Q2 2023 – Melbourne Industrial Market

July 23rd 2023 | , Urban Property Australia

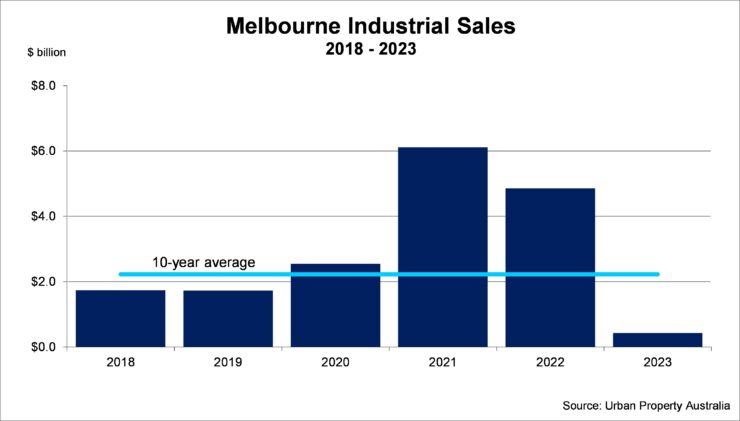

- Across the Melbourne industrial market only $450 million of sales has been recorded in the first half of 2023, well below the $2.5 billion transacted in the first half of last year;

- Rental growth gained momentum across all precincts in the Melbourne industrial market, with 32% annual growth rates recorded prime Melbourne industrial assets over the past year;

- Urban Property Australia estimates that Melbourne industrial vacancy rate currently stands at 1.1% with the Northern industrial precinct’s vacancy rate below 1%.

Industrial Market Summary

Vacant industrial space across the Melbourne market continues to decline, as the growth of e-commerce has driven tenant demand outpacing new supply. Melbourne’s industrial vacancy rate is estimated to currently stand at 1.1% which has supported strong rental growth across all precincts. Prime industrial rents have grown by 32% over the past 12 months with secondary rents having increased by 15%. The underlying strength in the retail trade and logistics demand is contributing to a rise in leasing activity with strong demand for new facilities.

Sales Volume / Yields

After more than $4.8 billion transacted across the Melbourne industrial market last year, its second highest annual level on record, sales activity has been modest in 2023 to date. Across the Melbourne industrial market only $450 million of sales has been recorded in the first half of 2023. With sales activity relatively limited in 2023 so far, offshore groups have accounted for more than half of all transactional volume with North American investors the prominent buyers. Industrial yields have continued to ease with average prime yields increasing to 5.0% as at June 2023 in comparison, secondary yields decompressed to 6.0%. While funding costs remain low and rental growth becomes more pronounced, Urban Property Australia anticipates that yields will remain steady as investors aggressively continue to seek prime industrial investment opportunities.

New Supply / Land Values

With institutional groups increasingly boosting their exposure to the industrial sector, annual new supply delivered in Melbourne industrial market surpassed one million square metres for the third consecutive year, last year. Once again Urban Property research forecast that new industrial supply will surpass 900,000sqm of new industrial stock expected be delivered in 2023. Looking ahead new supply levels will remain elevated with tenant demand robust driven by the growing e-commerce sector. New supply continues to struggle to meet the robust demand from occupiers with 50% of new supply pre-committed. The bulk of the new stock expected to be completed this year is located in the Western (55%) and South Eastern (30%) regions. Declining land supply coupled with elevated tenant demand is placing upward pressure on land values as owner occupiers compete with institutional owners. Having increased substantially in recent years, average industrial land values remained steady in 2023 so far, however the scarcity of developable industrial land and improving business outlook is likely to led to further land value growth.

Tenant Demand

Industrial leasing activity in the Melbourne industrial market totalled 100,000 over 2023 to date, constrained by limited availability after elevated leasing levels in recent years boosted by the growing penetration of e-commerce. Retailers and wholesale trade boosted by the lift in non-discretionary spending have led tenant demand followed by logistics occupiers with leasing activity above the long-term average. The focus of the tenant demand in 2023 to date has been in the South East according to Urban Property Australia research.

Vacancy / Rents

Vacant industrial space across the Melbourne market continues to decline, as the growth of e-commerce has driven tenant demand outpacing new supply. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 1.1% as at June 2023 with the North vacancy rate below 1%. Elsewhere, the vacancy rate of the South East region is 1.2% and the Western region standing at 1.4%.

Melbourne’s low vacancy rates have supported strong rental growth across all precincts in the Melbourne industrial market. Prime industrial rents have grown on average by 32% over the 12 months to June 2023 with secondary rents having increased by 15% as tenants struggle to source accommodation of all qualities. Prime rental growth was led by the Western precinct. Urban Property Australia expects that rents will continue to increase through this year as landlords recover the increased costs of new developments. The underlying strength in the retail trade and logistics demand is contributing to a rise in leasing activity with strong demand for larger facilities to accommodate automated supply chain requirements.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.