Q3 2019 – Melbourne Retail Market

October 22nd 2019 | , Urban Property Australia

- Retail spending growth in Victoria outperformed all other major Australian states;

- Total vacancy across Melbourne’s prime retail strips remains elevated, with vacancy increasing to 9.2%;

- Impacted by a number of store closures, the Melbourne CBD retail vacancy increased to 4.6%, its highest level in 10 years;

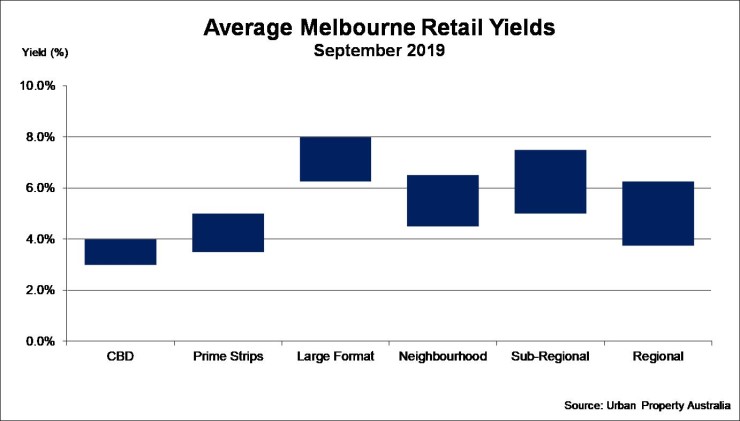

- While investment activity in the CBD and suburban strips remains buoyant, weak investor sentiment for major centres has resulted in yields softening for enclosed centres;

Retail Market Summary

Although retail spending in Victoria continues to outperform other Australian states, reflecting the challenging discretionary spending sectors, investor and retailer sentiment is easing signalled by the rising vacancy levels and soft investment activity.

Retail Trade

Although the rate of retail trade growth has risen over the past 12 months, annual growth remains below the 10-year average. Over the year to August 2019, Australian retail trade grew by 2.9%, higher than the 2.6% growth recorded over the year to August 2018. The overall growth in retail trade was underpinned by improvement in Food and Clothing. Despite the upturn in retail sales, leasing demand and retailer sentiment remains subdued with many occupiers seeking to consolidate the number of stores.

Retail spending in Victoria continues to outperform the other major Australian states, underpinned by strong population and economic growth. Over the year to August 2019, retail trade in Victoria grew by 4.5% compared with annual growth of 4.3% in Queensland and 1.6% in New South Wales.

Consistent with Victoria’s strong population growth, Food (5.2%), Hardware supplies (8.1%) and Clothing (7.0%) recorded annual growth above their five-year average in the 12 months to August 2019.

Retail vacancy rate changes were mixed by state and by sub-sector over 2019 to date. Shopping centre vacancy rates have been impacted with store rationalisation and a number of local retailers falling into administration over the year with Melbourne centres tending to contain more vacancies than their respective long-term average.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, in August 2019 online sales made up 6.2% of total retail sales. Over the year to August 2019, Australian online sales grew by 13%, with Australian consumers spending approximately $29 billion online over the 12 months.

Despite the slight improvement in retail trade over the past 12 months, discretionary retail categories remain under pressure reflecting the modest income growth against the increased living costs. The recent round of cuts in the cash rate will support retail trade conditions however the soft consumer sentiment environment is likely to result in a delayed response to the interest rate cuts.

Retail Strip Market

Total vacancy across Melbourne’s prime retail strips remains elevated, with vacancy continuing to increase, having now risen to 9.2% as at September 2019 reflecting the subdued trading conditions and reduced discretionary spending. Of all of Melbourne’s prime retail strips, only the vacancy rate of Toorak Road, South Yarra and High Street, Armadale sits below their long-term averages. Over the year to September 2019, only Clarendon Street, South Melbourne and Burke Road, Camberwell recorded decreases in vacancy. The vacancy levels of the iconic retail strips of Chapel Street, South Yarra and Bridge Road, Richmond remains highest amongst the prime retail strips with the current vacancy sitting above 15%.

Tenant demand for Melbourne’s retail strips continues to be driven by food-based retailers, typically at the expense of clothing retailers. While the growth of food retail in the strips has been underpinned by the number of apartments recently completed close to the popular shopping precincts, increasingly retail is being driven by experiential shopping.

Despite the elevated vacancy levels and soft retail trading conditions, investment demand for strip retail assets remains solid with transactions demonstrating yields between 3.5% and 5.0% for properties on prime strips.

Rising population, employment and tourism is expected to boost retail trade and lower vacancy rates in the medium term. Looking ahead, rents are expected to stabilise over the short term with vacancy plateauing and landlords gradually adapting to achievable rents.

CBD Retail Market

As at September 2019, Melbourne’s CBD retail overall vacancy increased to 4.6%, its highest level in 10 years. The increase in overall vacancy was driven by a rise in vacancy within shopping centres as a result of a number of store rationalizations and retailer administrations. Street frontage vacancy also increased reflecting the challenging retail conditions many occupiers are experiencing.

Reflecting the softening discretionary retail spending conditions, food retailers continue to expand their presence in the CBD retail market, typically at the expense of the fashion retailers, who have been more affected by the slow wage growth.

Despite the increase is overall vacancy, the Melbourne CBD retail market remains healthy. Underpinned by record residential population growth and strong international student and tourism numbers, the city centre’s premium location continues to draw tenant demand.

Melbourne CBD-based employment and residential population growth continues to underpin demand for CBD retail space from both domestic and international retailers. According to the Australian Bureau of Statistics, between June 2017 and June 2018 the City of Melbourne’s residential population increased by 6.8% to reach 169,961, while employment increased to 461,000.

Furthermore, total inbound international tourism numbers for Melbourne increased by 4.0% to reach 2.93 million over the 12 months to June 2019, an all-time high, which has supported the continued growth of luxury international retailers in the Melbourne CBD retail market.

Rental rates across the Melbourne CBD retail core have remained stable over the past 12 months, however incentives have increased marginally.

Retail investment sales volumes in 2019 to date have increased on the same period last year, however volume is on par with the longer-term average. Prime yields for Melbourne CBD retail assets range between 3.0% and 4.0%and are expected to remain steady in the short term reflecting the challenging retail conditions.

Sales Activity

Investment activity in the Victorian retail property sector has been relatively subdued in 2019 reflecting the broad softening in purchaser sentiment. Although a number of major sales have transacted which have boosted the total volume, the number of assets transacting is significantly below the long-term average. Over 2019 to date, Urban Property Australia has recorded $900 million in retail property sales, lower than the $1.3 billion transacted over the previous period in 2018.

While private investors and syndicators continue to actively seek prime retail assets below $50 million, maintaining the current low yield environment, yields for major shopping centres (in excess of $75 million) have softened over 2019. The softening in yields for major retail assets reflects the adjustment for income in light of the challenging trading conditions and increased capital expenditure required to ensure that shopping centres remain relevant to the changing consumer trends.

Copyright © 2019 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.