Q2 2023 – Australian Economic Overview

July 23rd 2023 | , Urban Property Australia

The Australian economy has shown resilience to global headwinds, supported by a post-pandemic rebound in household spending, strong employment growth and a pick-up in wages. National income is also being supported by elevated commodity prices.

However, the Australian economy is not immune to the global slowdown and there are clear signs that domestic demand is responding to higher interest rates and other cost-of-living pressures with consumers and the housing sector most exposed. This is being offset by a stronger than expected rebound in service exports following the reopening of international borders. Looking ahead the Australian economy is projected to slow to 1.5% in the 12 months to June 2024 before strengthening to 2.25% 2024/25.

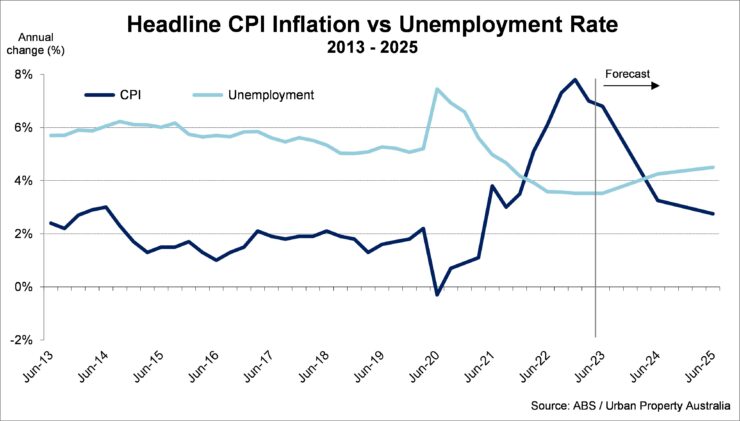

Inflation appears to have peaked at the end of 2022 and is now moderating. Supply constraints and the impact of Russia’s invasion of Ukraine have begun to subside and the Government’s Energy Price Relief Plan is expected to further reduce inflation over the next 12 months. It is projected that inflation will decline to the RBA’s target band by mid-2025, although cost-of-living pressures will remain a near term weight on households.

Financial markets and market economists now expect the cash rate to remain at 3.85% until early 2024, before gradual cuts back to 3% by June 2025. This will continue to hinder consumption and dwelling investment activity once the backlog of work is completed in the near term.

Business investment is expected to support activity, underpinned by the strong pipeline of work and a need to add capacity to meet the level of demand. Adding to the recovery in services exports, mining and rural export volumes are forecast to recover after weather-related disruptions. Spending on goods imports and overseas travel by Australians is expected to moderate, in line with more subdued domestic demand.

The tight labour market has persisted but is expected to gradually soften in response to slowing demand. Employment growth will be supported by stronger migration which is expected to result in the unemployment rate is expected to increase modestly from a near 50-year low of 3.5% to 4.25% by mid-2024, and 4.5% by June 2025.

Following a strong post-pandemic rebound in services spending, including pent-up demand for international tourism, household consumption growth is expected to slow. The cumulative impact of cost-of-living pressures and higher interest rates is now constraining household budgets. Recent data indicates household spending has slowed since March 2023, and high interest rates (including the roll-off of fixed-rate mortgages) will increasingly weigh on household budgets and spending over the year ahead.

A significant pipeline of projects currently underway is supporting dwelling investment, with the sector working through the tail end of recent strong demand, supply chain delays and disruption due to floods last year. As work is completed and the impact of earlier interest rate rises and house price declines flow through the system, activity is expected to contract over the next 12 months. The downturn in activity is expected to extend into mid-2025, before recovering strongly in the second half of 2025 and onwards. The ongoing rebound in net overseas migration, strong rental yields, expected lower interest rates and a reduction in building input costs are expected to drive the recovery, particularly in medium and high-density housing. Government initiatives to boost supply will also assist in supporting investment in new dwellings.

Public investment activity will remain solid as state and federal governments work through a large pipeline of public infrastructure projects. However, progress and projected delivery is anticipated to be at a slower pace than previously expected due to sustained capacity constraints in the sector.

Population growth is now expected to be 2.0% in the year to June 2023 underpinned with net overseas migration estimates of 400,000. Looking ahead, Australia’s population is forecast to increase by 1.7% next year with net overseas migration remaining above average reflecting the catch up from the pandemic. This strength in migration and population growth is expected to be temporary, with migration forecast to largely return to normal patterns from 2024/25.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.