Q2 2021 – Melbourne Industrial Market

August 2nd 2021 | , Urban Property Australia

- Across Melbourne’s industrial market, more than $3.4 billion was transacted, already exceeding the previous record annul level of $2.5 billion;

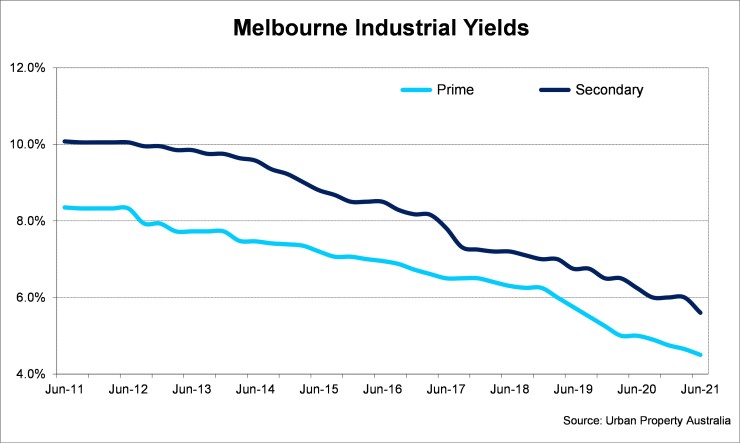

- Investor demand for industrial assets has been underpinned with the pandemic driving faster take up of e-commerce and online retail penetration, has driven yields to historic lows;

- Vacant industrial space across the Melbourne market decreased through the 12 months to July 2021, as the level of speculative development diminished with the industrial vacancy rate below 4%.

Industrial Market Summary

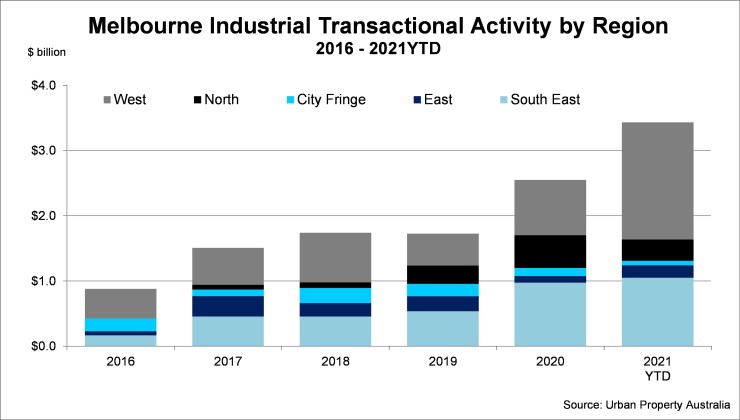

While investor demand was already gaining traction pre-COVID, the exceptional growth of online spending during the pandemic has underpinned investor appetite for the sector. Across Melbourne’s industrial market, more than $3.4 billion was transacted, already exceeding the previous record annul level of $2.5 billion. Significant growth in online food channels last year has led occupier to continue to invest in their online supply chains. Some larger retailers are adopting hub and spoke models to expand their reach into highly populated areas.

Sales Volume/Yields

While investor demand was already gaining traction pre-COVID, the exceptional growth of online spending during the pandemic has underpinned investor appetite for the sector. Across Melbourne’s industrial market, Urban Property recorded more than $3.4 billion was transacted in the sector in 2021 to date. Indeed, the level of sales has already exceeded the previous record annul level of $2.5 billion achieved in 2020. Transactional activity in the sector has been boosted by a number of major portfolio sales as institutions sought to increase their exposure the industrial market.

In 2021 to date, transactional activity in the Melbourne industrial market was focused on the key precincts of the South East and West which collectively accounted for 83% of total sales. Influenced by the major portfolio transactions, offshore purchasers have accounted for 70% of the volume of industrial sales in 2021 to date, their highest share of industrial property sales in Melbourne in 10 years.

Investor demand for industrial assets has been underpinned with the pandemic driving faster take up of e-commerce and online retail penetration, bolstering demand for warehouse and distribution space across the country. In contrast to the office and retail property sectors, yields for the industrial sector have firmed through the past 12 months. Prime Melbourne industrial yields range between 4.00% and 5.00%, with secondary Melbourne industrial yields ranging between 5.25% and 6.00%.

New Supply/Land Values

Following the decade-high of new supply last year, another 875,000sqm of industrial stock is scheduled to be completed in 2021. As developers took a more cautious approach to speculative activity in 2020, the vast majority of new supply is already pre-leased with 70% of buildings scheduled for completed this year pre-committed. The bulk of the new stock expected to be completed this year is located in the Western and Northern regions.

Land values continue to escalate in the Melbourne industrial market supported by strong levels of underlying demand and a scarcity of developable industrial land. Reflecting this declining state of developable land, land values in Melbourne have experienced significant year on year growth of more than 20% over the past two years. Land values are likely to climb further given the strong demand outlook.

Tenant Demand

Significant growth in online food channels last year has led occupier to continue to invest in their online supply chains. Some larger retailers are adopting hub and spoke models to expand their reach into highly populated areas. Industrial leasing demand has been significant across Melbourne in 2021 to date. The focus of the tenant demand has been on the Western region driven by occupiers in the retail trade and transport & logistics sectors which collectively accounted for 70% of gross take-up according to Urban Property Australia research.

Vacancy/Rents

Vacant industrial space across the Melbourne market decreased through the 12 months to July 2021, as the level of speculative development diminished. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 3.5% as at July 2021 with the Outer East and South East region vacancy rates below 2%.

Rental growth was subdued across all precincts in the Melbourne industrial market in the year to July 2021, although there was a slight rise in incentives levels from landlords. The underlying strength in the retail trade and logistics demand is contributing to a rise in leasing activity and the demand for modern facilities remains partly unsatisfied. Urban Property Australia expects that this unsatisfied demand is likely to see rental growth rates improve over the next 12 months particularly in the South East which is expected to outperform given the lack of leasing options.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.