Q2 2022 – Global Economic Outlook

August 19th 2022 | , Urban Property Australia

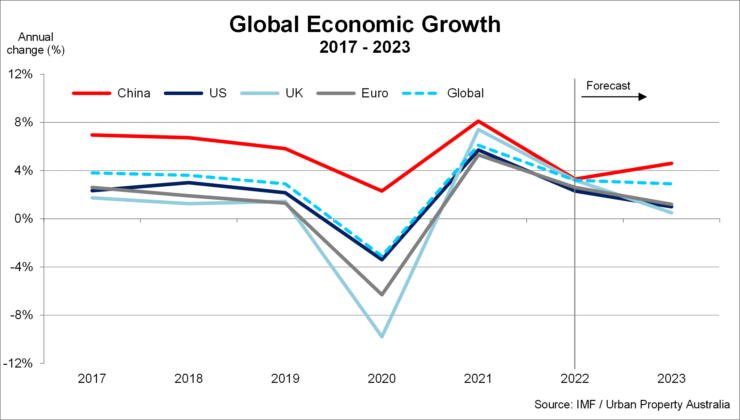

After a tentative recovery, increasingly gloomy developments in 2022 have resulted in global economic growth easing, impacted by economic downturns in China and Russia and higher inflation worldwide, triggering a sharp tightening in global financial conditions.

The IMF is expecting global inflation to reach 8.3% by the end of this year – driven by higher food and energy prices, and strained supply chains. Central banks have responded to high inflation by removing some of the substantial policy stimulus put in place during the COVID-19 pandemic. The increases in policy rates by central banks in advanced economies have been relatively quick compared with the past and are intended to reduce the risk.

According to the IMF, the global economy is projected to grow by 3.2% in 2022 and 2.9% in 2023, both lower than previous forecasts. Downgrades for China and the United States, as well as for India, are driving the downward revisions to global growth.

The uncertainty around this outlook is high with the effects of the war in Ukraine possibly greater than assumed with further increases in commodity prices, or stronger disruptions to global supply chains.

Growth in Australia’s major trading partners is expected to fall well below its pre-pandemic average this year, before picking up modestly in 2023.

United States

The growth of United States’ economy is forecast to slow to 2.3% in 2022 and 1.0% in 2023. A rapid normalisation of monetary policy, fiscal consolidation, ongoing supply disruptions and a rise in oil prices will weigh on growth. However, the further reorientation of domestic demand back towards the services sector should help to alleviate some supply shortages. A very tight labour market will support stronger nominal wage increases, but high inflation will limit real wage growth in the near term. As the world’s largest oil producer with capacity to expand production, the US economy will be partially insulated the impact of from higher oil prices.

China

The Chinese economy contracted by 2.5% in the June 2022 quarter. This was significantly weaker than expected and reflected containment measures to slow the spread of COVID-19 in Shanghai, Beijing and elsewhere. Recent lockdowns in China have generally been stricter than those seen in other countries. The real estate sector has been a significant drag on the Chinese economy over the past year. In response to the weakening economy, Chinese authorities have increased a wide range of fiscal support measures, while maintaining accommodative monetary policy. According to the IMF, China’s economy is forecast to grow by 3.3% in 2022, 4.6% in 2023.

Europe

The Euro area economy is showing signs of weakening with economic growth stagnated at 0.3% (non-annualised) in the first quarter of 2022, with considerable cross-country divergence. There has been a record drop in business sentiment, notably in Germany, while inflation has continued to strengthen, becoming more broad-based and widespread across the Euro area. The war in Ukraine is having significant effects on the Euro area economy and spending to support Ukrainian refugees (over 5 million within the European Union). The Euro area economy is forecast to grow by 2.6% in 2022 and 1.2% in 2023.

United Kingdom

The United Kingdom’s economy is projected to grow by 3.2% in 2022 before stagnating in 2023 due to depressed demand. Business confidence remains well above pre-pandemic levels, but consumer confidence remains subdued, reflecting concerns related to the rising cost of living. Private consumption will slow as rising prices erode households’ incomes. Household savings will decline to below pre-pandemic levels, with some households taking on more debt to keep up with the rising cost of living. Inflation will continue to rise, driven by increasing global prices of tradable goods and services due to supply bottlenecks, transportation costs and energy prices.

India

After recording the strongest GDP rebound in the G20 in 2021, the Indian economy is progressively losing momentum as inflationary expectations remain elevated due to rising global energy and food prices, monetary policy normalises, and global conditions deteriorate. The Indian economy is projected to grow by 7.4% in 2022 and 6.1% in 2023, though strong government spending will continue to support activity. The direct impact of the war in Ukraine is relatively limited, as trade between India and both Russia and Ukraine is small.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.