Q2 2022 – Melbourne Residential Market

August 19th 2022 | , Urban Property Australia

- Having reached an all-time high as at December 2021, Melbourne’s median house prices have eased through 2022 with values down 12% from the peak;

- Vacancy rates have trended down across all regions over the year, however only the Outer Melbourne region records vacancy below average;

- Metropolitan residential rents across the precincts increased over the past year with apartments outperforming houses.

Residential Market Summary

Having reached an all-time high as at December 2021, Melbourne’s median house prices have eased through 2022 with values down 12% from the peak and their lowest level since March 2021. While median prices have fallen, buoyed by improving vacancy rates, rents across the Melbourne increased over the past year. Investor finance continues to strengthen with levels increasing by 15% over the year and now account for 33% of total housing finance commitments in Victoria.

Prices

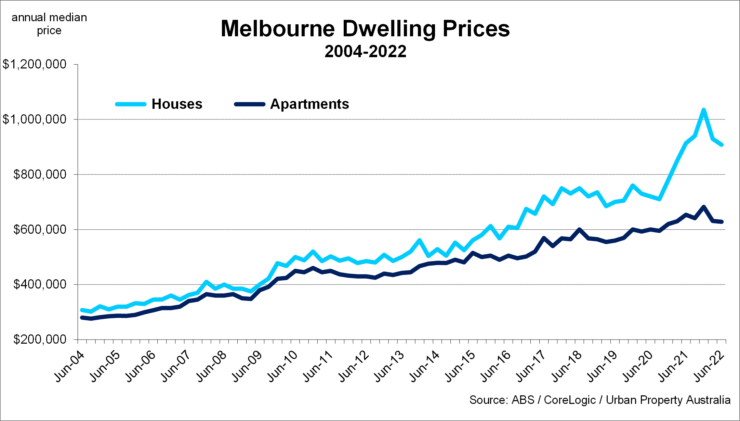

Having reached an all-time high as at December 2021, Melbourne’s median house prices have eased through 2022 with values down 12% from the peak. Melbourne median house prices have fallen to $907,600 – their lowest levels since March 2021. Similar to the detached housing sector, Melbourne median apartment prices have eased in 2022, decreasing to $627,800, 8% lower than its peak of December 2021. Although median prices of Melbourne apartments and houses have declined through 2022, they both remain well above the levels of 2017. Looking ahead, with forecasts for the cash rate to continue to increase coupled with rising household expenses due to inflation, prices are likely to ease further in the short term.

Supply

According to the ABS, there are currently 73,000 dwellings under construction across Victoria, its highest level on record. The number of dwellings currently under construction is 21% above the 10-year average having increased by 14% over the year. While the number of houses under construction across Victoria is above the 10-year average, the number of apartments under development remains below the 10-year average, having been adversely impacted by the closure of Australia’s international borders and declining population growth. Over the past year, Victoria’s population shrunk as residents moved interstate and offshore. In the 12 months to June 2022, a total of 65,500 dwellings were approved in Victoria, slightly below the 10-year average. Reflecting the slowdown of the development of apartment developments, approvals for houses now account for 61% of all new dwellings approved, compared to 52% as at June 2016.

Demand

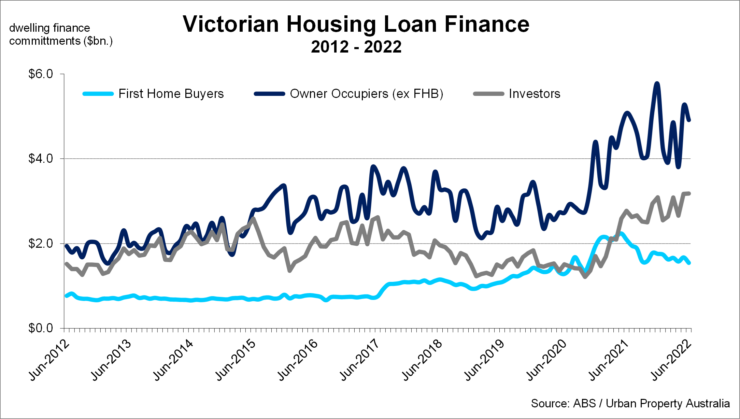

Despite Victoria’s population declining by more than 3,500 over the past 12 months, current total annual Victorian housing finance commitments sit 62% above the 10-year average in June 2022 with $109 billion financed. The elevated housing finance levels have been underpinned by owner occupiers with current levels sitting 63% above the 10-year average. Although first home buyers remain active in the market with current levels at 47% above their 10-year average, levels appear to have peaked with levels decreasing 26% over the year to June 2022. In contrast, investor finance continues to strengthen with levels increasing by 15% over the year, reaching $33.6 billion of commitments. Indeed, investors now account for 33% of total housing finance commitments in Victoria, compared to their share of 28% a year ago. The share of investors has now reached its highest proportion since 2018. Looking ahead, with the federal treasurer endorsing tighter credit policies for home lending, the volume of housing finance is likely to temper.

Vacancy

According to the REIV, as at June 2022, the vacancy rate for Melbourne residential property fell to 4.0%, down from its peak of 6.5% of March 2021, however remains above its 10-year average of 3.0%. While vacancy rates have trended down since peaking in mid-2021, only the Outer Melbourne region records vacancy below average. Over the year to June 2022, the residential vacancy rate declined to 3.9% in the Inner (0-4km) precinct, down from 8.0%. The vacancy rate of the Outer precinct has now fallen to 1.6%, with all regions recording declines in vacancy over the year. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain above the long-term average for the remainder of 2022, before tightening further as Melbourne’s population growth increases back to long-term averages.

Rents

Mirroring the improving vacancy trends, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over the year to June 2022, the weekly median rent for houses in metropolitan Melbourne increased to $500 per week, up from $470 per week a year earlier. Across Melbourne, rents for houses located in the Outer region increased by 7.1%, with rents in the Inner and Middle regions increasing by 2.3% and 3.8% respectively. Interestingly, rents for Melbourne apartments increased by 7.5% over the year with apartment rents rising across the precincts. Looking forward, Urban Property expects that residential rents will gradually increase as the broader economy continues to improve following the shock of the pandemic, however increases will be varied depending on migration patterns across Victoria.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.