Q1 2024 – Australian Economic Overview

April 26th 2024 | , Urban Property Australia

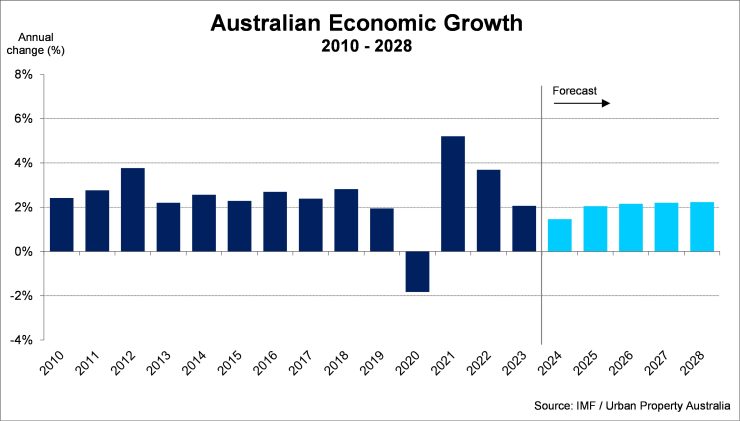

Economic growth in Australia is expected to remain subdued in the near term as inflation and higher interest rates continue to weigh on demand. The forecast for Australian economic growth is softer than three months ago, largely reflecting a weaker outlook for household consumption in the near term. From late 2024, growth is expected to pick up gradually as inflation declines and the pressures on household incomes ease.

Inflation continues to moderate and is expected to return to the target range of 2–3% in 2025 and reach the midpoint in 2026 (based on the assumption that the cash rate will remain around the current level until the middle of 2024).

The cash rate is projected to remain around its current level of 4.35% until mid-2024 before declining to around 3.25% by the middle of 2026.

The pressure on household budgets from declines in real incomes over the past couple of years is expected to weigh on consumption, particularly in the first half of 2024.

High construction costs and ongoing capacity constraints – reflecting shortages for skilled trades – are forecast to continue weighing on new building approvals and dwelling investment. Growth in non-mining business investment and public investment is forecast to soften from the high rates seen over the past year. However, the level of investment is expected to remain high, as firms continue to work through the large pipeline of construction work.

Dwelling investment is forecast to increase from 2025 onwards as earlier strong population growth and higher prices for established housing lead to a pick-up in demand for new housing.

The labour market remains strong, with over 330,000 additional people employed over the past 12 months, compared to the 10-year average of 260,000. The unemployment rate remains very low with the current rate of 3.8% as at March 2024, maintaining its longest consecutive run below 4% in 30 years.

Employment is expected to increase further, but at a slower pace than last year. Much of the labour market adjustment to subdued growth in economic activity is expected to occur through a decline in average hours worked.

Strong population growth – driven by growth in international students – and the continued recovery in inbound tourism is expected to support domestic activity in the near term and provide some offset to weak spending by Australian residents.

Looking ahead, Australian economic growth is forecast to pick up gradually from later this year, largely reflecting stronger growth in household consumption and public demand. Household consumption growth is forecast to pick up to around its pre-pandemic average over the next year or so, supported by a recovery in real income growth as inflation continues to moderate.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.