacated the prominent strips, impacted by store rationalisation and the growing influence of e-commerce.

With many strips having been re-discovered by locals now working from home, some retailers have successfully adjusted to the changing consumer trends. The elevated vacancy levels and rationalisation of some retailers has resulted in rental levels easing with some landlords also offering flexible lease terms and incentives to attract new occupiers.

The retail sector has improved at a remarkable pace and well beyond any forecasts. Now that more normalised spending patterns have emerged and if the economic recovery continues to gather pace, looking forward, Urban Property Australia expect to see a stabilisation of service-based consumption and a shift towards goods-based consumption moving forward which will benefit the retail strips markets.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.