Q2 2023 – Victorian Regional Residential Market

July 23rd 2023 | , Urban Property Australia

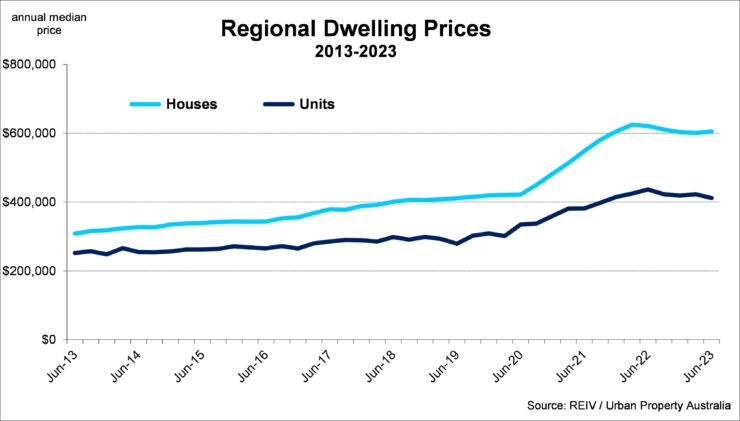

- Median Victorian Regional house prices appear to be stabilising with prices up 0.2% through 2023 to date however remain 2.7% lower than levels observed 12 months according to the REIV;

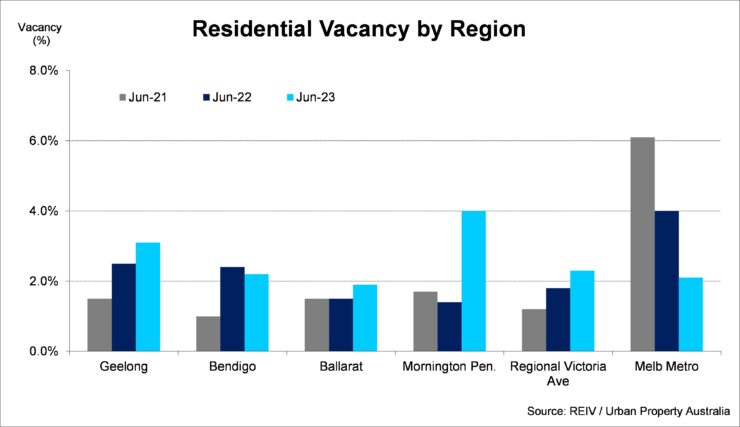

- While the vacancy rate for Regional Victoria remains very tight at 2.3%, levels have increased over the past 12 months and is higher than the metropolitan average of 2.1% for the first time since the emergence of the pandemic;

- Rental levels in the Regional markets also showing signs of easing with the average rental levels for houses seemingly having peaked while average weekly rental rates for units have declined over the first half of 2023.

Victorian Regional Residential Market Summary

After declining for four consecutive quarters, median Victorian Regional house prices increased in the June 2023 quarter, rising by 0.6% however remain 2.7% lower than levels observed 12 months ago. Rental levels in the Regional markets also showing signs of easing with the average Regional Victorian weekly rental levels for houses seemingly having peaked while average weekly rental rates for Regional units have declined by 2.8% over the first half of 2023.

Prices

After declining for four consecutive quarters, median Victorian Regional house prices increased in the June 2023 quarter, rising by 0.6% to $604,500 according to the REIV. Through 2023 to date, values for Victorian Regional houses have increased by 0.2%. Similar to the broader Regional area, according to the REIV, median house prices have fallen over the past 12 months in the regional cities with median house prices in Ballarat (down by 1.7% to $570,000), median house prices falling 0.9% in Bendigo to $565,000 and median house prices in Geelong down by 2.6% over the year to $735,000 as at June 2023. Interestingly, median unit prices in Regional Victoria fell at a faster rate than houses, declining by 5.7% to $411,500.While there is some downside risk to median dwelling prices for Victorian regional properties, given the relative affordability compared to metropolitan properties, Urban Property Australia expects that the Regional housing markets will outperform the metropolitan housing market in the short term.

Demand / Vacancy

According to the ABS, Victoria’s regional population increased by 16,700 over the year to June 2022 with Geelong, Ballarat and Bendigo accounting for 53% of the population growth across the regional area. Over the 12 months to June 2022, Geelong experienced the greatest population growth of all regional cities across Victoria followed by Ballarat. The pandemic and working from home has made a regional move more possible for those in capital city-based jobs, with the flexibility of work never been so recognised as previously considered. According to the REIV, as at June 2023, the vacancy rate for Regional Victoria remains very tight at 2.3% (albeit higher than the rate of 1.8% recorded a year earlier) in comparison to the metropolitan average of 2.1%. The vacancy rates of the major Regional Cities also remain very low, led by Ballarat (1.9%) followed by Bendigo at 2.2% and Geelong (3.1%).

Rents

Rental levels in the Regional markets are showing signs of easing with the average Regional Victorian weekly rental levels for houses seemingly having peaked at $450 while average weekly rental rates for Regional units have declined by 2.8% over the first half of 2023. By regional city, Bendigo outperformed both Ballarat and Geelong with the weekly median rent for houses up 12.5% to $450 as at June 2023. In comparison weekly median rents for houses in Geelong increased by 6.7% to $480 with rents for Ballarat houses increasing by 2.6% to $400 per week as at June 2023. Overall, median rental levels for houses in Regional Victoria increased by 7.1% over the year to June 2023 while median rents for Regional units decreased by 2.8% over the year.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.