Q2 2022 – Melbourne Office Market

August 19th 2022 | , Urban Property Australia

- Sales activity in Melbourne’s metropolitan office market has surpassed $900 million in 2022 to date, accounting for almost 19% of all sales transacted across Melbourne this year;

- Melbourne CBD office vacancy has continued to increase having risen to 12.9% which has also resulted in a record high level of sub-lease space available;

- While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels with Melbourne office occupancy levels the lowest of all Australia’s capital.

Office Market Summary

Despite potentially structural changes of working styles, sales activity in Melbourne’s metropolitan office market has surpassed $900 million in 2022 to date, accounting for almost 19% of all sales transacted across Melbourne this year. Reflecting the employment growth of Victoria, tenant enquiries and leasing activity continues to improve across the metropolitan office market. Elsewhere, the vacancy rate of the St Kilda Road office market rose to its highest rate in 30 years.

Sales Volume / Yields

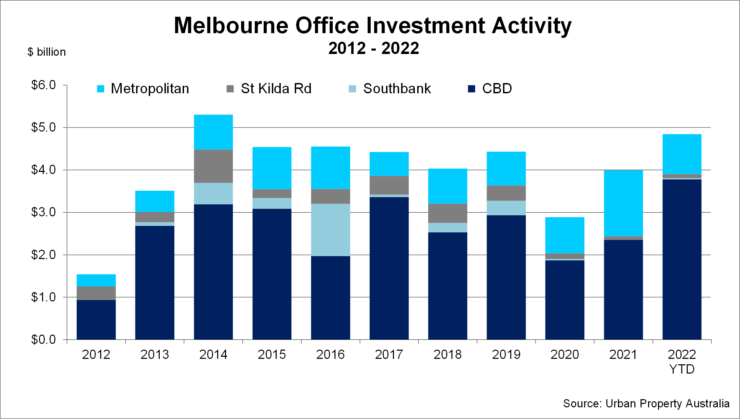

Sales activity in Melbourne’s metropolitan office market has surpassed $900 million in 2022 to date, accounting for almost 19% of all sales transacted across Melbourne this year. Transactional activity across the metropolitan office market this year has been dominated by institutions with four property sales totalling $428 million. With sales activity above average for the past four consecutive years, investment activity is expected to remain elevated with investor demand for Melbourne property robust for quality assets with strong covenants.

Despite potentially structural changes of working styles, yields compressed in the metropolitan office market as institutions become more active in the sector. Prime metropolitan office yields eased to average 5.4% with secondary yields averaging 6.75%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

Urban Property is currently tracking a 180,000sqm of new office projects currently under construction. Of all the total stock currently under construction in the metropolitan office market, 45% is already committed. The amount of uncommitted stock in the developments under construction is likely to put further upward pressure of the vacancy rate of the Melbourne metropolitan office market over the next two years. Looking ahead, UPA expects that new supply in the metropolitan office market has peaked for the medium term with tenants cautious to commit to new leases in the current environment.

Tenant Demand

With the Victorian economy the hardest hit hardest by the pandemic, Victoria’s total employment has increased by 103,000 over the year to June 2022. Reflecting the employment growth of Victoria, the State’s unemployment rate has fallen to 3.2% as at June 2022, down from 7.3% as at June 2020. Highlighting the growing business investment environment, as at June 2022, there were 80,700 jobs being advertised compared with only 25,500 in June 2020. Mirroring the employment growth, tenant enquiries and leasing activity continues to improve. While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels with Melbourne office occupancy levels the lowest of all Australia’s capital cities at 38% as at July 2022.

Vacancy/Rents

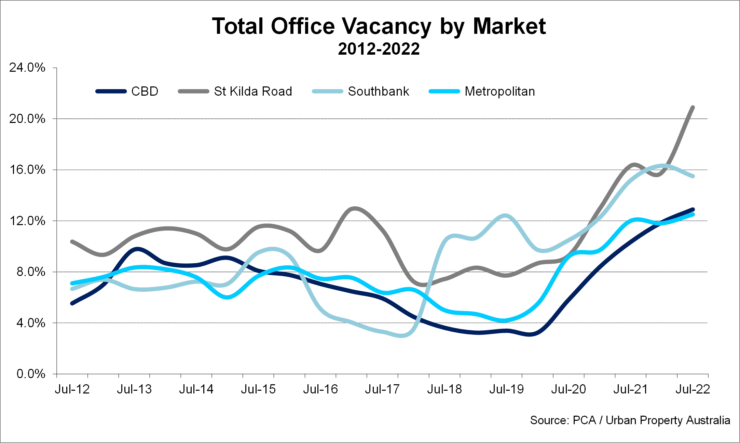

With an improving level of tenant demand, the vacancy rate of the Melbourne metropolitan office market has fell to 11% as at July 2022, having significantly elevated over the past two years. Urban Property forecast that the vacancy rate of the metropolitan office market has peaked for the short term and will stabilise through 2022 as the pipeline of new supply begins to dissipate.

Reflecting the stabilising vacancy levels and improving leasing activity across the Melbourne metropolitan office market, prime rents have once again started to rise with both growth in net face rental levels and a marginal decrease in incentive levels albeit still below the peaks of late 2019. Looking ahead, Urban Property Australia forecasts that prime rents will continue to rise as tenant demand gathers momentum. Secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is being currently demonstrated from enquiries.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to increase having risen to 12.9% as at July 2022, its highest level in more than 20 years. The pandemic has also resulted in a surge of sub-lease space in the CBD with more than 132,500 –the highest level on record. The level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs. The impact of the pandemic has also resulted in prime CBD office net effective rents which have declined back to their lowest levels in four years has now stabilised. Urban Property Australia forecasts that prime CBD office net effective rents will stabilise in 2022 with many landlords having aggressively reduced asking rents to entice new tenants in CBD space.

Outside of the CBD, the vacancy rate of the Southbank office market fell to 15.5% as at July 2022, above its 10-year average. While the vacancy rate of the St Kilda Road office market rose to 20.8% as at July 2022, its highest rate in 30 years. Similar to the CBD, both the St Kilda Road and Southbank office markets have elevated sub-lease vacancy levels. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Sales activity in both Southbank and St Kilda Road office markets remains limited with only two assets having transacted across both precincts in the year to date.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.