Q1 2022 – Melbourne Residential Market

April 22nd 2022 | , Urban Property Australia

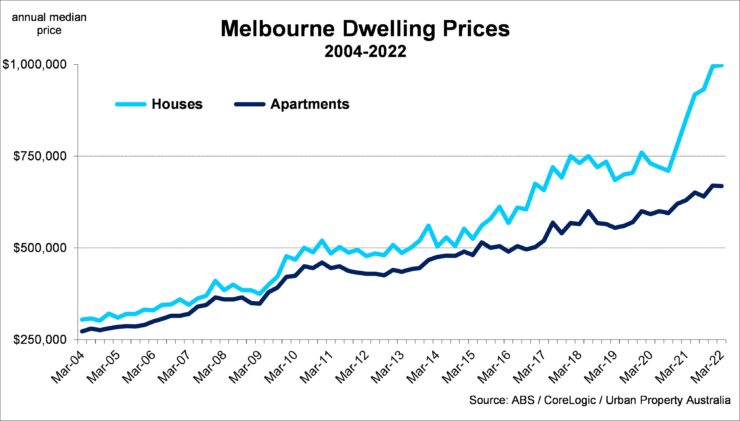

- Melbourne’s median house prices achieved an all-time high as at March 2022, with the price differential between Melbourne house and apartment prices now also expanding to an all-time high, more than three times the long-term average;

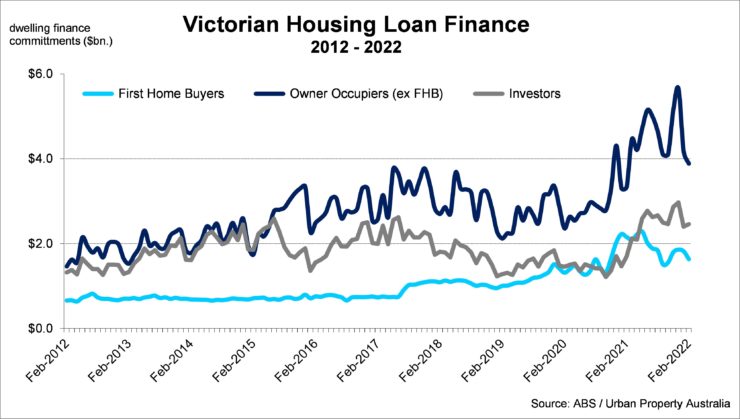

- Investor finance continues to strengthen with levels increasing by 45% over the year, with the share of investors having now reached its highest proportion since 2018;

- The vacancy rate for Melbourne residential property has fallen to 5.1% with the vacancy rate of the Outer precinct having now fallen to its lowest level on record.

Residential Market Summary

Despite Victoria’s population declining, current total annual Victorian housing finance commitments sit 65% above the 10-year average and reached all-time highs in February 2022 with $108 billion financed. Investors now account for 30% of total housing finance commitments in Victoria, their highest proportion since 2018. Although first home buyers remain active in the market, levels appear to have peaked with levels decreasing 24% over the year.

Prices

Melbourne’s median house prices achieved an all-time high as at March 2022, having increased by 17% over the year to reach $997,900. The strength of growth of house prices observed over the past two years has resulted in the price differential between Melbourne house and apartment prices expanding to an all-time high, more than three times the long-term average. While the median house prices of Melbourne have recorded six consequence quarters of growth, there are emerging signs that the rate of growth is slowing with house prices growing by 0.3% over the quarter -the slowest rate since 2020. Although, Melbourne apartment prices increased over the year to reach $668,000, over the March 2022 quarter, apartment prices recorded a marginal decline. Looking ahead, while a strengthening economy, low jobless rate and rising income growth will support dwelling prices, higher costs of living are likely to weigh on housing demand.

Supply

According to the ABS, there are currently 67,000 dwellings under construction across Victoria having trended down since 2018. Although the current dwelling supply pipeline of Victoria is below the peak of March 2018, the number of dwellings currently under construction remain 12% above the 10-year average. The closure of Australia’s international borders is also expected to reduce demand for inner city rental housing given the likely lack of international students in the short term. A shift in preferences towards detached houses has also been weighing on demand for inner city apartments. While population growth slumped in Victoria over the past year as residents moved to other states, risks of oversupply are mitigated by the considerably smaller volume of higher-density inner city apartments due for completion in 2022 and 2023 relative to previous years. In the 12 months to February 2022, a total of 71,800 dwellings were approved in Victoria, its highest level since 2018. Reflecting the slowdown of the development of apartment developments, approvals for houses now account for 64% of all new dwellings approved, compared to 52% as at September 2018.

Demand

Despite Victoria’s population declining by more than 60,500 over the past 12 months, current total annual Victorian housing finance commitments sit 65% above the 10-year average and reached all-time highs in February 2022 with $108 billion financed. The elevated housing finance levels have been underpinned by owner occupiers with current levels sitting 44% above the 10-year average. Although first home buyers remain active in the market with current levels at 60% above their 10-year average, levels appear to have peaked with levels decreasing 24% over the year to February 2022. In contrast, investor finance continues to strengthen with levels increasing by 45% over the year, reaching $24.6 billion of commitments. Indeed, investors now account for 30% of total housing finance commitments in Victoria, compared to their share of 22% a year ago. The share of investors has now reached it highest proportion since 2018. Looking ahead, with the federal treasurer endorsing tighter credit policies for home lending, the volume of housing finance is likely to temper.

Vacancy

According to the REIV, as at March 2022, the vacancy rate for Melbourne residential property has fell to 5.1%, down from its peak of 6.5% of March 2021, however remains well above its 10-year average of 3.0%. While vacancy rates have trended down since peaking in mid-2021, vacancy in the Middle region has risen. Over the year to March 2022, the residential vacancy rate declined to 5.9% in the Inner (0-4km) precinct but increased to 7.1% in the Middle precinct. The vacancy rate of the Outer precinct has now fallen to 1.6%, its lowest level on record as residents moved further away from the Inner region. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain above the long-term average for the short term, particularly in the Inner precincts given Victoria’s population growth will be muted for the medium term, as overseas migration will remain relatively subdued over the next two years.

Rents

Mirroring the vacancy trends, according to the REIV, metropolitan residential rents across most of the precincts are showing signs of stabilising having fallen through 2020. Over the year to March 2022, the weekly median rent for houses in metropolitan Melbourne increased to $500 per week, up from $490 per week a year earlier. Across Melbourne, rents for houses located in the Outer region increased by 4.8%, whereas rents in the Inner and Middle regions both decreased over the year, falling by 0.7% and 1.0% respectively. Interestingly, rents for Melbourne apartments increased by 5% over the year with apartment rents rising across the precincts. Looking forward, Urban Property expects that residential rents will gradually increase as the broader economy continues to improve following the shock of the pandemic, however increases will be constrained with Victoria’s population adversely impacted as a result of people leaving the state.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.